Premier GST Litigation & Criminal Defence Counsel: Advocate Siddharth Nair & Company Secretary Rahul Kumar Dhiman – Defending Businesses Across New Delhi, Delhi NCR & Pan-India Against GST Fraud Allegations, Tax Evasion Charges & Complex Indirect Tax Litigation

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive GST Defence in New Delhi, Delhi NCR & Pan-India

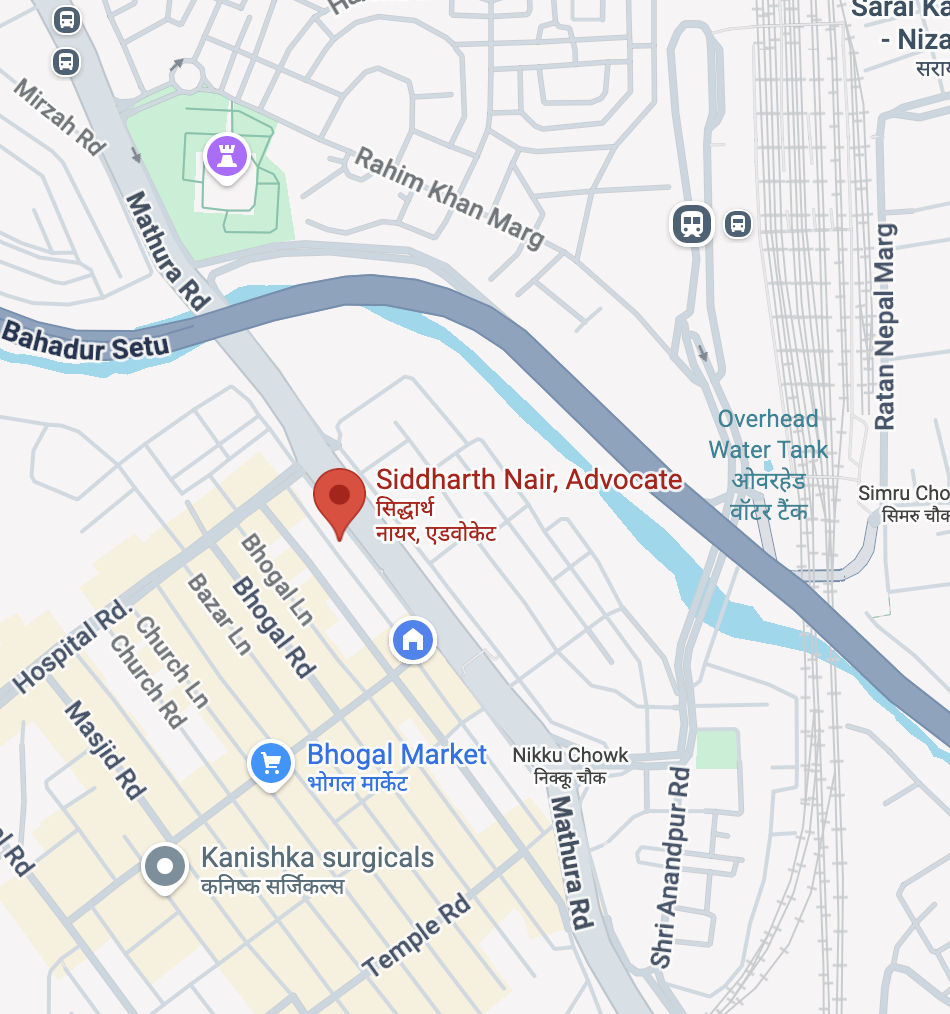

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | DRT | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sundays & Festivals: Holiday/ Meetings strictly by appointment

ABOUT ADVOCATE SIDDHARTH NAIR & CS RAHUL KUMAR DHIMAN

Best GST Lawyers in New Delhi & Delhi NCR

Advocate Siddharth Nair stands as one of New Delhi and Delhi NCR’s most distinguished criminal defence advocates and taxation lawyers, specializing exclusively in Goods and Services Tax (GST) litigation, criminal trials, and complex indirect taxation matters. With an exceptional track record of successfully defending companies, registered proprietorships, and businesses against false GST-related litigation and criminal prosecution, Advocate Nair has established himself as the go-to legal expert for businesses facing the most challenging tax controversies and criminal allegations under the Central Goods and Services Tax Act, 2017 (CGST Act), Integrated Goods and Services Tax Act, 2017 (IGST Act), Union Territory Goods and Services Tax Act, 2017 (UTGST Act), and State Goods and Services Tax Acts across India.

In strategic partnership with Company Secretary Rahul Kumar Dhiman, widely recognized as the leading Company Secretary in New Delhi and Delhi NCR, this formidable legal team brings together unparalleled expertise in corporate compliance, secretarial practice, tax advisory, and litigation defense. CS Rahul Kumar Dhiman’s deep understanding of corporate governance, regulatory compliance frameworks, and GST procedural requirements perfectly complements Advocate Nair’s litigation prowess, creating a comprehensive defense strategy that addresses both the legal and compliance dimensions of GST controversies.

Together, Advocate Siddharth Nair and CS Rahul Kumar Dhiman, supported by a team of highly qualified Chartered Accountants and Certified Auditors, provide end-to-end legal representation and defense services to businesses across New Delhi, Gurugram, Noida, Greater Noida, Faridabad, Ghaziabad, and throughout India who are facing:

- Criminal prosecution for alleged GST fraud, tax evasion, and non-compliance

- Civil litigation involving GST demand orders, assessment proceedings, and penalty impositions

- Investigation and summons by Central and State GST authorities

- Enforcement actions by the Directorate General of GST Intelligence (DGGI), Directorate General of Revenue Intelligence (DRI), and Central Bureau of Investigation (CBI)

- Registration cancellation proceedings and retrospective revocation of GST registration

- Input Tax Credit (ITC) denial and reversal demands

- Complex compliance issues including inverted duty structure, interstate transaction complications, and return filing errors

With decades of combined experience, this partnership has successfully defended thousands of businesses in the most complex GST litigation matters before various forums including GST Tribunals, High Courts across India, and the Supreme Court of India.

CONTACT INFORMATION

For Immediate Legal Consultation and Case Evaluation:

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive GST Defence in New Delhi, Delhi NCR & Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | DRT | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sundays & Festivals: Holiday/ Meetings strictly by appointment

COMPREHENSIVE UNDERSTANDING OF THE GST FRAMEWORK IN INDIA

The Goods and Services Tax Regime: A Constitutional and Legislative Overview

The Goods and Services Tax (GST), implemented on July 1, 2017, through the Constitution (One Hundred and First Amendment) Act, 2016, represents the most significant indirect tax reform in India’s economic history. This comprehensive indirect tax system subsumed multiple central and state taxes including Central Excise Duty, Service Tax, Value Added Tax (VAT), Purchase Tax, Luxury Tax, Entry Tax, Entertainment Tax, and various other levies, creating a unified national market with a seamless flow of input tax credits across the value chain.

Dual GST Structure: Constitutional Framework under Articles 246A and 366(12A)

India’s GST architecture follows a unique dual GST model where both the Central Government and State Governments have concurrent powers to levy and collect GST on the supply of goods and services. This constitutional design, enshrined in Article 246A of the Constitution of India, created four distinct but interconnected tax statutes:

1. Central Goods and Services Tax Act, 2017 (CGST Act) Levied and collected by the Central Government on intra-state supplies of goods and services. The CGST Act establishes the framework for registration, tax liability, input tax credit, returns, assessment, audit, investigation, appeals, offenses, and penalties at the central level.

2. State Goods and Services Tax Acts, 2017 (SGST Acts) Enacted by each state legislature, these substantially mirror the CGST Act provisions while allowing for state-specific adaptations. SGST is levied and collected by State Governments on intra-state supplies, with revenue accruing to the respective states.

3. Integrated Goods and Services Tax Act, 2017 (IGST Act) Governs interstate supplies, imports, and supplies to Special Economic Zones (SEZs). IGST is levied and collected by the Central Government with subsequent apportionment between Centre and States based on the destination principle.

4. Union Territory Goods and Services Tax Act, 2017 (UTGST Act) Applicable to Union Territories without legislatures (now primarily applicable to Ladakh), this Act operates similar to SGST but is administered by the Central Government.

Critical Provisions Under the CGST Act, 2017

Understanding the statutory framework is essential for businesses to ensure compliance and for mounting effective legal defense when controversies arise. Key provisions include:

Section 2: Definitions Critical definitions including “business,” “goods,” “services,” “supply,” “taxable person,” “taxable supply,” “input tax,” “input tax credit,” and numerous other terms that form the foundation of GST jurisprudence.

Section 7: Scope of Supply Defines what constitutes a “supply” under GST, forming the charging section for tax liability. This includes supply in the course or furtherance of business, transactions specified in Schedule I (supplies without consideration), transactions specified in Schedule II (activities treated as supply of goods or services), and transactions specified in Schedule III (activities not constituting supply).

Section 9: Levy and Collection The principal charging section imposing liability for payment of CGST/SGST on all intra-state supplies of goods or services or both at rates prescribed in the GST Rate Schedules.

Section 12 and 13: Time of Supply Determines the point in time when tax liability crystallizes for goods (Section 12) and services (Section 13), crucial for determining applicable rates, filing obligations, and compliance timelines.

Section 15: Value of Taxable Supply Prescribes the transaction value (price actually paid or payable) as the basis for tax calculation, with specific inclusions, exclusions, and adjustments.

Section 16: Eligibility and Conditions for Taking Input Tax Credit (ITC) One of the most litigated provisions, Section 16 prescribes conditions for availing ITC including possession of tax invoice/debit note, receipt of goods/services, filing of returns, and payment of tax by supplier. Sub-section (4) imposes crucial time limits for claiming ITC.

Section 17: Apportionment of Credit and Blocked Credits Specifies common credits requiring apportionment and blocked credits that cannot be claimed even if tax is paid, including credits on motor vehicles (except specified categories), food and beverages, outdoor catering, beauty treatment, health services, life insurance, travel benefits, works contract services for immovable property (except plant and machinery), goods/services for personal consumption, and goods lost, stolen, destroyed, written off, or disposed of by way of gift or free samples.

Section 22 and 24: Registration Section 22 mandates compulsory registration for businesses exceeding specified turnover thresholds (currently Rs. 40 lakhs for goods and Rs. 20 lakhs for services, with lower limits for special category states). Section 24 prescribes compulsory registration in specified circumstances regardless of turnover.

Section 25: Procedure for Registration Details the application process, verification, and grant or rejection of registration by the proper officer.

Section 29: Amendment and Cancellation of Registration Empowers authorities to amend or cancel GST registration on specified grounds including cessation of business, contravention of Act provisions, failure to file returns, or obtaining registration through fraud/willful misstatement/suppression of facts.

Section 37, 38, and 39: Returns Section 37 requires every registered person to furnish returns for each tax period. Section 38 deals with GSTR-1 (outward supplies), Section 39 with GSTR-3B (summary return), and other provisions deal with various other returns including GSTR-2A, GSTR-2B, GSTR-9 (annual return), and GSTR-9C (reconciliation statement).

Section 61: Scrutiny of Returns Empowers officers to scrutinize returns to verify correctness, identify errors, omissions, or inconsistencies, and issue notice for discrepancies detected.

Section 65, 66, and 67: Audit Section 65 empowers officers to conduct audits of registered persons to verify compliance. Section 66 deals with special audit by Chartered Accountants or Cost Accountants, and Section 67 prescribes powers of officers during audit proceedings.

Section 73: Determination of Tax Not Paid or Short Paid or Erroneously Refunded or ITC Wrongly Availed Applies when tax has not been paid or short paid or ITC has been wrongly availed or utilized due to reasons other than fraud, willful misstatement or suppression of facts. Imposes an extended period of three years (now 30 months for most cases post-amendment) for issuing show cause notices, and prescribes penalties.

Section 74: Determination of Tax in Cases of Fraud or Willful Misstatement The most serious provision dealing with cases involving fraud, willful misstatement, or suppression of facts to evade tax. Provides for:

- Extended period of five years for issuing show cause notices

- Recovery of tax along with interest

- Penalty ranging from 100% to 200% of tax evaded (reduced to 25% if tax and interest paid before issuance of show cause notice)

- Potential criminal prosecution

Section 67: Power to Inspect, Search and Seize Empowers authorized officers to inspect places of business, goods, documents, books, or other things, and seize goods, documents, books, or things if the officer has reasons to believe that such goods, documents, books, or things will be helpful in the proceedings.

Section 69: Power to Arrest Authorizes arrest of persons who have committed offenses specified under Section 132 where the amount of tax evaded or ITC wrongly availed or utilized or refund wrongly taken exceeds Rs. 5 crores (now reduced to Rs. 2 crores for certain offenses post-amendment).

Section 70: Summons Empowers officers to summon persons to give evidence or produce documents during the course of any inquiry or investigation.

Section 122: Penalty for Certain Offenses Prescribes penalties for various contraventions including:

- Supply without invoice or with false invoice

- Issuance of invoice without supply

- Collection of tax without being registered

- ITC availment or utilization without actual receipt of goods/services

- Fraudulent obtaining of refund

- Taking or utilizing ITC in violation of provisions

- Fake or wrong invoicing

Section 132: Punishment for Certain Offenses This is the CRIMINAL provision prescribing imprisonment for serious offenses. Key offenses include:

- Supply without issue of invoice or with false/incorrect invoice with intent to evade tax

- Issuance of invoice without supply with intent to evade tax or ITC availment

- Collection of tax but failure to pay to Government beyond three months

- Taking/utilizing ITC without actual receipt of goods/services

- Fraudulent obtaining of refund

- Falsification/substitution/destruction of records

- Obstruction/prevention of officers from performing duties

Punishments range from imprisonment up to 5 years and/or fine depending on the tax amount involved and nature of offense.

Section 168A: Power to Extend Time Limits Empowers Government to extend time limits specified in the Act through notification, particularly relevant during COVID-19 and other extraordinary circumstances.

COMMON GST COMPLIANCE CHALLENGES FACED BY BUSINESSES

Based on extensive litigation experience across New Delhi, Delhi NCR, and throughout India, Advocate Siddharth Nair and CS Rahul Kumar Dhiman have identified the following recurring compliance challenges and litigation triggers affecting businesses:

1. Input Tax Credit (ITC) Issues and Denial

Input Tax Credit represents the cornerstone benefit of GST, allowing businesses to offset taxes paid on inputs against their output tax liability. However, ITC has become the single largest source of litigation due to:

Mismatch Between GSTR-2A/2B and GSTR-3B: Systematic mismatches between supplier’s GSTR-1 (reflected in recipient’s GSTR-2A/2B) and recipient’s claimed ITC in GSTR-3B lead to automatic discrepancy detection and disallowance proposals.

Supplier Registration Cancellation: Retrospective cancellation of supplier’s GST registration creates downstream ITC denial for recipients, even though transactions were genuine and tax was paid at the time of transaction.

Time Limit Restrictions under Section 16(4): Strict time limit for claiming ITC (earlier due date of return for September of next financial year or filing of annual return, whichever is earlier) results in permanent loss of credit for late claims, even if otherwise eligible.

Rule 36(4) Restrictions: Restriction on ITC availment to 110% (now 120% post-amendment) of eligible credit appearing in GSTR-2B creates practical difficulties when supplier filing is delayed.

Blocked Credit Categories under Section 17(5): Denial of ITC on specified categories like motor vehicles, construction services for immovable property (other than plant & machinery), and goods/services for personal use frequently leads to disputes about applicability to specific transactions.

2. Interstate Transaction Complexities and Place of Supply Issues

Determining the correct “place of supply” under Sections 10-13 of IGST Act decides whether IGST or CGST+SGST applies. Common issues include:

Job Work Complications: Movement of goods for job work (Section 143) and subsequent returns creates confusion regarding place of supply, applicable tax, and ITC reversal/reclaim requirements.

Branch/Depot Transfer Pricing: Transfers between branches/depots/agents in different states treated as inter-state supply, requiring careful valuation and documentation.

Service Location Determination: Determining whether services are taxable in recipient’s location (import of services) or supplier’s location, particularly for cross-border and multi-location services.

3. Inverted Duty Structure Challenges

Inverted duty structure occurs when input goods/services are taxed at rates higher than output supplies, leading to accumulation of ITC that cannot be offset against output liability. Common scenarios:

Manufacturing Sector: Manufacturers using inputs taxed at 18% or 28% to produce goods taxed at 5% or 12% face perpetual ITC accumulation.

Export-Oriented Units: Exporters supplying zero-rated supplies accumulate ITC on inputs, requiring frequent refund applications under Rule 89 or Rule 96.

Pharma and FMCG Sectors: Products in these sectors often have concessional tax rates (5% or 12%) while inputs are taxed at 18%, creating systemic ITC accumulation.

Refund Processing Delays: Despite statutory timeline of 60 days for processing refunds, actual processing often takes 6-12 months with multiple deficiency memos, clarifications, and verification requirements, severely impacting working capital.

4. Classification and Rate Disputes

Determining the correct HSN/SAC code and applicable GST rate involves interpretation of:

HSN Code Classification: Goods classification under 8-digit Harmonized System of Nomenclature (HSN) codes with reference to Customs Tariff Act and GST rate schedules.

SAC Code Classification: Services classification under Service Accounting Codes (SAC) and applicable exemptions or concessional rates.

Composite vs Mixed Supplies: Determining whether a transaction constitutes a composite supply (naturally bundled, where one is principal supply) taxable at principal supply rate, or mixed supply (not naturally bundled) taxable at highest rate applicable to any of the supplies.

Works Contract Classification: Construction, erection, commissioning, or installation services involving both goods and services, with specific valuation and rate determination rules.

5. Return Filing Complexities and Technical Glitches

The GST portal and return filing system presents numerous challenges:

GSTR-1 Filing Issues: Errors in invoice reporting, HSN code mismatches, and amendments of previously filed invoices create cascading compliance issues.

GSTR-3B Liability Calculation: Self-assessed tax liability in GSTR-3B must match with detailed transaction reporting in GSTR-1, requiring perfect reconciliation.

Annual Return (GSTR-9 and GSTR-9C) Complexity: Reconciliation of annual turnover, ITC availed, and tax paid between monthly returns and audited financial statements requires extensive documentation.

Technical Portal Glitches: Frequent portal downtimes, system errors, transaction upload failures, and file format rejections create complian ce difficulties, particularly near filing deadlines.

Frequent Amendments in Return Formats: Continuous changes to return formats, new tables, modified reporting requirements, and additional reconciliation statements increase compliance burden and error probability.

6. Registration Cancellation and Revocation Issues

GST registration cancellation under Section 29 on grounds of:

- Non-filing of returns for continuous six months

- Non-commencement of business within six months of registration

- Registration obtained through fraud, willful misstatement, or suppression of facts

- Other violations of Act provisions

Creates immediate cessation of business operations, ITC loss, and supplier relationship disruption. Retrospective cancellation (effective from a date prior to the cancellation order date) further compounds difficulties by:

- Making all transactions during the intervening period void

- Requiring recipients to reverse entire ITC claimed from such suppliers

- Exposing business to tax demands for the entire period with interest and penalties

7. Scrutiny, Assessment, Audit, and Investigation

Businesses face multiple levels of verification and examination:

Automated Scrutiny (Section 61): System-generated discrepancy notices (DRC-01) for mismatches, return filing defaults, or ITC inconsistencies require response within 30 days.

Departmental Audit (Section 65): In-depth examination of books of account, returns, and compliance for specified periods, often extending to 3-5 years.

Special Audit (Section 66): Court-ordered or department-directed audits by independent Chartered Accountants or Cost Accountants when business accounts are complex or verification requires specialized expertise.

Investigation by DGGI/DRI: Intelligence-driven investigations involving searches, seizures, summons to directors/partners, statement recordings, and extensive document scrutiny for suspected tax evasion or fraud.

8. E-Way Bill and E-Invoice Compliance

E-Way Bill (Rule 138): Mandatory electronic waybill for goods movement exceeding Rs. 50,000 in value (Rs. 1,00,000 for certain categories) creates compliance burden with requirements for:

- Generation before goods dispatch

- Carrying valid e-way bill during transit

- Updation of transporter details and vehicle number

- Validity period management based on distance

Non-compliance invites detention, seizure, and penalties under Section 129.

E-Invoice (Rule 48): Mandatory electronic invoice generation for businesses exceeding Rs. 5 crore turnover (threshold progressively reduced from initial Rs. 500 crore) through Invoice Registration Portal (IRP) creates:

- Real-time invoice validation requirements

- IRN (Invoice Reference Number) generation mandate

- QR code embedding obligations

- System integration challenges

CRIMINAL CHARGES AND OFFENSES UNDER GST LAWS

Understanding criminal liability under GST is crucial for directors, partners, proprietors, and key management personnel of businesses. Advocate Siddharth Nair and CS Rahul Kumar Dhiman provide specialized criminal defense services for all GST-related offenses.

Section 132: Cognizable and Non-Bailable Offenses

Section 132 of the CGST Act (identically replicated in SGST/UTGST Acts) prescribes imprisonment for specified offenses. The section has been progressively amended to enhance penal consequences:

Category 1 Offenses (Tax Evaded or ITC Wrongly Availed/Utilized or Refund Wrongly Taken exceeds Rs. 5 Crores) – as amended:

(a) Supply without invoice or with false invoice to evade tax: Imprisonment extending to 5 years AND fine

(b) Issuance of invoice without supply to wrongly avail/utilize ITC or fraudulent refund: Imprisonment extending to 5 years AND fine

(c) Collection of tax but failure to pay to Government beyond 3 months: Imprisonment extending to 5 years AND fine

(d) Taking/utilizing ITC without actual receipt of goods/services: Imprisonment extending to 5 years AND fine

(e) Fraudulent obtaining of refund: Imprisonment extending to 5 years AND fine

(f) Falsification/substitution of financial records or producing fake accounts/documents to evade tax: Imprisonment extending to 5 years AND fine

(g) Obstruction of officer in discharge of duties: Imprisonment extending to 5 years AND fine

Category 2 Offenses (Tax Amount between Rs. 2 Crores and Rs. 5 Crores): For the above offenses where amount involved is between Rs. 2-5 crores: Imprisonment extending to 3 years AND fine

Category 3 Offenses (Tax Amount between Rs. 1 Crore and Rs. 2 Crores): Where amount involved is between Rs. 1-2 crores: Imprisonment extending to 1 year AND/OR fine

Offenses below Rs. 1 Crore: Not subject to imprisonment; penalties under Section 122 apply.

Critical Features of GST Criminal Prosecution:

1. Cognizable Nature: Under Section 132(5), offenses under Section 132(1)(a), (b), (c), and (d) (involving amounts exceeding Rs. 5 crores, reduced to Rs. 2 crores for arrest) are cognizable (police can arrest without warrant) and non-bailable (bail at court’s discretion, not as of right).

2. Liability of Company Officers (Section 137): Where offense is committed by a company:

- Directors, manager, secretary, and other officers in charge of and responsible for conduct of business are deemed guilty

- Must prove offense was committed without their knowledge or they exercised due diligence to prevent commission

- Extends to partners of firms, members of associations, karta of HUF, and other similar entities

3. Compounding of Offenses (Section 138):

- First-time offenders can compound offenses (settle by payment) for amounts up to 150% (now 100% for first-time compounding) of tax involved

- Compounding application within specified period, acceptance by Commissioner, payment of compounding amount terminates criminal proceedings

- Second compounding allowed for 150% of tax amount

- Compounding not available where prosecution filed with Court’s cognizance or where offense relates to fake invoicing specifically to evade tax exceeding Rs. 500 lakh or repeat offender

4. Prosecution by Complaint (Section 132(4) read with Section 132(1A) and (1B)):

- Prior sanction of Commissioner required before filing complaint before Magistrate

- Complaint by gazetted officer authorized by Commissioner

- Commissioner’s sanction order must contain material particulars and reasons for prosecution

- Cognizance only by Magistrate not below rank of JMFC/Metropolitan Magistrate

5. Presumption of Culpable Mental State (Section 140): In prosecution, Court shall presume accused had requisite mens rea (guilty mind), placing burden on accused to prove its absence.

6. Arrest Provisions (Section 69):

- Commissioner or authorized officer can arrest if reason to believe person committed offense punishable under Section 132(1)(a), (b), (c), or (d) and (i), and tax evaded/ITC wrongly availed/refund wrongly taken exceeds Rs. 5 crores (reduced to Rs. 2 crores for certain specified offenses)

- Person arrested must be informed of grounds, produced before Magistrate within 24 hours

- Statement made to GST officer during investigation not admissible as confession but can be used as corroborative evidence

- Arrested person entitled to consult and be defended by legal practitioner of choice

7. Good Faith Protection (Section 157): Officers acting in good faith in accordance with Act provisions protected from prosecution and lawsuits for actions taken during official duties.

Other Related Criminal Provisions:

Section 122: Penalties for Non-Arrestable Offenses: Civil penalties (not involving imprisonment) ranging from Rs. 10,000 to Rs. 25,000 or higher of tax amount (whichever is higher) for various contraventions like:

- Supply without invoice or with incorrect particulars

- ITC availment or utilization in contravention of provisions (not involving fake invoicing)

- Collection of tax but non-payment beyond 3 months (below Rs. 1 crore)

- Obstruction of officers

- Transportation of goods without proper documents

- Tampering with goods under detention/seizure

- Non-appearance in response to summons

Section 123: Penalty for Supplying or Transporting Goods without Documents: Penalty of Rs. 10,000 or tax evaded (whichever is higher) for supply or transport of taxable goods without proper documents.

Section 125: General Penalty: For contraventions not covered under specific penalty provisions, penalty up to Rs. 25,000.

Section 129: Detention, Seizure and Release of Goods and Conveyances in Transit: For goods transported in contravention of Act provisions:

- Detention and seizure of goods and conveyance

- Release on payment of:

- Tax equal to 100% of tax payable on goods detained (200% for exempted goods without documents)

- Penalty equal to 100% of value of goods or Rs. 25,000 (whichever is less) if value not ascertainable (200% of tax or Rs. 50,000 for exempted goods)

Section 130: Confiscation of Goods or Conveyances: Goods and conveyances used in transport can be confiscated after due notice and hearing if:

- Transported in contravention of Act provisions

- Person opts for confiscation instead of payment of penalty under Section 129

- Notice proceedings result in confiscation order

Money Laundering Implications:

Prevention of Money Laundering Act, 2002 (PMLA):

- GST evasion through fake invoicing, false returns, and fraudulent ITC claims can constitute “scheduled offense” under PMLA

- Enforcement Directorate (ED) can investigate, attach properties, and prosecute for money laundering if tax evasion proceeds are integrated into legitimate business

- Imprisonment up to 7 years for money laundering (10 years for certain narcotics/cross-border offenses)

- Confiscation of properties derived from or involved in money laundering

- Reverse burden of proof: accused must prove legitimacy of assets

Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015:

- If GST evasion involves undisclosed foreign assets or income, provisions of Black Money Act apply

- Tax at 30% plus 90% penalty on undisclosed foreign income/assets

- Rigorous imprisonment from 3 to 10 years for willful non-disclosure

- Non-compoundable and non-bailable offense for concealment exceeding Rs. 1 crore

INVESTIGATIVE AND REGULATORY AGENCIES INVOLVED IN GST ENFORCEMENT

Businesses under investigation need to understand the jurisdictional scope, powers, and operating procedures of multiple enforcement agencies. Advocate Siddharth Nair and CS Rahul Kumar Dhiman provide comprehensive defense strategies against actions by:

1. Central Board of Indirect Taxes and Customs (CBIC)

Constitutional and Statutory Basis: CBIC operates under Department of Revenue, Ministry of Finance, Government of India, administering CGST, IGST, UTGST, Central Excise, Customs, and other indirect tax laws.

Functions:

- Policy formulation and interpretation

- Issuance of circulars, notifications, and clarifications

- Supervision of field formations

- Appellate review through revisionary powers

- Representation in High Courts and Supreme Court

2. Directorate General of GST Intelligence (DGGI)

Establishment and Mandate: DGGI, established as the apex intelligence and investigation agency for GST, functions under CBIC with headquarters in New Delhi and 22 zonal units covering entire India including zones in:

- Delhi

- Mumbai

- Chennai

- Kolkata

- Bengaluru

- Ahmedabad

- Lucknow

- Jaipur

- Chandigarh

- Hyderabad

- Bhubaneswar

- Guwahati

- And other major cities

Powers and Functions:

- Intelligence gathering on GST evasion, fake invoicing, ITC fraud

- Investigation of complex fraud cases involving multiple states

- Search and seizure operations under Section 67

- Arrest of accused persons under Section 69

- Statement recording under Section 70

- Coordination with State GST Intelligence agencies

- Handling of transnational GST evasion cases

Key Investigation Areas:

- Fake invoice rackets and paper companies

- Fraudulent ITC chains

- Suppression of turnover and tax evasion

- Export fraud and duty drawback misuse

- Trade-based money laundering through GST fraud

- Shell company operations

3. Directorate General of Revenue Intelligence (DRI)

Jurisdiction and Role: Though primarily a Customs enforcement agency, DRI investigates:

- Import/export violations involving GST implications (IGST evasion)

- Under-invoicing and over-invoicing in international trade

- Misuse of export promotion schemes (Advance Authorization, EPCG)

- Smuggling of gold, drugs, arms where GST components exist

- Trade-based money laundering involving import/export

Powers:

- Search and seizure under Customs Act, 1962

- Arrest provisions under Customs Act

- Coordination with DGGI for integrated investigations

- International cooperation through customs mutual assistance agreements

4. State GST Enforcement and Anti-Evasion Wings

Structure: Each State/UT has dedicated enforcement and anti-evasion wings within its GST Department including:

- Delhi: Delhi State GST Anti-Evasion Branch

- Haryana: Haryana SGST Enforcement Wing

- Uttar Pradesh: UP SGST Enforcement Commissionerate

- Rajasthan: Rajasthan SGST Enforcement Directorate

- Punjab: Punjab SGST Anti-Evasion Branch

- Maharashtra: Maharashtra SGST Intelligence and Investigation Directorate

Functions:

- State-level investigation of GST evasion

- Registration verification and fraud detection

- Fake firm identification and crackdowns

- Search, seizure, and arrest operations under SGST Act

- Coordination with DGGI for inter-state cases

Jurisdictional Coordination (Section 6): Section 6(2)(b) of CGST Act provides that where one authority (CGST or SGST) has initiated proceedings, the other shall not initiate proceedings on the same subject matter for the same period. However, investigations by DGGI and State enforcement often overlap, requiring careful jurisdictional navigation.

5. Central Bureau of Investigation (CBI)

Role in GST Cases: CBI investigates GST matters when:

- Predicate offense for corruption (bribery of GST officers)

- Large-scale conspiracy involving multiple parties across states

- Cases involving disproportionate assets of public servants (GST officials)

- Cases referred by Central Government, High Courts, or Supreme Court

Relevant Sections:

- Prevention of Corruption Act, 1988 for bribery and corruption

- IPC provisions for criminal conspiracy (Section 120B), cheating (Section 420), forgery (Sections 463-477A)

6. Enforcement Directorate (ED)

PMLA Investigation: ED under Department of Revenue investigates money laundering where:

- GST evasion is scheduled offense under PMLA

- Proceeds of GST fraud integrated into legitimate business or properties purchased

- Cross-border money laundering involving trade-based schemes

Powers:

- Provisional attachment of properties under Section 5 PMLA

- Search and seizure under Section 17 PMLA

- Arrest under Section 19 PMLA

- Prosecution under Section 45 PMLA (special court)

- Confiscation of attached properties post-conviction

7. Serious Fraud Investigation Office (SFIO)

Companies Act Angle: SFIO investigates serious frauds involving companies where:

- GST fraud involves company operations

- Directors/KMPs involved in criminal breach of trust, fraud against creditors

- Financial statements falsified to conceal GST liabilities

Powers under Companies Act, 2013:

- Investigation under Sections 212-218

- Prosecution of directors and officers

- Penalty and imprisonment for fraud exceeding Rs. 10 lakh (Section 447)

8. Income Tax Department

Coordination with GST Authorities:

- Information sharing under Section 158 CGST Act and Section 138 Income Tax Act, 1961

- Cross-verification of turnover declared in GST returns vs ITR

- Detection of unaccounted income through GST evasion proceeds

- Search and seizure operations revealing GST violations

- Assessment of suppressed income with reference to GST discrepancies

9. State Police and Economic Offenses Wings

Criminal Complaints:

- FIRs filed based on complaints by GST Department

- Investigation of cheating, forgery, criminal breach of trust related to GST

- Arrest and custody in non-bailable offenses

- Economic Offenses Wings of State Police handle white-collar crimes including GST frauds exceeding specified thresholds

10. Competition Commission of India (CCI)

Indirect Relevance:

- Anti-competitive agreements and cartelization affecting pricing and GST compliance

- Abuse of dominant position cases where GST component forms part of investigation

11. Adjudicating and Appellate Authorities

GST Adjudication Hierarchy:

- Proper Officer/Adjudicating Authority: Initial assessment, demand orders, penalty imposition

- First Appellate Authority (Section 107): Commissioner (Appeals) hearing appeals against adjudication orders

- GST Appellate Tribunal (Section 109): Two-member benches (one Judicial, one Technical) hearing appeals from Commissioner (Appeals). Currently non-functional in most states; jurisdiction vested with High Courts

- High Court (Section 117): Appeals on substantial questions of law from Tribunal orders (currently from First Appellate Authority due to non-functioning Tribunals)

- Supreme Court (Article 136): Appeals from High Court orders

Alternative Dispute Resolution:

- Advance Ruling Authority (Sections 95-106): Pre-transaction rulings on classification, applicability of notifications, rate determination, ITC eligibility for specific business models

- Settlement Commission (Section 138): Abolished; compounding under Section 138 available instead

LANDMARK CASE LAWS: SUPREME COURT OF INDIA

The Supreme Court of India has delivered several watershed judgments shaping GST jurisprudence. Understanding these precedents is essential for effective litigation strategy. Advocate Siddharth Nair and CS Rahul Kumar Dhiman extensively rely on these judgments in their practice:

1. Safari Retreats Private Limited vs. Chief Commissioner of CGST (2024) – Input Tax Credit on Commercial Properties

Citation: (2025) 2 SCC 523; Supreme Court Order dated October 3, 2024

Issue: Whether Input Tax Credit (ITC) is available on construction of immovable property used for letting out/leasing, which is restricted under Section 17(5)(d) of CGST Act.

Facts: Safari Retreats constructed commercial properties (shopping complexes) for leasing/renting to tenants. They claimed ITC on goods/services used for construction. Department denied ITC under Section 17(5)(d) which restricts ITC on “goods or services received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services are used in the course or furtherance of business.”

Supreme Court Holding:

- Upheld constitutional validity of Section 17(5)(d)

- However, clarified that if the immovable property constructed qualifies as “plant or machinery” from a functional test perspective, ITC would be available

- Commercial properties used for leasing/renting as core business activity may qualify as “plant or machinery” on case-by-case functional analysis

- Remanded matter for fresh consideration applying functional test

Relevance for Defense: This judgment provides avenue for businesses engaged in leasing/hospitality/commercial real estate to claim ITC by demonstrating that the immovable property serves as “plant or machinery” for their core business operations. Advocate Nair has successfully argued similar contentions for hotel operators, co-working space providers, and mall developers.

2. Union of India vs. Brij Systems Limited (2025) – Rectification of Bonafide Errors in GST Returns

Citation: (2025) 3 SCC (CJ) 1395; Supreme Court Order dated January 2025

Issue: Whether taxpayers should be allowed to rectify bonafide clerical or arithmetical errors in GST returns after the stipulated period under Sections 37(3) and 39(9).

Facts: Brij Systems and similarly situated taxpayers filed ITC claims in wrong sections/tables of GSTR-1/GSTR-3B due to clerical errors or system-generated auto-population mistakes. Department denied ITC claiming rectification not permissible after statutory time limit.

Supreme Court Holding:

- Severely criticized Union of India and CBIC for rigid approach denying rectification of bonafide errors

- Held that right to correct clerical or arithmetical mistakes flows from right to do business under Article 19(1)(g) of Constitution

- Directed CBIC to re-examine and liberalize timelines for error rectification

- Purchasers/recipients cannot suffer double taxation (denied ITC despite paying tax) due to supplier’s inadvertent filing errors

- Directed revenue authorities to allow rectification of bonafide errors even after prescribed timelines in appropriate cases

Relevance for Defense: This landmark judgment opens remedies for thousands of businesses who lost legitimate ITC due to technical errors, wrong reporting in return forms, or supplier-side filing mistakes. Advocate Nair has successfully invoked this precedent to restore wrongly disallowed ITC in multiple High Court writ petitions.

3. Mineral Area Development Authority vs. Steel Authority of India Ltd. (2024) – Retrospective State Tax on Mining

Citation: Supreme Court Judgment dated August 14, 2024 (Nine-Judge Bench)

Issue: Whether State Governments have power to levy tax on mineral-bearing land and mineral rights; applicability retrospectively from April 1, 2005.

Facts: 50+ year old controversy regarding State powers to levy royalty and taxes on mining activities. Central Government collected royalty; States claimed separate taxation power.

Supreme Court Holding (9-Judge Bench):

- Royalty under Mines and Minerals (Development and Regulation) Act, 1957 is not a tax

- States have legislative competence to impose taxes on mining activities under Entries 49 and 50, List II (State List), Seventh Schedule

- Decision applies retrospectively from April 1, 2005

- However, waived interest and penalties for demands before July 25, 2024

- Permitted staggered payment over 12 years from April 1, 2026

Relevance for Mining Companies: While primarily a State tax issue, this judgment impacts GST compliance for mining companies regarding:

- Treatment of State levies as tax vs. royalty for GST credit purposes

- Valuation of taxable supplies including/excluding such State taxes

- GST on mining lease and mineral rights transactions Advocate Nair’s team provides integrated defense covering both direct State tax challenges and consequential GST implications.

4. Gameskraft Technologies Pvt. Ltd. vs. DGGI (Ongoing) – Online Gaming GST Classification

Citation: Supreme Court proceedings; Karnataka High Court order quashing Rs. 21,000 crore GST demand stayed by Supreme Court; Next hearing July 15, 2025

Issue: Whether online gaming (skill-based) attracts 18% GST as “gaming services” or 28% as “gambling”; Tax on gross gaming revenue vs. Gross Gaming Revenue (GGR) vs. net commission.

Status: One of highest-stakes GST cases in Indian history. Supreme Court stayed Karnataka High Court’s favorable order to Gameskraft. Matter sub judice; awaiting final determination.

Relevance: Critical for gaming, e-sports, fantasy sports industry regarding classification, valuation, and tax rate determination. Demonstrates quantum of exposure businesses face from GST controversies.

5. K.P. Mozika vs. Commissioner of Central Excise (2024) – Service vs. Sale Classification

Citation: Supreme Court Judgment 2024

Issue: Whether hiring of vehicles/cranes without transfer of effective control constitutes “service” (post-GST taxable) vs. “sale” (pre-GST VAT regime).

Facts: Contractor supplied vehicles and cranes to ONGC/IOCL without transferring control (driver/operator remained contractor’s employees). Department sought to levy VAT treating it as deemed sale.

Supreme Court Holding:

- Applied BSNL vs. Union of India test: Control, possession, and legal rights must transfer for transaction to be sale

- Since operator/driver remained with contractor and no exclusive control transferred to client, transaction is purely service, not sale

- Post-GST, such transactions clearly taxable as services under SAC 996791 (Hiring services of transportation vehicles with operator)

Relevance for Defense: Clarifies service vs. sale distinction critical for correct GST classification. Advocate Nair applies this principle in contract disputes, job work arrangements, and manpower supply cases to establish correct tax liability classification.

LANDMARK CASE LAWS: DELHI HIGH COURT

Delhi High Court, having territorial jurisdiction over the national capital and significant national-level GST controversies, has delivered important judgments directly impacting businesses in Delhi NCR:

1. Suresh Chand Gupta vs. Union of India (W.P.(C) 11492/2024) – Retrospective Cancellation of GST Registration

Date: August 21, 2024

Issue: Whether GST registration can be cancelled retrospectively without stating specific reasons in show cause notice.

Facts: Petitioner’s GST registration cancelled retrospectively under Section 29(2)(e) (registration obtained by fraud/willful misstatement/suppression). Show cause notice merely reproduced statutory provision without stating nature of alleged fraud, misstatement, or suppressed facts.

Delhi High Court Holding:

- Show cause notice was cryptic and violated principles of natural justice

- Notice must clearly state:

- Nature of alleged fraud/misstatement/suppression

- Specific facts allegedly misrepresented or suppressed

- Evidence/material on which department relied

- Proposed action (cancellation with effective date)

- Retrospective cancellation without clear notice of retrospective effect violates due process

- Quashed cancellation order; directed fresh proceedings with proper SCN

Relevance for Defense: Establishes strict procedural requirements for registration cancellation, particularly retrospective cancellation. Advocate Nair successfully challenged dozens of registration cancellation orders using this precedent to restore client registrations.

2. Bablu Rana vs. Proper Officer (W.P.(C) 9394/2024) – Communication of Notices via GST Portal

Date: July 11, 2024

Issue: Whether show cause notice uploaded under “View Additional Notices and Orders” tab (before portal redesign) constitutes proper communication to taxpayer.

Delhi High Court Holding:

- Before portal redesign, notices under “View Additional Notices and Orders” tab (under “User Services”) were not prominently visible

- Taxpayers primarily checked “View Notices and Orders” tab for official communications

- Notice under incorrect tab does not constitute proper service/communication

- Authorities must ensure notices uploaded in correct, visible, designated sections

- Post-redesign, GST portal merged both tabs; this issue prospectively resolved

- Quashed proceedings for lack of proper notice

Relevance for Defense: Provides ground to challenge proceedings where initial show cause notice/assessment order not properly communicated via portal. Time limit for filing appeals computed from date of actual knowledge/proper communication, not from upload date. Advocate Nair routinely verifies portal communication timestamps and tab categories to challenge limitation defenses by department.

3. M/s JSW Steel Limited vs. DGGI (W.P.(C) 13769/2024) – Challenge to CBIC Circular on Post-Sale Discounts

Date: October 1, 2024

Issue: Constitutional validity of CBIC Circular No. 212/6/2024-GST dated June 26, 2024 mandating collection of CA/CMA certificate from recipient confirming credit reversal for post-sales discounts.

Facts: JSW Steel challenged circular requiring elaborate documentary evidence (CA/CMA certificate from each customer) before allowing deduction of post-sale discounts from taxable value under Section 15(3)(b).

Delhi High Court Holding:

- Entertained writ petition challenging vires of circular

- Noted substantial questions raised regarding:

- Interpretation of Section 15(3)(b) on valuation adjustments for post-sale discounts

- Whether such onerous documentary requirements can be imposed through circular

- Taxability of guarantee commission received by JSW Steel

- Issued notice to respondents

- Directed revenue not to insist on these requirements during pendency of writ petition

Relevance for Defense: Demonstrates judicial willingness to examine constitutional validity of circulars imposing excessive compliance burdens. Advocate Nair filed similar challenges for clients in pharmaceutical and FMCG sectors where post-sale discounts and promotional schemes are common, successfully securing interim relief from such stringent documentary requirements.

4. Chegg India Private Limited vs. Assistant Commissioner CGST (W.P.(C) 11718/2025 & Batch) – Appellate Authority Powers for Refund Adjudication

Date: September 8, 2025

Issue: Scope of Appellate Authority’s powers under Section 107(11) to re-adjudicate refund claims; whether Appellate Authority can consider fresh documents and consolidated claims.

Facts: Education technology company Chegg India filed multiple refund applications for export of services across various periods. Adjudicating authority passed inconsistent orders—some allowing partial refunds, others rejecting claims citing insufficient documents. Chegg approached High Court seeking consolidated adjudication.

Delhi High Court Holding:

- Section 107(11) grants Appellate Authority full powers to confirm, modify, or annul orders

- Appellate Authority must comprehensively re-adjudicate refund claims

- Can consider fresh documents, additional evidence submitted at appellate stage

- Should avoid piecemeal, staggered adjudication causing inconsistencies

- Embargo on remand (Section 107(11)) doesn’t restrict Appellate Authority from full examination of facts and law

- Directed Appellate Authority to consolidate all pending refund appeals and pass comprehensive order after considering all evidence

Relevance for Defense: Critical for exporters and businesses with accumulated ITC seeking refunds. Establishes that appellate remedy is not merely review but full re-adjudication with opportunity to present complete case. Advocate Nair leverages this to secure consolidated relief in fragmented refund litigations.

5. Alaknanda Steel vs. Union of India (2024) – Limitation on Retrospective Cancellation

Issue: Effective date of GST registration cancellation—whether from date of SCN or retrospectively from an earlier date.

Delhi High Court Holding:

- If SCN does not propose retrospective cancellation with specific effective date and reasons, cancellation order cannot be retrospective

- Registration cancellation effective prospectively from SCN date (June 9, 2023), not retrospectively from July 1, 2017

- Retrospective cancellation requires clear proposal in SCN giving taxpayer opportunity to respond specifically to retrospectivity

Relevance for Defense: Protects businesses from cascading consequences of retrospective cancellation (ITC reversal by recipients, tax demands for entire past period). Advocate Nair applies this principle to limit temporal effect of cancellation orders.

LANDMARK CASE LAWS: HIGH COURT OF KERALA

Kerala High Court delivered one of the most significant GST judgments in 2024-25 on the doctrine of mutuality:

1. Indian Medical Association (IMA) Kerala State Branch vs. Union of India (W.A. Nos. 1659, 1487 & 468 of 2024) – GST on Association Services to Members

Date: April 11, 2025 (Division Bench)

Issue: Constitutional validity of Section 7(1)(aa) and Explanation to Section 2(17)(e) introduced by Finance Act, 2021, deeming services by clubs/associations to their members as taxable supply with retrospective effect from July 1, 2017.

Facts: IMA Kerala Branch received summons from DGGI demanding GST for services rendered to member doctors during 2017-18 to 2021-22. IMA challenged retrospective amendment as unconstitutional, invoking doctrine of mutuality.

Kerala High Court Holding (Division Bench – Justices A.K. Jayasankaran Nambiar and Easwaran S.):

On Doctrine of Mutuality:

- Reaffirmed that club/association and its members form single legal entity; no duality of supplier-recipient required for “supply”

- Relied on Supreme Court precedent in State of West Bengal vs. Calcutta Club Ltd. (2019) which held doctrine of mutuality survives even after 46th Constitutional Amendment introducing service tax

On Constitutional Validity:

- Section 7(1)(aa) deemed fiction violates constitutional understanding of “supply” under Article 366(12A) read with Article 246A

- Creating new levy by overturning long-established legal position (mutuality exemption) retrospectively from 2017 is ultra vires Constitution

- Retrospective levy without taxpayers’ knowledge (associations did not collect any amounts from members towards such tax) causes substantial unforeseen prejudice

- Violates rule of law and principles of legitimate expectation

Order:

- Declared Section 7(1)(aa) and associated amendments unconstitutional and struck down

- Quashed SCN No. 58/2024-25 (GST) demanding Rs. [large sum] from IMA

- Restored exemption from GST for associations/clubs providing services to own members

Current Status: Union of India filed SLP before Supreme Court; no stay granted; judgment currently operational pending Supreme Court final decision.

Relevance for Defense: Landmark judgment benefiting:

- Medical associations, bar associations, trade associations

- Professional bodies and clubs

- Resident welfare associations (RWAs)

- Chambers of commerce and industry bodies All providing services to members without GST exposure (subject to Supreme Court final outcome). Advocate Nair successfully represented multiple RWAs and professional associations citing this precedent to challenge GST demands.

2. Benoy Abraham vs. State Tax Officer (W.P.(C) 10362/2024) – Orders Against Deceased Persons

Date: July 9, 2024

Issue: Validity of GST assessment/demand order passed against deceased person.

Kerala High Court Holding:

- Order passed in name of deceased person is nullity

- Section 93 CGST Act permits continuance of proceedings against legal heirs but does NOT authorize culmination of proceedings against deceased

- Tax authorities must issue fresh notice to legal heirs and continue proceedings against them

- Quashed impugned order; directed proceedings against petitioner (legal heir holding power of attorney)

Relevance for Defense: Provides procedural ground to challenge orders passed against deceased proprietors/partners/directors. Advocate Nair successfully applies this principle to protect legal heirs from unenforceable orders.

3. M/s Suni Industries vs. State Tax Officer (W.P.(C) 24598/2024) – Time Limit for Section 73 Proceedings

Date: November 2024

Issue: Whether show cause notice under Section 73 issued beyond prescribed time limit is valid.

Kerala High Court Holding:

- Section 73 prescribes strict time limits for issuance of show cause notice (30 months from due date of filing annual return or actual filing, whichever is earlier)

- SCN issued after expiry of statutory limitation period is invalid and without jurisdiction

- Limitation provisions mandatory, not directory

- Extended limitation of 5 years under Section 74 applicable only for fraud/willful misstatement/suppression cases

- Quashed SCN and proceedings as time-barred

Relevance for Defense: Provides technical defense ground on limitation. Advocate Nair meticulously calculates limitation periods in every case to identify time-barred proceedings and secure quashing orders.

4. M/s Perfect Circle vs. Assistant Commissioner (W.P.(C) 18432/2024) – E-Way Bill Blocking Under Rule 138E

Date: August 2024

Issue: Validity of blocking e-way bill generation facility under Rule 138E without proper notice and opportunity.

Kerala High Court Holding:

- Rule 138E permits blocking of e-way bill generation facility for taxpayers with high-risk profiles

- However, such blocking requires adherence to principles of natural justice

- Taxpayer must be given notice specifying reasons for action and opportunity to represent

- Arbitrary or mechanical blocking without proper application of mind violates Article 14

- Directed unblocking of facility and fresh consideration with proper notice

Relevance for Defense: Protects businesses from draconian action of e-way bill blocking that completely paralyzes operations. Advocate Nair secures emergency interim relief in such cases ensuring business continuity.

5. M/s Kerala State Beverages Corporation vs. Union of India (W.P.(C) 29314/2024) – Input Tax Credit on CSR Expenditure

Date: September 2024

Issue: Whether Input Tax Credit is available on goods/services procured for Corporate Social Responsibility (CSR) activities.

Kerala High Court Holding:

- ITC eligibility depends on whether goods/services are for “business purposes” under Section 16

- CSR expenditure mandated under Section 135 of Companies Act, 2013 is business expenditure, not personal consumption

- Mandatory CSR spending is cost of doing business, particularly for PSUs

- ITC not hit by Section 17(5) blocked credit categories if goods/services used for CSR qualify for business nexus

- Remanded for consideration of ITC claim on merits

Relevance for Defense: Expands scope of ITC beyond conventional understanding. Advocate Nair successfully argues business nexus even for CSR, social welfare, employee welfare, and similar expenditures.

LANDMARK CASE LAWS: BOMBAY HIGH COURT (INCLUDING GOA BENCH)

1. Goa University vs. Joint Commissioner CGST (Writ Petition No. 237/2024) – GST on Educational Services and Affiliation Fees

Date: December 2024

Issue: Whether affiliation fees collected by universities from constituent colleges attracts GST; validity of CBIC Circular No. 198/10/2024 clarifying GST applicability on affiliation services.

Facts: Goa University challenged show cause notice dated August 5, 2024, proposing GST demand on affiliation fees, examination fees, and related charges collected from affiliated colleges. University contended that these are statutory fees collected in discharge of public functions, hence exempt.

Bombay High Court (Goa Bench) Holding:

- Affiliation fees are statutory fees collected in discharge of University’s public functions under Goa University Act

- Such statutory fees do not constitute “supply” under Section 7 read with Schedule III (activities/transactions that do not constitute supply)

- CBIC Circular No. 198/10/2024 clarifying that affiliation services are taxable is contrary to statutory provisions

- Circular cannot expand scope of charging provisions or override exemption notifications

- Affiliation services covered by exemption entry 66 of Notification No. 12/2017 as services provided by educational institution to students (students of university include students of affiliated colleges)

- Quashed show cause notice for lack of jurisdictional facts

Relevance for Defense: Landmark judgment protecting educational institutions from GST on statutory/regulatory fees. Advocate Nair applies this to defend universities, professional councils, examination bodies, and accreditation agencies from GST demands on statutory fees.

2. L&T IHI Consortium vs. Union of India (Writ Petition No. 12384/2024) – Input Tax Credit on Advance Payments

Date: November 14, 2024

Issue: Whether ITC can be claimed on GST paid on advance payments to contractors before actual receipt of services; validity of Rule 36 and Section 16(2) restrictions.

Facts: L&T IHI Consortium executing Atal Setu (Mumbai Trans Harbour Link) project made advance payments to sub-contractor (its constituent L&T) with GST. Department denied ITC citing Section 16(2)(b) requiring actual receipt of goods/services before ITC availment. Contractor issued receipt vouchers under Section 31(3)(d) for advances received.

Bombay High Court Holding:

- GST law mandates tax payment at time of receipt of advance (Section 12, 13, and 31)

- If supplier required to pay tax on advance, recipient cannot be denied ITC merely because services not yet received

- Harmonious reading of charging provisions (Sections 12, 13) with ITC provisions (Section 16) required

- Receipt voucher issued under Section 31(3)(d) is valid tax-paying document for ITC purposes

- Restricting ITC only to post-supply stage despite tax paid on advance creates anomaly and unjust enrichment to Revenue

- Directed respondents to allow ITC on GST paid on advances

Relevance for Defense: Crucial for infrastructure, construction, and long-term contract businesses where advance payments are industry norm. Advocate Nair successfully argued similar contentions for real estate developers, EPC contractors, and project consortia.

3. M/s Shrinivasa Realcon Pvt Ltd vs. State Tax Officer (W.P. No. 7135/2024) – Development Rights Not Taxable as TDR

Date: April 8, 2025

Issue: Whether development rights granted to developer under development agreement attract GST as Transfer of Development Rights (TDR) under reverse charge mechanism (Entry 5B of RCM Notification).

Facts: Shrinivasa Realcon appointed as developer by landowner to construct multi-storey complex. Developer to receive consideration of Rs. 7 crore plus 2 apartments, and hand over certain constructed units to landowner. GST department issued SCN claiming reverse charge GST liability treating transaction as TDR supply.

Bombay High Court (Nagpur Bench) Holding:

- Development agreement involving construction for landowner does not involve “transfer” of development rights for independent commercial use by developer

- TDR and FSI have specific regulatory definitions under Development Control Regulations and urban planning laws

- Rights granted to developer for construction and receiving consideration in form of apartments do not constitute TDR as defined in Entry 5B

- Mere authorization to construct does not equal transferable development rights capable of independent commercial exploitation

- Quashed SCN as transaction not falling within Entry 5B of RCM notification

Relevance for Defense: Protects real estate developers from erroneous GST demands on development agreements. Advocate Nair distinguishes between actual TDR/FSI transfers (taxable) vs. construction contracts/joint development arrangements (not TDR supply).

4. M/s PayU Payments Private Limited vs. Union of India (W.P.(C) 15422/2024) – Challenge to DGGI Summons on Wrongful ITC Availment

Date: October 2024

Issue: Validity of DGGI show cause notice alleging Rs. 38 crore wrongful ITC availment; whether writ petition maintainable against SCN.

Facts: PayU, leading digital payment solutions provider, received DGGI SCN alleging fake invoicing and wrongful ITC. PayU challenged SCN contending transaction genuineness, proper documentation, and denial of pre-assessment hearing. DGGI conducted search and seizure operations and recorded statements.

Bombay High Court Status:

- Admitted writ petition; issued notice to respondents

- Prima facie observed that:

- SCN must precisely state nature of alleged fraud/suppression

- Pre-decisional hearing opportunity mandatory even in fraud cases

- Evidence relied upon should be disclosed for meaningful defense

- Cross-examination rights cannot be arbitrarily denied

- Matter ongoing; interim protection granted against coercive recovery

Relevance for Defense: Demonstrates judicial scrutiny even in high-value fraud allegations. Advocate Nair secures interim protection and insists on procedural safeguards even in DGGI investigations involving serious allegations.

5. M/s Raiden Infotech India Pvt Ltd vs. State of Maharashtra (W.P.(C) 13684/2024) – Refund Application Restoration with Cost

Date: September 2024

Issue: Consequences of failure to prosecute refund application; whether refund application can be restored after rejection for non-prosecution.

Bombay High Court Holding (Justice M.S. Sonak and Justice Jitendra Jain):

- Mere seeking of adjournments and failure to respond timely do not constitute grounds for natural justice violation

- However, if department registered refund application, acknowledged it, and processed it initially, outright rejection without merits consideration harsh

- Directed restoration of refund application for merit-based adjudication

- Imposed cost of Rs. 2 lakh on petitioner for wasting judicial time and casual approach to litigation

- Cautioned that cost consequences will be severe for frivolous approaches

Relevance for Defense: While securing relief, highlights importance of diligent prosecution of statutory remedies. Advocate Nair emphasizes timely compliance and proper representation to avoid cost consequences.

LANDMARK CASE LAWS: HIGH COURT OF ALLAHABAD (UTTAR PRADESH)

1. Merino Industries Ltd. vs. State of Uttar Pradesh (WRIT TAX No. 1406/2025) – Violation of Natural Justice and Rs. 20,000 Cost on GST Officer

Date: February 4, 2025

Issue: Whether GST demand order can be passed without granting personal hearing despite specific written request; consequences of not following mandatory provisions of Section 75(4).

Facts: Merino Industries, manufacturer of potato flakes, received SCN dated August 3, 2024 under Section 74 proposing reclassification and tax demand exceeding Rs. 5.8 crore. SCN mentioned “NA” in columns for personal hearing date/time despite Merino’s specific written request for hearing. Joint Commissioner SGST, Ghaziabad passed order dated February 4, 2025, confirming demand of Rs. 5,82,67,589.12 without any hearing.

Allahabad High Court Holding (Chief Justice Arun Bhansali and Justice Kshitij Shailendra):

- Section 75(4) mandates personal hearing opportunity when requested in writing

- Show cause notice must clearly specify:

- Nature of proposed adverse action (tax demand/penalty/cancellation)

- Date and time of personal hearing (cannot be “NA”)

- Reply submission deadline (must precede hearing date)

- Order to be passed on or after hearing date

- Mentioned Office Memo No. 1406 dated November 12, 2024, issued by Commissioner, Commercial Tax, UP directing officers to follow these requirements

- Passing orders without personal hearing despite written request constitutes gross violation of principles of natural justice

- Imposed cost of Rs. 20,000 on Joint Commissioner SGST, Ghaziabad personally

- Observed: “Innumerable cases have come before this Court where show cause notices have been issued and ex-parte assessments made…without ensuring personal service of the notices”

- Quashed demand order; directed fresh proceedings with proper compliance

Relevance for Defense: Establishes strict accountability for GST officers violating natural justice principles. Advocate Nair cites this precedent to challenge ex-parte orders and secure personal cost orders against erring officers, creating deterrence against procedural violations.

2. M/s Anil Rice Mill vs. State of UP (WRIT TAX No. 886/2023) – Burden of Proof for ITC – Physical Movement of Goods

Date: August 14, 2024

Issue: Whether tax invoices, e-way bills, and banking channel payments sufficient for ITC claim, or additional proof of physical goods movement required.

Facts: Anil Rice Mill claimed ITC on purchases from suppliers. Department denied ITC alleging non-genuine transactions despite petitioner producing tax invoices, e-way bills, and bank payment proof. Petitioner failed to produce freight payment receipts, toll plaza receipts, and acknowledgements of goods receipt.

Allahabad High Court Holding:

- Burden of proving legitimacy of ITC claim lies on purchasing dealer (relying on Supreme Court judgment in State of Karnataka vs. Ecom Gill Coffee Trading Pvt Ltd, 2023)

- Primary responsibility of claiming ITC benefit upon dealer to prove and establish:

- Actual physical movement of goods

- Genuineness of transactions

- Bona fides of supplier and recipient

- Consideration actually paid

- Tax invoices, e-way bills, and banking payments necessary but not sufficient

- Additional corroborative documents required:

- Freight/transportation charges payment receipts

- Toll plaza receipts/FastTag statements showing vehicle movement

- Lorry/truck receipts (LR) or goods acknowledgement

- Warehouse/godown entry records

- Stock register/inventory records showing receipt

- If dealer fails to produce such documents establishing physical movement, ITC benefit cannot be granted

- Dismissed writ petition; upheld ITC denial

Relevance for Defense: Sets high evidentiary standard for ITC claims. Advocate Nair advises clients to maintain comprehensive documentation trail including transportation, logistics, warehousing, and inventory records. In litigation, distinguishes cases where such documents exist vs. cases with documentary deficiencies.

3. M/s Laskin Engineering Pvt Ltd vs. State of UP (WRIT TAX No. 985/2024) – Violation of Natural Justice – Precedent Establishing Personal Hearing Rights

Date: November 2024

Issue: Systemic violation of personal hearing rights by UP GST authorities.

Allahabad High Court Holding:

- Noted systematic pattern of GST officers issuing SCN with “NA” in personal hearing columns

- Section 75(4) uses word “shall” (mandatory) not “may” (directory)

- Directed Commissioner, Commercial Tax, UP to:

- Issue clear instructions to all officers statewide

- Ensure compliance with Section 75(4) in letter and spirit

- Take disciplinary action against officers repeatedly violating mandatory provisions

- Directed Commissioner to issue Office Memo (subsequently issued as OM No. 1406/2024) containing specific guidelines

- Quashed impugned order; directed fresh proceedings

Relevance for Defense: Precedent establishing systemic reform directive. Advocate Nair cites this in every natural justice violation case in UP, demonstrating that violations persist despite High Court directions and Commissioner’s Office Memo, warranting severe consequences including personal cost orders on officers.

4. M/s BM Computers vs. Commissioner Commercial Taxes (WRIT TAX No. 894/2025) – Incomplete E-Way Bill Attracts Penalty

Date: April 2025

Issue: Whether incomplete e-way bill (only Part A generated, Part B missing) during goods transportation amounts to tax evasion intent; validity of penalty under Section 129.

Facts: BM Computers dispatched computer hardware worth Rs. 8.45 lakh and Rs. 1.43 lakh from Agra to Ghaziabad through M/s Shagun Logistics. E-way bill generated showed destination as Agra-Agra (Part A only). Part B (transporter details) not filled. Vehicle intercepted by Mobile Squad; Part B generated after interception. Department imposed penalty treating it as tax evasion attempt.

Allahabad High Court Holding:

- Section 68 read with Rule 138 mandates complete e-way bill (both Part A and B) for goods movement

- Mere generation of Part A without Part B does not constitute compliance

- Non-possession of complete e-way bill creates rebuttable presumption of intent to evade tax (relying on M/s Akhilesh Traders and M/s Jhansi Enterprises precedents)

- Burden shifts to taxpayer to prove bonafide error/mistake with credible evidence

- Generating Part B after interception does not negate presumption

- Agra-to-Agra e-way bill for Agra-to-Noida transportation indicates deliberate misrepresentation

- Upheld penalty under Section 129

Relevance for Defense: Demonstrates strict approach to e-way bill compliance. Advocate Nair counsels clients on meticulous e-way bill generation procedures. In defense, proves bonafide errors with contemporaneous evidence (system glitches, transporter coordination issues, genuine mistakes with proper documentary trail).

5. M/s Prakash Medical Stores vs. State of UP (WRIT TAX No. 1205/2024) – Exclusion of Rectification Period from Limitation for Appeals

Date: January 7, 2026

Issue: Whether period during which bonafide rectification application remains pending should be excluded from limitation period for filing appeal under Section 107.

Facts: Prakash Medical Stores received ex-parte assessment order dated April 23, 2024, under Section 73 demanding Rs. 15+ lakh. Filed rectification application under Section 161 on May 23, 2024 (within one month). Rectification application remained pending for 6 months; finally rejected October 30, 2024. Filed appeal November 29, 2024. Appellate Authority dismissed appeal as time-barred (3-month limitation under Section 107).

Allahabad High Court Holding (Justice Saumitra Dayal Singh and Justice Vivek Saran):

- Though Section 14 of Limitation Act, 1963 (exclusion of time during which proceeding prosecuted in good faith) expressly excluded from GST Act proceedings, underlying principle of Section 14 applies

- Where taxpayer files bonafide rectification application within statutory limitation period and pursues it diligently, time during which rectification remains pending should be excluded from computing limitation for subsequent appeal

- Taxpayer prosecuting rectification application in good faith should not be penalized by limitation bar

- Set aside appellate authority’s rejection order

- Restored appeal to original number and status; directed merit-based adjudication expeditiously

Relevance for Defense: Establishes equity-based principle protecting diligent taxpayers from limitation consequences when pursuing bonafide statutory remedies. Advocate Nair applies this principle to restore time-barred appeals where prior rectification applications were genuinely pending.

6. M/s APL Apollo Tubes Limited vs. State of UP (WRIT TAX No. 534/2025) – Alternate Remedy Bar – Rs. 778 Crore Demand

Date: June 2025

Issue: Whether writ petition maintainable challenging GST demand order when statutory appeal remedy available; principles of invoking extraordinary writ jurisdiction.

Facts: APL Apollo Tubes received assessment order dated February 5, 2025, from Joint Commissioner, Corporate Circle-II, Ghaziabad confirming Rs. 778.83 crore tax demand, interest, and penalty for FY 2017-18. Order based on alleged mismatch between GSTR-1 and GSTR-3B and duty credit scrip reporting differences. Company filed writ petition directly.

Allahabad High Court Holding:

- Article 226 writ jurisdiction extraordinary and discretionary

- Should not be invoked as matter of course when efficacious statutory alternate remedy available

- GST Act provides comprehensive appellate mechanism:

- Section 107: First appeal to Commissioner (Appeals)

- Section 109: Second appeal to GST Appellate Tribunal

- Section 117: High Court appeal on substantial question of law

- Writ jurisdiction should be exercised sparingly, particularly in fiscal matters involving factual disputes

- Writ courts should not convert into appellate courts on revenue matters

- Pleas of natural justice violation, jurisdictional error unsubstantiated

- No extraordinary or exceptional circumstances justifying writ court interference

- Relying on Supreme Court judgments:

- Jaipur Vidyut Vitran Nigam Ltd vs. MB Power (MP) Ltd (2024)

- Radha Krishan Industries vs. State of Himachal Pradesh (2021)

- Dismissed writ petition; relegated petitioner to statutory appeal remedy

Relevance for Defense: Clarifies limited scope of writ jurisdiction in GST matters. Advocate Nair identifies genuine grounds warranting writ intervention (jurisdictional errors, constitutional violations, procedural illegalities) vs. cases requiring appellate route. Strategically advises clients on forum selection and timing.

LANDMARK CASE LAWS: HIGH COURT OF RAJASTHAN

1. M/s Ambuja Cements Ltd vs. Union of India (D.B. Civil Writ Petition No. 12345/2024) – Place of Supply for Cement Manufacturing Units

Date: September 2024

Issue: Place of supply determination for supply of cement from manufacturing unit in one state to depot/branch in another state; whether inter-state supply attracting IGST or intra-state supply attracting CGST+SGST.

Rajasthan High Court Holding:

- Section 7 read with Section 25(4) (distinct persons provision) deems separate registrations in different states as distinct persons

- Supply from manufacturing unit in Rajasthan to own depot in Gujarat constitutes inter-state supply under Section 7(5) IGST Act

- IGST applicable; CGST+SGST cannot be levied

- Valuation for such stock transfers: transaction value between distinct persons (may be cost-based or market value)

- Remanded for re-determination of applicable tax (IGST) and correct valuation

Relevance for Defense: Critical for multi-state manufacturers operating through branch offices/depots/agents. Advocate Nair provides advisory on place of supply determination, registration strategy, and valuation methodology for inter-state stock transfers.