Advocate Siddharth Nair

Call Now For Help: +91-9625799959

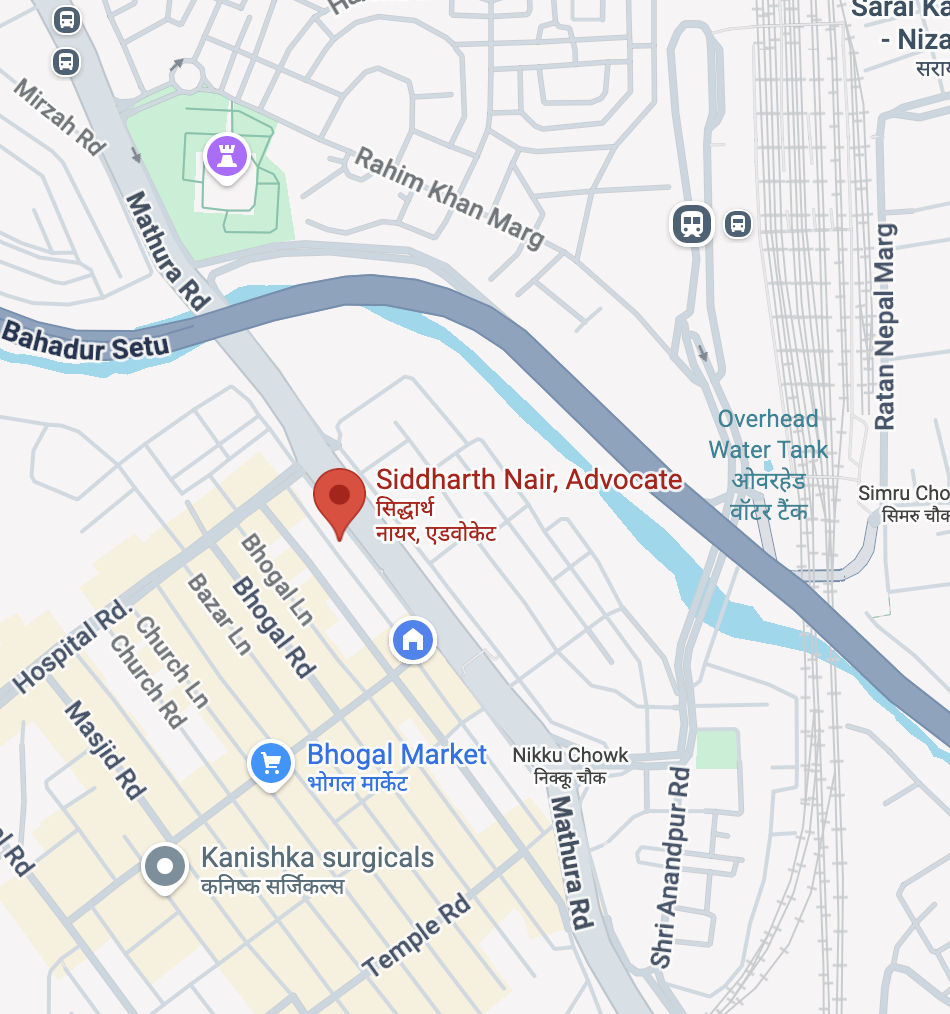

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

www.nairlawchamber.com

Comprehensive Legal Defence for Hawala Cases in New Delhi & Delhi NCR

Best Hawala Defence Lawyer in New Delhi/NCR

Are you facing criminal charges related to hawala transactions, money laundering, or foreign exchange violations in Delhi or the National Capital Region? Advocate Siddharth Nair is a premier criminal defence lawyer specialising in hawala cases, PMLA prosecutions, and financial crime defence with an exceptional track record of securing favourable outcomes through bail applications, trial defence, and strategic litigation in New Delhi and Delhi NCR.

With extensive expertise in the Prevention of Money Laundering Act (PMLA), 2002, the Foreign Exchange Management Act (FEMA), 1999, and related criminal legislation, Advocate Siddharth Nair has successfully defended numerous clients accused under hawala laws in the Special Courts of Delhi and the Delhi High Court. His strategic approach combines deep knowledge of anti-money laundering jurisprudence with aggressive courtroom advocacy, procedural expertise, and meticulous case preparation.

Who is Advocate Siddharth Nair? Your Trusted Hawala Defence Lawyer in Delhi

Best Hawala Defence Lawyer in New Delhi/NCR

Advocate Siddharth Nair stands as one of Delhi’s most accomplished criminal defence attorneys, with a specialised focus on complex financial crime cases, particularly hawala transactions, money laundering prosecutions, and enforcement cases initiated by the Directorate of Enforcement (ED). His reputation in the legal community is built on a foundation of consistent success in securing bail relief, obtaining acquittals, and effectively challenging prosecutorial overreach in some of the most complex criminal cases in New Delhi and the broader Delhi NCR jurisdiction.

Why Choose Advocate Siddharth Nair for Your Hawala Case?

- Proven Track Record of Success: Advocate Siddharth Nair has secured bail relief for clients facing PMLA charges, obtained acquittals in money laundering trials, and successfully challenged illegal arrests and procedural violations by the Enforcement Directorate.

- Specialised Expertise in Hawala Law: With detailed knowledge of how hawala networks operate, how law enforcement agencies investigate these cases, and the specific defences available under PMLA and FEMA, Advocate Nair provides strategic guidance tailored to the unique complexities of hawala prosecutions.

- Superior Courtroom Advocacy: His commanding presence in the Special Courts and Delhi High Court, combined with meticulous legal research and persuasive argumentation, has resulted in favourable judgments for clients across pre-trial relief, trial proceedings, and appellate matters.

- Understanding of ED Investigation Tactics: With intimate knowledge of how the Enforcement Directorate conducts raids, seizes assets, records statements, and constructs money laundering cases, Advocate Nair identifies procedural defects, challenges unlawful arrests, and protects clients’ constitutional rights.

- Comprehensive Legal Support: From initial consultation through anticipatory bail, regular bail, trial defence, and appeals—Advocate Siddharth Nair provides end-to-end legal representation addressing every stage of hawala case prosecution.

- Delhi & Delhi NCR Jurisdiction Expertise: Based in New Delhi, Advocate Nair maintains deep connections with the Special Courts, Delhi High Court, and appellate courts, ensuring clients receive representation before judicial authorities with whom he has established credibility and advocacy excellence.

Understanding Hawala: The Crime & Legal Framework in India

What is Hawala?

Hawala is an informal, underground money transfer system that operates outside the regulated banking and financial system. Unlike legitimate banking channels, hawala transactions involve:

- No formal documentation or official records

- No bank statements or government-regulated transaction trails

- Trust-based transfer of funds between hawala operators across international borders

- Anonymous transfers without official identification requirements

- Rapid cross-border movement of cash, often through courier services or carrying cash physically

Hawala networks typically operate between major financial hubs—connecting Mumbai to London, Delhi to Dubai, and Patna to Kabul—with funds flowing to support:

- Illegal betting and gambling operations

- Smuggling activities

- Tax evasion schemes

- Terror financing and secessionist activities

- Proceeds from drug trafficking and other scheduled offences

- Money laundering of illegally obtained wealth

Why is Hawala Illegal in India?

Hawala is comprehensively criminalised under two primary statutes:

1. Foreign Exchange Management Act (FEMA), 1999

Section 4 of FEMA strictly regulates all foreign exchange transactions, permitting only RBI-authorised persons to engage in currency exchange. Hawala operators, by definition, lack this authorisation. Under FEMA, hawala involves the illegal transfer of money in and out of India without going through authorised banking channels.

Penalties under FEMA (Section 13-15):

- Imprisonment: Up to 3 years

- Fines: Up to 3 times the transaction amount (or Rs. 2 lakhs if the amount is not quantifiable)

- Additional daily penalty: Rs. 5,000 per day for continued contravention

- Confiscation: Currency, securities, and all property involved in the violation

- Civil imprisonment: In case of non-payment of the penalty

- Business disqualification: Permanent bar from operating a business

2. Prevention of Money Laundering Act (PMLA), 2002

PMLA treats hawala transactions as money laundering offences when the funds originate from or are connected to scheduled offences (predicate crimes). Hawala-facilitated money laundering falls under:

- Section 3: Offence of money laundering

- Section 4: Punishment for money laundering

Penalties under PMLA (Section 4):

- Imprisonment: 3 to 7 years (more stringent than FEMA)

- Fines: As determined by the court (can be substantial)

- Asset seizure and confiscation: All property derived from or involved in the hawala transaction

- No compounding: PMLA offences cannot be settled or compounded like civil violations

The Critical Distinction: FEMA vs. PMLA in Hawala Cases

While hawala is fundamentally illegal under FEMA, the severity escalates when PMLA applies. Consider this:

- FEMA-only case: A one-time, accidental hawala transaction with no connection to crime carries FEMA penalties.

- PMLA case: The same transaction, if connected to terror financing, drug proceeds, or other criminal activity, triggers PMLA prosecution with higher imprisonment terms and stricter bail conditions.

In most serious hawala cases prosecuted in Delhi and Delhi NCR, the Enforcement Directorate initiates proceedings under both FEMA and PMLA, with PMLA ultimately driving the prosecution and determining sentencing.

Key Legislation Governing Hawala Cases in Delhi NCR

The Prevention of Money Laundering Act (PMLA), 2002: The Primary Framework

The PMLA forms the backbone of hawala prosecutions in India. For individuals accused of hawala transactions in Delhi, understanding PMLA’s critical provisions is essential.

Section 3: The Offence of Money Laundering

Section 3 PMLA defines the money laundering offence comprehensively:

“Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party to or is actually involved in any process or activity connected with the proceeds of crime, including its concealment, possession, acquisition or use and projecting or claiming it as untainted property shall be guilty of an offence of money laundering.”

For hawala cases, the prosecution must establish that:

- Proceeds of crime originated from a scheduled offence (predicate crime listed in PMLA Schedule—terrorism, drug trafficking, smuggling, etc.)

- The accused was involved in the hawala transaction—either as the operator, facilitator, or knowing participant

- The involvement was direct or indirect—meaning even intermediaries and facilitators can be prosecuted

- Intent to launder was present—the accused knowingly facilitated the movement of illicit funds through hawala channels

The breadth of Section 3 is significant: possession alone of proceeds of crime is an offence; concealment is an offence; acquisition is an offence. A person need not have personally handled cash—merely assisting in the process, such as providing bank accounts, contact information, or coordination, constitutes money laundering.

Section 4: Punishment for Money Laundering

“Whoever commits the offence of money-laundering shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to seven years and shall also be liable to a fine which may extend to five lakh rupees or one lakh rupees per crore of the value of proceeds of crime involved, whichever is higher.”

Key aspects:

- Minimum imprisonment: 3 years (non-bailable in most circumstances)

- Maximum imprisonment: 7 years

- Fines: Up to Rs. 5 lakhs or Rs. 1 lakh per crore of proceeds involved (whichever is higher)

- Multiple offences: If the accused facilitated multiple hawala transactions, separate charges can be levied for each transaction, potentially resulting in cumulative sentences

Section 19: Enforcement Directorate’s Power to Arrest

The ED possesses significant arrest powers under Section 19:

“An officer above the rank of Sub-Inspector may arrest any person concerned with the commission of an offence punishable under Section 3 or Section 4, if he has based on material in his possession, reason to believe…that such person is guilty of an offence under this Act.”

Critical safeguards following the Pankaj Bansal v. Union of India judgment (October 2023):

- Written grounds of arrest must be provided to the arrestee (not merely oral communication)

- Article 22(1) of the Constitution requires that the arrestee be informed of the grounds of arrest

- Failure to provide written grounds can vitiate the arrest itself, making any subsequent remand or detention unlawful

- This safeguard is essential for securing bail, as counsel can challenge the legality of custody

Section 24: The Reverse Burden of Proof

Section 24 PMLA imposes a reverse burden of proof that significantly affects the accused:

“In any proceeding relating to proceeds of crime under this Act, in the case of a person charged with the offence of money-laundering under section 3, the Authority or Court shall, unless the contrary is proved, presume that such proceeds of crime are involved in money-laundering.”

What this means for hawala defendants:

- The prosecution does NOT need to prove that the money involved is proceeds of crime

- A presumption operates against the accused that the money is the proceeds of crime

- The accused must prove the contrary—that the money was earned legitimately

- This is a reverse burden—placing the evidentiary onus on the defendant rather than the prosecution

However, critically, the prosecution must still:

- Prove that a scheduled offence (predicate crime) was committed

- Establish the nexus between the predicate offence and the proceeds

- Show the accused’s involvement in the hawala transaction

The Supreme Court in Vijay Madanlal Choudhary v. Union of India (2022) upheld Section 24 as constitutional, reasoning that the reverse burden is justified because money laundering inherently involves concealment and layering of illicit proceeds. The Court emphasised that the prosecution cannot merely presume property is proceeds of crime; it must first prove the foundational facts establishing the connection to the predicate offence.

Section 45: Bail Provisions—The “Triple Test” and Recent Jurisprudential Evolution

Section 45 PMLA contains the stringent bail conditions that make securing release extraordinarily difficult for hawala defendants:

“No person accused of an offence under this Act shall be released on bail or on his own bond unless the public prosecutor has been allowed to oppose the bail application, and the court is satisfied that there are reasonable grounds for believing that he has not committed an offence under Section 3 or Section 4 and that he is not likely to commit an offence while on bail.”

The “Twin Conditions”:

- Prima facie innocence: The court must be satisfied that the accused did not commit the money laundering offence

- No flight risk: The court must be satisfied that the accused is not likely to commit further offences while on bail

These twin conditions were originally struck down as unconstitutional in Nikesh Tarachand Shah v. Union of India (2017) for violating Article 14 and Article 21 of the Constitution. However, Parliament amended PMLA in 2018 (Amendment Act No. 13), reviving the twin conditions.

Recent judicial evolution—Favourable Developments for Hawala Defendants:

The Supreme Court’s landmark judgment in Manish Sisodia v. CBI & ED (August 9, 2024) has fundamentally altered bail jurisprudence under PMLA, creating significant new opportunities for bail relief:

- Right to speedy trial incorporated into Section 45: The Court held that prolonged incarceration coupled with indefinite trial delays constitutes deprivation of the right to speedy trial under Article 21 of the Constitution. This right must be read into Section 45 PMLA.

- Discretion in bail determination: The twin conditions are not an absolute bar; courts possess discretion and must consider:

- Length of incarceration (if prolonged, creates presumption favouring bail)

- Stage of trial (if trial has not commenced after substantial time, this favours bail)

- Nature and gravity of allegations (serious allegations require stricter scrutiny, but are not automatic grounds for denial)

- Flight risk assessment (deep societal roots and family ties reduce flight risk)

- Evidence largely documentary (reduces tampering concerns)

- Judicial scrutiny of prosecutorial delays: Courts must now examine whether investigative agencies are using prolonged custody as a tool of oppression rather than investigative necessity. In Manish Sisodia’s case, the Supreme Court criticised the Trial Court and High Court for “ignoring” the Court’s own observations on reading speedy trial rights into PMLA bail provisions.

- Article 21 supremacy: When Section 45 PMLA conflicts with Article 21 of the Constitution (right to life and liberty), Article 21 prevails. Indefinite incarceration for an undertrial cannot be justified merely by invoking the twin conditions.

These developments have created a favourable jurisprudential window for hawala defendants, particularly those who have been in custody for extended periods with slow-moving trials. Advocate Siddharth Nair leverages this recent jurisprudence strategically in bail applications.

Section 50: Enforcement Directorate’s Investigation Powers

Section 50 grants the ED quasi-judicial powers to:

- Summon any person to produce records and documents

- Record statements of persons believed to know hawala operations

- Conduct inquiries into the movement and ownership of funds

- Levy penalties (up to Rs. 500) for non-compliance with summons

Critically, statements recorded under Section 50 are admissible in court as evidence (upheld in Vijay Madanlal Choudhary v. Union of India). This creates a significant vulnerability for defendants: any statement made to ED during the investigation can be used against them in trial. This underscores the importance of obtaining legal representation immediately upon being summoned by ED or raided.

Landmark Precedents Protecting Hawala Defendants’ Rights in Delhi NCR

1. Vijay Madanlal Choudhary v. Union of India, (2022) 10 SCC

Date: July 27, 2022 | Court: Supreme Court of India | Significance: Foundational PMLA jurisprudence; 545-page landmark judgment

This watershed judgment upheld the constitutionality of most PMLA provisions while establishing critical procedural safeguards for accused persons:

Key Holdings Favouring Defendants:

- Scheduled offence is a prerequisite: The ED cannot initiate PMLA proceedings without a predicate scheduled offence being registered and established. Money laundering cannot exist in isolation from a predicate crime.

- Direct nexus required: There must be a direct causal connection between the predicate scheduled offence and the alleged proceeds of crime. ED cannot merely assume that property possessed by the accused is proceeds of crime; it must prove the connection.

- Proceeds of crime must be defined: The term “proceeds of crime” is not to be interpreted broadly. The prosecution must specifically identify:

- What criminal activity generated the proceeds

- How much money was generated

- How the alleged proceeds relate to the accused’s possessions

- Section 24 burden is constitutional but limited: While the reverse burden of proof is valid, the prosecution must first prove foundational facts—that the predicate offence occurred and generated proceeds. Only then can the presumption under Section 24 be invoked.

- ED arrest powers have safeguards: Section 19 arrest power, while broad, is subject to:

- Recorded “reason to believe”

- Post-arrest judicial review

- Constitutional protection of Article 22 (informed of grounds of arrest)

Application to Hawala Cases:

In a hawala prosecution, the prosecution must establish:

- A predicate scheduled offence (e.g., smuggling, terror financing, drug trafficking)

- That specific amounts of money were generated from this offence

- That the accused’s involvement in the hawala transaction directly facilitated the laundering of these specific proceeds

- Cannot assume guilt merely from possession of large sums

Advocate Siddharth Nair leverages this precedent to challenge vague ED allegations, demand specific evidence of nexus between predicate offence and hawala transaction, and contest the application of Section 24 presumption when the foundation is weak.

2. Manish Sisodia v. CBI & ED, 2024 INSC 595

Date: August 9, 2024 | Court: Supreme Court of India | Justices: B.R. Gavai & K.V. Viswanathan | Significance: Transformative bail jurisprudence for PMLA cases; recent and highly favourable to accused

This landmark judgment has fundamentally altered the landscape of bail in PMLA cases, including hawala prosecutions, by reading the right to speedy trial into Section 45 PMLA and granting bail despite stringent provisions.

Critical Holdings:

- Prolonged incarceration triggers right to bail: After approximately 17 months in custody without commencement of trial, the accused possesses a right to bail under Article 21 of the Constitution, notwithstanding the twin conditions of Section 45.

- Section 45 is not absolute: The Court stated:

- “…in case of delay coupled with incarceration for a long period and depending on the nature of the allegations, the right to bail will have to be read into Section 45 of PMLA.”

- The twin conditions do not operate as an absolute bar to bail; courts retain discretionary power.

- Judicial discretion is paramount: Courts must balance:

- Severity of allegations and evidence

- Length of incarceration

- Stage of investigative and trial proceedings

- Possibility of speedy conclusion of trial

- Flight risk and tampering potential (assessed realistically)

- Criticism of strict application: The Supreme Court explicitly criticised the Trial Court and Delhi High Court for:

- Rigidly applying the “triple test” without acknowledging the Court’s own jurisprudence

- Ignoring the right to a speedy trial

- Using prolonged custody as a de facto punishment rather than an investigative necessity

- Failing to exercise discretion despite prolonged incarceration

- Documentary evidence reduces tampering concerns: Where evidence is predominantly documentary (as in financial crime cases), the risk of witness tampering diminishes, warranting bail relief.

- Speedy trial is a fundamental right: The Court observed that “trial is yet to begin even after a long delay of 17 months” and that the accused “has been deprived of his right to speedy trial,” making the case “a fit case for granting bail notwithstanding the restrictive bail conditions.”

Application to Hawala Cases in Delhi NCR:

This precedent is extraordinarily favourable to hawala defendants:

- If custody exceeds 12-18 months without trial commencement, clients can argue deprivation of speedy trial and demand bail

- Documentary nature of hawala evidence (bank records, ED documents, transaction logs) reduces tampering concerns

- Courts should exercise discretion based on proportionality—bail should not be withheld as a de facto punishment

- Trial delays are increasingly common in financial crime cases; these delays favour the accused

Advocate Siddharth Nair uses this judgment aggressively in bail applications, arguing that:

- The twin conditions alone cannot justify indefinite incarceration

- Article 21 protections override PMLA’s stringent provisions

- The court possesses and should exercise discretion to grant bail in cases of prolonged custody

3. Pankaj Bansal v. Union of India, SLP(CRL) Nos. 9275-9276 of 2023

Date: October 3, 2023 | Court: Supreme Court of India | Significance: Critical procedural safeguard establishing mandatory written grounds of arrest

This judgment addresses a specific but crucial procedural defect in ED arrests that can wholly vitiate the legality of custody.

The Issue:

The ED had developed a practice of orally communicating grounds of arrest to detained persons, arguing that since they had to be brought before a magistrate within 24 hours anyway, formal written communication was unnecessary.

Supreme Court’s Ruling:

The Court held that Article 22(1) of the Constitution mandates:

- The arrestee must be informed of the grounds of arrest

- This information must be provided in writing

- Oral communication alone is insufficient

- Written communication is a sine qua non—an absolute prerequisite

Why Written Grounds Matter:

- Effective legal representation: Without written grounds, the accused cannot adequately instruct counsel on defence strategy

- Bail applications: The accused needs written grounds to challenge the legal basis for arrest during bail hearings

- Constitutional compliance: Article 22(1) contemplates meaningful notification, not ephemeral oral statements

- Evidentiary record: A written document creates a record against which the ED’s claims can be tested

Application to Hawala Cases:

In many ED hawala investigations, particularly those predating or immediately following this judgment, the ED may have:

- Arrested persons without providing written grounds

- Claimed oral communication satisfied the requirement

- Proceeded with remand based on alleged oral notification

Advocate Siddharth Nair’s Strategic Use:

If written grounds were not provided:

- The arrest itself may be vitiated (no valid custody exists)

- All subsequent remands are unlawful (proceedings from an invalid arrest are void)

- Evidence gathered post-arrest may be inadmissible (fruits of an illegal arrest)

- Automatic grounds for bail (the entire custodial status is compromised)

This precedent has proven invaluable in challenging the legality of ED arrests in hawala cases where procedural corners were cut.

4. Nikesh Tarachand Shah v. Union of India

Date: 2017 | Court: Supreme Court of India | Significance: Original striking down of twin conditions; later revived by Parliament

Originally, this judgment declared the twin conditions in Section 45(1) of PMLA unconstitutional for violating:

- Article 14 (right to equality)—the classification based on the punishment threshold was arbitrary

- Article 21 (right to life and liberty)—the conditions forced disclosure of defence, violating the right against self-incrimination

The Court held that the twin conditions were manifestly arbitrary and required accused persons to “disclose their defence at a point in time when they are unable to adequately prepare.”

Subsequent Development:

Parliament amended PMLA in 2018 (Amendment Act No. 13 of 2018), reviving the twin conditions. Courts have upheld this amendment as curing the constitutional defect identified in Nikesh Shah.

Current Significance:

While the twin conditions are now constitutionally valid, the principles articulated in Nikesh Shah—regarding the importance of due process, the presumption of innocence, and the dangers of forcing premature defence disclosure—inform judicial interpretation of Section 45 in bail applications. Courts are guided to interpret the conditions reasonably and exercise discretion in light of these principles.

5. K Kavitha v. Union of India

Date: 2023 | Court: Supreme Court of India | Significance: Demonstrates judicial discretion in PMLA bail; favourable to educated, prominent accused

K Kavitha, a prominent political figure and Member of Parliament, sought bail under the first proviso to Section 45(1) of PMLA, which permits bail for women, minors, the ill, or those accused of laundering less than Rs. 1 crore.

The Delhi High Court (Single Judge) rejected her bail because she was an educated, politically prominent woman and therefore not “vulnerable” enough to warrant the special proviso.

Supreme Court’s Holding:

The Supreme Court reversed the High Court, holding:

- The proviso applies to all women, not merely “vulnerable” or illiterate women

- The court erred in imposing an additional “vulnerability” test not found in the statute

- The education level and social prominence of the accused do not exclude them from constitutional protections

Significance for Hawala Cases:

- Courts must apply statutory provisions as written, without adding interpretive layers

- Even in serious PMLA cases, courts retain discretion to grant bail based on individual circumstances

- The Court’s refusal to engage in judge-made classifications protects accused persons’ rights

6. Pankaj Kumar Tiwari v. Directorate of Enforcement, 2024 SCC OnLine Del 7387

Date: 2024 | Court: Delhi High Court | Significance: Recent authority confirming Article 21 supremacy in PMLA bail

This recent judgment reiterates that Section 45 of PMLA must be interpreted with deference to Article 21 of the Constitution:

Key Holdings:

- Article 21 (right to life and liberty) prevails over PMLA’s stringent bail conditions

- Section 45 cannot be weaponised for prolonged undertrial incarceration

- Mitigating circumstances matter: Long incarceration periods, pending trial, and other factors can justify bail despite twin conditions

- Judicial discretion is required: Courts must balance public interest in prosecution against the fundamental right to liberty

Relevance to Hawala Defendants:

- Courts increasingly recognise that PMLA’s stringent provisions can be used oppressively

- Long incarceration awaiting trial is itself a form of punishment and must be accounted for in bail decisions

- Article 21 protection is a powerful tool for challenging indefinite detention

How Advocate Siddharth Nair Defends Hawala Cases: Strategic Approach for Delhi NCR Clients

Stage 1: Anticipatory Bail (Section 438 CrPC) — Before Arrest

If a client apprehends arrest in a hawala investigation, the optimal strategy is to seek anticipatory bail proactively under Section 438 of the Code of Criminal Procedure, 1973.

Section 438 Framework:

The CrPC permits any person apprehending arrest to apply to the High Court or District Court for an order granting bail in anticipation of arrest. This is a critical protective mechanism, as it:

- Prevents arrest and detention, preserving liberty

- Establishes bail conditions in advance, avoiding forced remands

- Demonstrates proactive respect for law, favorably impacting judicial perception

- Avoids the trauma of sudden arrest, detention, and interrogation

How Advocate Siddharth Nair Structures Anticipatory Bail Applications:

- Factual Narration: Present a balanced, detailed account of the client’s background:

- Deep roots in Delhi/Delhi NCR (family, business, property)

- Absence of criminal history

- Established social, professional, and community ties

- Circumstances that may have led to inadvertent involvement in a hawala transaction

- Procedural Compliance Arguments:

- ED has not yet lodged an ECIR (Enforcement Case Information Report), or

- If ECIR exists, the investigation is still preliminary

- No FIR has been registered yet (or only FIR registered, investigation ongoing)

- Premature arrest would hamper a fair investigation

- Absence of Flight Risk:

- Substantial immovable property in Delhi/Delhi NCR

- Family residing in the jurisdiction

- Business interests in the region

- Voluntary cooperation with the investigation

- Undertaking not to travel abroad without the court’s permission

- No Tampering Risk:

- Limited direct involvement in hawala network (if true)

- Financial transactions are documented and seized by ED

- No witnesses requiring intimidation

- Documents cannot be destroyed (ED has already seized them)

- Proportionality:

- Alleged involvement is peripheral/inadvertent (if applicable)

- Detention is not necessary for investigation (client willing to cooperate)

- Bail conditions can ensure compliance

- Constitutional Rights:

- Presumption of innocence

- Right to speedy trial and liberty

- Proportionality of pre-trial detention to offence severity

Advocate Nair’s Track Record in Anticipatory Bail:

Advocate Siddharth Nair has successfully obtained anticipatory bail orders for numerous clients facing hawala investigations, permitting them to:

- Engage counsel immediately

- Prepare defence from the outset

- Avoid trauma of arrest and coercive interrogation

- Establish a favourable custodial history from the beginning

Stage 2: Regular Bail (Section 439 CrPC) — After Arrest

If anticipatory bail is not obtained or the client is arrested despite precautions, the immediate step is filing a regular bail application under Section 439 of the CrPC.

Procedural Framework:

After arrest, the accused must be:

- Brought before a magistrate within 24 hours

- Informed of charges and grounds of arrest (critically, must be in writing per Pankaj Bansal)

- Permitted to apply for bail before the magistrate or higher court

Advocate Siddharth Nair’s Bail Application Strategy:

Step 1: Verify Procedural Compliance

Before making substantive arguments, Advocate Nair examines:

- Were written grounds of arrest written? (If not, arrest may be vitiated per Pankaj Bansal)

- Was the arrest recorded in writing with proper signatures?

- Was the arrestee informed of the specific sections invoked?

- Is the ECIR (Enforcement Case Information Report) proper?

Any procedural defect becomes a ground for immediate bail based on illegality of arrest.

Step 2: Factual Narrative—Mitigating Circumstances

Advocate Nair presents:

- Client’s background: Professional achievements, family ties, community standing

- Circumstances of involvement: Whether inadvertent, peripheral, or based on misunderstanding

- Cooperation with investigation: Prior statements given to ED, documents provided

- Absence of flight risk: Strong roots in Delhi/Delhi NCR, no prior criminal history

- Prejudice from prolonged detention: Family hardship, business disruption, psychological impact

Step 3: Invocation of Manish Sisodia Jurisprudence

Advocate Nair leverages the August 2024 Supreme Court judgment to argue:

- Even in serious PMLA cases, bail should be granted if incarceration is prolonged

- Article 21 (right to life and liberty) supersedes Section 45 if detention becomes oppressive

- Discretion is paramount, and courts must balance public interest against individual liberty

- Trial delays favor the accused, not the prosecution

Step 4: Twin Conditions Analysis (Section 45 PMLA)

Even if PMLA applies, Advocate Nair addresses the twin conditions:

Condition 1: Prima Facie Innocence

- Prosecution must prove predicate scheduled offense: Was smuggling, terror financing, drug trafficking, etc. actually established? If ED is vague or lacking evidence of predicate crime, the entire PMLA foundation crumbles.

- Nexus between predicate offense and hawala transaction: Even if a scheduled offense exists, did the accused’s hawala transaction facilitate the laundering of proceeds from that specific offense? Or is ED merely assuming guilt?

- Strength of evidence against accused: What specific evidence links the client to the hawala network? Circumstantial evidence, mere possession of funds, or association with hawala operator is insufficient.

- Possibility of innocent explanation: Could the funds have originated from legitimate business, inheritance, loans, or other lawful sources?

Condition 2: Likelihood to Commit Further Offenses

- No prior criminal history: First-time offense, suggesting low risk of recidivism

- Nature of offense: Hawala is typically a one-time transaction or isolated involvement, not a pattern of behavior requiring detention to prevent repetition

- Monitoring and conditions: Strict bail conditions (reporting to IO, travel restrictions, device sealing) adequately mitigate any risk

Step 5: Burden of Proof Arguments (Section 24)

Advocate Nair challenges the application of Section 24 presumption:

- Prosecution has not established the foundation: The predicate scheduled offense and nexus to proceeds must be proven with particularity before presumption invokes

- Accused can challenge the presumption: By establishing legitimate source of funds or lack of connection to predicate offense

- Presumption is rebuttable: The defendant can produce evidence (business records, bank statements, inheritance documents, loan agreements) showing innocent origin

Step 6: Constitutional Arguments

Under Article 21 of the Constitution:

- Right to liberty before conviction is fundamental

- Bail is the rule; detention is the exception (absent specific legislative override)

- Proportionality principle: Pre-trial detention must be proportionate to offense severity and investigative necessity

- Speedy trial: Prolonged detention without trial commencement violates this right

Stage 3: Trial Defence — Systematic Dismantling of Prosecution’s Case

Once bail is secured and trial commences, Advocate Nair employs comprehensive trial defence strategies:

Challenge 1: Predicate Scheduled Offense

The foundation of every PMLA case is a scheduled offense (predicate crime). Without establishing a predicate offense, the entire PMLA prosecution collapses.

Advocate Nair examines:

- Was an FIR registered for a scheduled offense (smuggling, drug trafficking, terror financing, etc.)?

- Is the alleged scheduled offense proven beyond reasonable doubt?

- What specific evidence establishes the commission of the scheduled offense?

If the predicate offense is not proven, Section 3 PMLA offense fails because there are no “proceeds of crime” to launder.

Application to Hawala Cases:

Many hawala cases involve alleged terror financing or smuggling. Advocate Nair may challenge:

- Whether actual terror funding occurred (or whether it was merely suspicion)

- Whether the alleged smuggling actually happened (or whether possession of goods is merely possession, not smuggling)

- Whether the predicate offense generated the specific proceeds being laundered through hawala

Challenge 2: Nexus Between Predicate Offense and Alleged Proceeds

Even if a scheduled offense is established, the prosecution must prove that the specific funds alleged to be laundered came from that offense.

Vijay Madanlal Choudhary v. Union of India emphasizes this requirement.

Advocate Nair argues:

- Where did the prosecution trace the money? Bank records, ED seizures, documentary evidence?

- Is there a clear chain showing predicate offense → proceeds → hawala transaction?

- Or is ED merely assuming that because the accused possessed large sums and was involved in hawala, the sums must be proceeds of crime?

- Can the accused explain the source through alternative legitimate means?

Challenge 3: Scope of “Proceeds of Crime” (Section 2(u))

The definition of proceeds of crime in PMLA is elaborate:

- Property derived or obtained (directly or indirectly) from criminal activity

- The value of such property

- Property held abroad equivalent in value

Advocate Nair challenges:

- Is the calculation of “proceeds” accurate? ED may overestimate or conflate different sources

- Are proceeds defined with precision? Vague allegations that large sums “must be” proceeds of crime are insufficient

- Has ED actually proven the quantum of criminal proceeds generated?

Challenge 4: Direct Involvement in Money Laundering

Section 3 PMLA requires that the accused was actually involved in the money laundering activity—either directly operating the hawala network or knowingly facilitating it.

Advocate Nair examines:

- What is the nature of accused’s involvement? Mere receipt of funds through hawala? Facilitation? Actual operation?

- Was involvement knowing or inadvertent? Did the accused know the funds were proceeds of crime, or was the connection unknown?

- Is the evidence direct or circumstantial? Circumstantial evidence must overcome the presumption of innocence

Scenarios where involvement may be challenged:

- Inadvertent recipient: Person received money through hawala without knowing it was proceeds of crime (e.g., family abroad sent money through informal channels, not knowing it was illegal)

- Forced participation: Coerced to facilitate by more dominant hawala operators

- Mistaken involvement: Thought one was facilitating legitimate remittance, not criminal proceeds

Challenge 5: Reversing the Burden of Proof (Section 24) Through Proving Legitimate Source

Under Section 24 PMLA, once the prosecution presents material suggesting the property is proceeds of crime, a presumption operates against the accused. However, the accused can rebut this presumption by proving legitimate source.

Advocate Nair’s strategy:

- Business records and income statements: If the accused runs a business, documented business income can be traced to the funds

- Banking records and loan documentation: Loans taken from banks, documented family loans, or advances

- Inheritance and gift documentation: Property received through will or documented gifts from family/friends

- Stock sales and investment returns: Income from sale of stocks, bonds, or investment withdrawals

- Professional income: Salary, consultation fees, professional service receipts

Presenting credible, documentary evidence of legitimate source neutralizes the Section 24 presumption and shifts the burden back to the prosecution to prove criminal origin beyond reasonable doubt.

Challenge 6: ED’s Investigation Tactics and Procedural Defects

Advocate Nair scrutinizes ED’s investigative conduct:

- Unlawful searches or seizures: Violated Fourth Amendment equivalents (Article 21) through warrantless or overly broad searches

- Improper recording of statements: Statements under Section 50 must be voluntary; coercion or duress renders them inadmissible

- Violation of confidentiality: ED disclosing investigation details prematurely, prejudicing fair trial

- Suppression of exculpatory evidence: If ED possessed evidence of innocence, failure to disclose violates fair trial rights

Challenge 7: Cross-Examination of Prosecution Witnesses

During trial, Advocate Nair conducts rigorous cross-examination:

- ED officers: Questioning the basis of their suspicion, consistency of their observations, adherence to procedural requirements

- Bank officials and remittance agents: Testing their knowledge of the accused, documentation maintained, and whether they notified authorities of suspicious transactions

- Co-accused/approver witnesses: Exposing bias, incentives to incriminate the present accused in exchange for consideration, inconsistencies in their accounts

Stage 4: Appellate Representation — Challenging Convictions

If the trial court enters an unfavorable judgment, Advocate Siddharth Nair pursues appeals before the Delhi High Court and, if necessary, the Supreme Court.

Grounds for appeal in hawala cases:

- Erroneous assessment of evidence: Trial court failed to properly evaluate prosecution evidence or misapprehended facts

- Violation of Section 24 PMLA burden of proof: Trial court improperly shifted burden without requiring prosecution to prove foundation

- Failure to consider reasonable doubts: Conviction entered despite insufficient evidence beyond reasonable doubt

- Procedural violations: Arrest, search, seizure, or interrogation violated constitutional rights

- Misapplication of hawala law: Trial court misinterpreted PMLA, FEMA, or relevant sections

Advocate Nair’s appellate work emphasizes:

- Detailed legal research leveraging recent Supreme Court judgments (Manish Sisodia, Pankaj Bansal, Vijay Choudhary, etc.)

- Factual clarity: Meticulous re-examination of trial record to identify weaknesses in prosecution’s case

- Constitutional anchoring: Grounding arguments in fundamental rights and constitutional principles

Common Hawala Scenarios & Advocate Nair’s Defence Approach

Scenario 1: Receipt of Funds Through Hawala from Abroad

Fact Pattern: A person’s family abroad (parents, siblings, spouse) sends money through hawala channels instead of banks. The sender knows hawala is “informal” but may not realize it’s illegal. ED raids and alleges money laundering.

Advocate Nair’s Defence:

- Absence of guilty knowledge: The accused did not know the money was proceeds of crime; they believed it was family remittance

- No involvement in hawala network: The accused merely received money; the family member abroad initiated the hawala, not the accused

- Source documentation: Family can provide proof of legitimate income (employment, business, property sales) explaining the source of remitted funds

- Innocent receipt theory: Receiving money from family, even through informal channels, does not constitute money laundering if the source is legitimate

Relevant Jurisprudence: Vijay Choudhary established that there must be actual involvement in money laundering; mere receipt of funds without knowledge of criminality or involvement in the laundering process is insufficient.

Scenario 2: Business-to-Business Transaction Facilitation

Fact Pattern: An exporter or importer facilitates payment for goods through hawala to avoid banking delays or high transfer fees. They did not know the counterpart was involved in smuggling or other scheduled offense. ED alleges the importer knowingly facilitated laundering of smuggling proceeds.

Advocate Nair’s Defence:

- Commercial necessity: Use of hawala was for genuine business transaction facilitation, not money laundering

- Absence of knowledge: The accused did not know the counterpart’s activities were illegal

- Independent scheduled offense: Even if the counterpart was engaged in smuggling, that does not make the legitimate goods transaction itself proceeds of crime

- Section 3 PMLA requires knowing involvement: The statute requires that involvement be “knowing”; inadvertent facilitation of an illegally-sourced payment is not money laundering

Evidence to Present:

- Commercial invoices, bills of lading, shipping documents

- Business correspondence showing the transaction was bona fide

- Bank records showing legitimate business account activity

- Witness testimony from customs or industry experts establishing normal trade practices

Scenario 3: Large Cash Deposits Seized During ED Raids

Fact Pattern: ED raids a person’s residence or office and seizes large amounts of cash. ED alleges the cash is proceeds of crime because it was found in hawala-related premises or in possession of someone with alleged hawala connections.

Advocate Nair’s Defence:

- Possession alone is not proceeds of crime: Holding cash is not inherently criminal

- Legitimate source of cash: The accused may explain the cash as:

- Business income (if self-employed, retailer, or service provider handling cash)

- Savings accumulated over time

- Withdrawals from bank accounts for business or personal use

- Inheritance or gifts received in cash

- Loan received from informal lenders (common in business circles)

- Invoking Section 24 PMLA burden shift: If ED claims the cash is proceeds of crime, the burden shifts to the accused under Section 24. The accused can rebut by:

- Producing bank statements showing regular deposits corresponding to the seized amount

- Business records (invoices, receipts, accounts) documenting the source

- Witness testimony from business associates, family, or accountants

- Confiscation must be proportionate: Even if the source of cash is unclear, indefinite confiscation without trial is unjust. Advocate Nair can file applications for release of seized funds on grounds of:

- Financial hardship

- Necessary for legal defence

- Needed for family sustenance

Scenario 4: Forced or Coerced Participation in Hawala

Fact Pattern: A person was coerced or threatened by more powerful hawala operators to facilitate transfers, provide bank accounts, or receive/send money under duress. ED prosecutes the person as a willing participant.

Advocate Nair’s Defence:

- Duress defence under IPC: Under IPC Section 94, an act done under threats or coercion may not constitute a crime if:

- The threat was of imminent death or grievous injury

- The threatened person reasonably believed the threat would be carried out

- The act was done to avoid the threat

- No mens rea (guilty intent): Under PMLA, the prosecution must prove the accused knowingly and intentionally participated. Coerced participation suggests absence of free will and guilty intent.

- Evidence of coercion:

- Witness testimony from co-accused or third parties

- Communications (messages, phone records) showing threats or coercion

- Medical evidence of injuries or psychological trauma

- Prior history of violence by the coercing party

Scenario 5: False Accusation by Co-accused/Informant

Fact Pattern: A co-accused or police informant falsely implicates the accused in hawala operations in exchange for leniency or reward. The accusation lacks independent corroboration.

Advocate Nair’s Defence:

- Test the credibility of the informant/approver:

- Has the informant received consideration (reduced charges, immunity, reward money)?

- Does the informant have a motive to falsely implicate others?

- Are there inconsistencies in the informant’s account?

- Has the informant provided provably false information on other matters?

- Demand independent corroboration: Under the Illicit Traffic in Narcotic Drugs (ITND) principle (borrowed from narcotics law), accusation by an approver/informant must be corroborated by independent evidence. Uncorroborated testimony is insufficient.

- Cross-examination: Rigorous cross-examination of the informant exposing:

- Their criminal background and motive to lie

- Inconsistencies between their statements to police and trial testimony

- Lack of direct knowledge of the accused’s involvement

- Details only the police could have provided (suggesting the statement was coached)

Protecting Clients Through Statutory Compliance & Procedural Rigor

Beyond substantive legal arguments, Advocate Siddharth Nair ensures his clients are protected through meticulous procedural compliance and identification of defects in the prosecution’s case.

Critical Procedural Checkpoints

1. Verification of ECIR Registration (Enforcement Case Information Report)

The ED must register an ECIR—not an FIR—when initiating money laundering investigations. The ECIR is the ED’s internal document initiating the investigation.

Advocate Nair verifies:

- Was an ECIR properly registered with specified sections (Section 3 or Section 4)?

- Was an ECIR registered only after a scheduled offense FIR was filed?

- Is the ECIR based on material/information that itself alleges a scheduled offense?

If the ECIR is registered without a corresponding scheduled offense, the entire PMLA prosecution is legally flawed.

2. Validation of FIR for Predicate Offense

Every PMLA case must be based on an FIR for a scheduled offense. Advocate Nair checks:

- Is the predicate FIR properly registered and investigated?

- Does the predicate FIR clearly allege a scheduled offense?

- Has the predicate offense been established with sufficient evidence?

3. Examination of Attachment Orders (Section 5 PMLA)

The ED has power to attach property as proceeds of crime. This power is significant and subject to challenge:

- Was the attachment order issued with proper “reason to believe” (recorded in writing)?

- Was the owner of attached property given notice and opportunity to be heard?

- Is the property specifically alleged to be proceeds of the crime, or is it mere assumption?

If attachment was issued without due process, attached property should be de-attached or released.

4. Challenge to Confiscation Proceedings (Section 8 PMLA)

Confiscation is the final action that vests property in the State. It requires:

- Proof that property is proceeds of crime (by preponderance of probabilities in civil proceedings, though civil and criminal cases can have evidential interconnections)

- Proper adjudication by the Adjudicating Authority

- Opportunity for the owner to be heard and present evidence

Advocate Nair challenges confiscation orders that lack evidentiary foundation or violate procedural fairness.

5. Surveillance of Admissibility of Statements Under Section 50 PMLA

ED records statements under Section 50 (investigating officer powers). These statements are admissible but subject to conditions:

- Must be voluntary (not coerced or obtained under duress)

- The person making the statement must have been informed of their right to consult a lawyer

- Confession must not be the only evidence of guilt

Advocate Nair challenges statements obtained:

- Without informing the person of their legal rights

- Under threat or intimidation

- After prolonged interrogation causing psychological duress

- Where the “statement” is actually the IO’s interpretation of the person’s response, not verbatim

Bail Conditions & Release Strategy

Once bail is secured, Advocate Nair negotiates favorable conditions and works toward release with minimal restrictions:

Typical Bail Conditions in PMLA/Hawala Cases

- Furnishing of bail bond: Often Rs. 1-5 lakhs depending on severity

- Sureties: Usually two sureties of similar amount, often family members

- Reporting requirement: Weekly or bi-weekly reporting to Investigating Officer

- Passport surrender: Surrender passport with the Special Court

- Restriction on foreign travel: Cannot leave India or Delhi NCR without permission

- Non-tampering undertaking: Undertaking not to tamper with evidence or witness

- Residence notification: Informing the IO of current residential address

Advocate Nair’s Negotiation Strategy

- Minimize reporting frequency: If weekly reporting is imposed, negotiate for bi-weekly or monthly

- Secure exemption from reporting during business hours: If the accused is self-employed, arrange evening or weekend reporting

- Seek interim passport release: For clients with legitimate international business, seek conditional passport release for specific, time-bound trips

- Negotiate sureties: Reduce surety requirements for first-time offenders or those with established community roots

- Allow temporary residence changes: If business or family circumstances require temporary relocation, seek permission in advance

Why Delhi NCR Clients Choose Advocate Siddharth Nair

Unparalleled Track Record

Advocate Siddharth Nair’s success in hawala and money laundering cases is evident in:

- Bail successes: Numerous clients have secured bail despite PMLA’s stringent provisions, many within weeks of arrest

- Acquittals: Clients have been acquitted when the prosecution failed to establish the predicate offense or nexus to proceeds of crime

- Conviction reversals: Appellate arguments have resulted in convictions being overturned by the Delhi High Court and Supreme Court

- Asset recovery: Strategic challenges have resulted in attached and confiscated properties being de-attached or released to clients

Specialised Knowledge

Advocate Nair possesses:

- Deep expertise in PMLA and FEMA beyond what general criminal lawyers possess

- Familiarity with ED’s tactics and investigative procedures, enabling him to identify procedural defects others miss

- Mastery of recent jurisprudence, particularly the transformative Manish Sisodia judgment and Pankaj Bansal procedural safeguards

- Understanding of financial crime investigation, including money trails, banking systems, and hawala network operations

Personalized, Client-Centered Approach

Advocate Nair provides:

- Comprehensive initial consultation addressing the client’s specific circumstances, fears, and priorities

- Regular updates keeping the client informed of developments at each stage

- Strategic planning in consultation with the client, respecting their preferences and concerns

- Emotional support during what is often a traumatic legal process

- Coordination with family and business matters to minimize collateral damage

Courtroom Excellence

Advocate Nair is recognized for:

- Persuasive oral advocacy before Special Courts and the Delhi High Court

- Meticulous written submissions supported by case law and statutory analysis

- Cross-examination skill exposing weaknesses in the prosecution’s case

- Professional demeanor and credibility that judges respect and rely upon

- Ethical practice ensuring all advocacy remains within the boundaries of law and judicial propriety

The Investigation & Prosecution Timeline: What Clients Should Expect

Phase 1: Investigation (Weeks to Months)

What happens:

- ED receives tip-off about hawala activity

- ED registers ECIR (Enforcement Case Information Report)

- ED conducts surveillance, financial analysis, interviews

- ED identifies persons involved in the hawala network

- ED prepares to conduct raids and seizures

What client should do:

- Consult Advocate Siddharth Nair immediately (don’t wait for arrest)

- Apply for anticipatory bail if apprehension is high

- Gather documents supporting innocent explanation (business records, bank statements, family correspondence)

- Prepare mentally and emotionally for possible arrest

Phase 2: Raid & Arrest (Hours to Days)

What happens:

- ED conducts simultaneous raids at multiple locations

- Cash, documents, electronic devices seized

- Client arrested (or voluntarily surrenders if anticipatory bail obtained)

- Brought before magistrate within 24 hours

- Bail application hearing

What client should do:

- Exercise right to silence during ED interrogation

- Request for lawyer to be present during any statement recording

- Apply for bail immediately

- Provide Advocate Nair with accurate background information for bail application

Phase 3: Custody & Investigation (Days to Weeks)

What happens:

- ED requests 5-7 days of custody from the magistrate for interrogation

- ED records statements under Section 50 PMLA

- ED analyzes documents and financial records seized

- ED files chargesheet within statutory period (usually 90 days from arrest)

What client should do:

- Maintain composure during custody

- Exercise caution during ED interrogation; consult counsel before responding

- Assist counsel in gathering mitigating evidence

- Arrange funds for bail surety if required

Phase 4: Filing of Chargesheet (60-90 Days Post-Arrest)

What happens:

- ED files detailed chargesheet before Special Court

- Chargesheet alleges specific sections (Section 3 & 4 PMLA, FEMA sections, IPC sections)

- Client is formally charged before the Special Court

- Framing of charges hearing occurs

What client should do:

- Continue to comply with bail conditions strictly

- Assist counsel in preparing defence (gathering witnesses, documents)

- Prepare for trial proceedings

Phase 5: Trial (Months to Years)

What happens:

- Prosecution presents evidence (ED officers, bank officials, witnesses)

- Defence cross-examines prosecution witnesses

- Client may testify in own defence

- Arguments and judgment

What client should do:

- Maintain regular contact with counsel

- Attend all hearings punctually

- Follow counsel’s advice on courtroom demeanor

- Preserve all relevant documents and evidence

Phase 6: Judgment & Possible Appeal

What happens:

- Trial court pronounces judgment (conviction or acquittal)

- If convicted, sentencing occurs

- Right to appeal arises

What client should do:

- Discuss appeal prospects with Advocate Nair

- Pursue appellate remedies if conviction is unjust

Frequently Asked Questions (FAQs) About Hawala Cases in Delhi NCR

Q1: What should I do if the ED shows up at my residence or office?

Answer:

- Do not panic. Remain calm and composed.

- Do not resist or obstruct. ED has lawful authority to search and seize.

- Do not make any statements without your lawyer present. Politely say, “I wish to consult my lawyer before answering any questions.”

- Request written grounds of arrest (per Pankaj Bansal judgment). If only oral grounds are provided, note this for later challenge.

- Note names, badge numbers of ED officers for documentation.

- Contact Advocate Siddharth Nair immediately by phone. Provide him with the information so anticipatory bail can be prepared if arrest is imminent.

Q2: Can I be arrested without notice?

Answer:

Yes. ED can arrest without warning under Section 19 PMLA if the officer has “reason to believe” the person is guilty of money laundering. This is why anticipatory bail is critical for those who suspect they are under ED scrutiny.

Q3: What happens in the first 24 hours after arrest?

Answer:

- You must be brought before a magistrate within 24 hours (per Section 167 CrPC)

- The magistrate will inform you of charges and grounds of arrest

- You will be asked if you wish to apply for bail

- This is when you should immediately apply for bail with the assistance of Advocate Siddharth Nair

- ED may request 5-7 days of custody for interrogation; the magistrate decides

Q4: Should I give a statement to the ED?

Answer:

Consult Advocate Siddharth Nair before any statement. While remaining silent is your right, strategic silence in some cases may be counterproductive. Your counsel will advise whether:

- To remain silent entirely

- To make a carefully prepared, written statement

- To make oral statements with counsel present (under Section 50 PMLA)

Any statement you make can and will be used against you in court, so caution is paramount.

Q5: What is the difference between FEMA and PMLA prosecution?

Answer:

- FEMA: Addresses unauthorized foreign exchange transactions; penalties include 3 years imprisonment and 3x fines

- PMLA: Addresses money laundering (if connected to scheduled offenses); penalties include 3-7 years imprisonment with higher fines

- Most serious hawala cases involve both FEMA and PMLA prosecution, with PMLA driving the severity

Q6: Can I get bail even if charged under PMLA?

Answer:

Yes. While PMLA imposes stringent bail conditions (Section 45), recent Supreme Court judgments (particularly Manish Sisodia, 2024) confirm that:

- Bail is not impossible; courts retain discretion

- Prolonged incarceration creates presumption favoring bail

- Article 21 constitutional rights supersede PMLA’s rigid provisions

- Advocate Siddharth Nair has successfully secured bail for numerous PMLA-charged clients

Q7: What is a “scheduled offense” and why does it matter?

Answer:

A scheduled offense is a predicate crime specifically listed in PMLA’s Schedule, such as:

- Smuggling and customs offenses

- Drug trafficking

- Terrorism financing

- Counterfeiting currency

- Corruption

PMLA cannot be invoked without a scheduled offense. If ED cannot establish that a scheduled offense occurred and generated the proceeds being laundered, the entire PMLA case fails. This is why challenging the predicate offense is crucial.

Q8: What happens to my seized assets?

Answer:

Seized assets proceed through:

- Attachment (Section 5): ED attaches property as proceeds of crime

- Confiscation (Section 8): Special Court may confiscate property to the State

- You can challenge both attachment and confiscation if you can prove:

- The property is not proceeds of crime

- The source is legitimate

- Confiscation is disproportionate or unjust

Advocate Siddharth Nair files applications for release of seized assets based on financial hardship, innocence of the property owner, or procedural defects in the attachment/confiscation process.

Q9: How long do hawala cases typically take?

Answer:

- From arrest to chargesheet: 60-90 days

- From chargesheet to trial commencement: 6-12 months (though delays are common)

- Trial duration: 1-3 years depending on number of witnesses and complexity

- Total time from arrest to final judgment: 2-5 years is typical

- Appellate process: Additional 1-2 years if appeals are pursued

This timeline underscores the importance of securing bail early to avoid prolonged incarceration.

Q10: What if I am a victim of ED harassment or false accusation?

Answer:

If you believe ED has:

- Illegally arrested you (without written grounds per Pankaj Bansal)

- Seized your property without justification

- Tortured or coerced statements

- Fabricated evidence

You can:

- Challenge the arrest through bail or habeas corpus proceedings

- File a complaint against the ED officer for illegal conduct

- Seek damages for wrongful prosecution

- Appeal convictions based on procedural violations and false evidence

Advocate Siddharth Nair handles these remedies aggressively, protecting your fundamental rights against state overreach.

Contact Advocate Siddharth Nair: Secure Expert Legal Defence Today

If you are facing hawala charges, ED investigation, or money laundering prosecution in Delhi or Delhi NCR, do not delay in seeking expert legal counsel. The earlier you engage Advocate Siddharth Nair, the better your chances of securing anticipatory bail, protecting your assets, and establishing a strong defence foundation.

Immediate Steps:

- Schedule a confidential consultation with Advocate Siddharth Nair to discuss your specific circumstances

- Bring relevant documents: Banking records, business documents, family correspondence, property deeds—anything supporting your innocent explanation

- Discuss all aspects openly: Your counsel is bound by confidentiality and needs full information to advise effectively

- Decide on bail strategy: Anticipatory bail vs. waiting for arrest? Advocate Nair will guide based on risk assessment

Why Act Now?

- Anticipatory bail is easier to secure before arrest

- Early engagement allows gathering of mitigating evidence

- Procedural defects in ED’s case can be identified and challenged immediately

- Asset protection strategies can be implemented proactively

Your Defence Against Hawala Charges Begins Here

Click Here for the Checklist before Your First Meeting with Advocate Siddharth Nair.

Hawala cases represent among the most serious criminal prosecutions in India, with potential imprisonment terms of 3-7 years and substantial asset confiscation. The complex interplay of PMLA and FEMA, combined with the Enforcement Directorate’s broad investigative powers, creates a daunting landscape for accused persons.

However, recent Supreme Court jurisprudence—particularly the transformative Manish Sisodia judgment and Pankaj Bansal procedural safeguards—has opened new avenues for effective defence. Accused persons are no longer defenceless in the face of PMLA prosecutions; constitutional rights, judicial discretion, and strategic litigation can result in bail relief, acquittals, and conviction reversals.

Advocate Siddharth Nair is New Delhi’s premier criminal defence lawyer for hawala cases, combining deep legal expertise, strategic acumen, courtroom excellence, and unwavering commitment to protecting clients’ rights. Whether you are apprehending arrest, already incarcerated, or standing trial, Advocate Nair provides the expert, aggressive, and ethical legal representation that results in favorable outcomes.

Contact Advocate Siddharth Nair today for a confidential consultation. Your liberty, assets, and future depend on securing the best possible legal representation from the outset.

Contact Advocate Siddharth Nair:

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Call: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Disclaimer: This article is for informational purposes and does not constitute legal advice. Hawala and money laundering laws are complex, with fact-specific applications. Every case is unique and requires individualized legal counsel. Consult with a qualified criminal defence attorney in your jurisdiction for advice specific to your circumstances. Advocate Siddharth Nair provides specialised representation in Delhi and Delhi NCR; clients outside this jurisdiction should seek representation from qualified local counsel.

3 thoughts on “Best Hawala Defence Lawyer in New Delhi/NCR”

Comments are closed.