Best Lawyer for Loans & Credit Cards Non-payment of EMI In New Delhi & Delhi NCR

Best Advocate For Loans & Credit Cards Non-payment of Equated Monthly Instalment (EMI) In New Delhi & Delhi NCR

Click Here To Know More About EMI Defaults, Debt Recovery, and Borrower Rights in India: A Detailed Legal, Regulatory, and Constitutional Examination of Banking Recovery Powers, RBI Safeguards, and Judicial Protection Against Abuse

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

India’s Most Trusted & Result-Oriented Loan Recovery and Credit Card Default Defence Lawyer

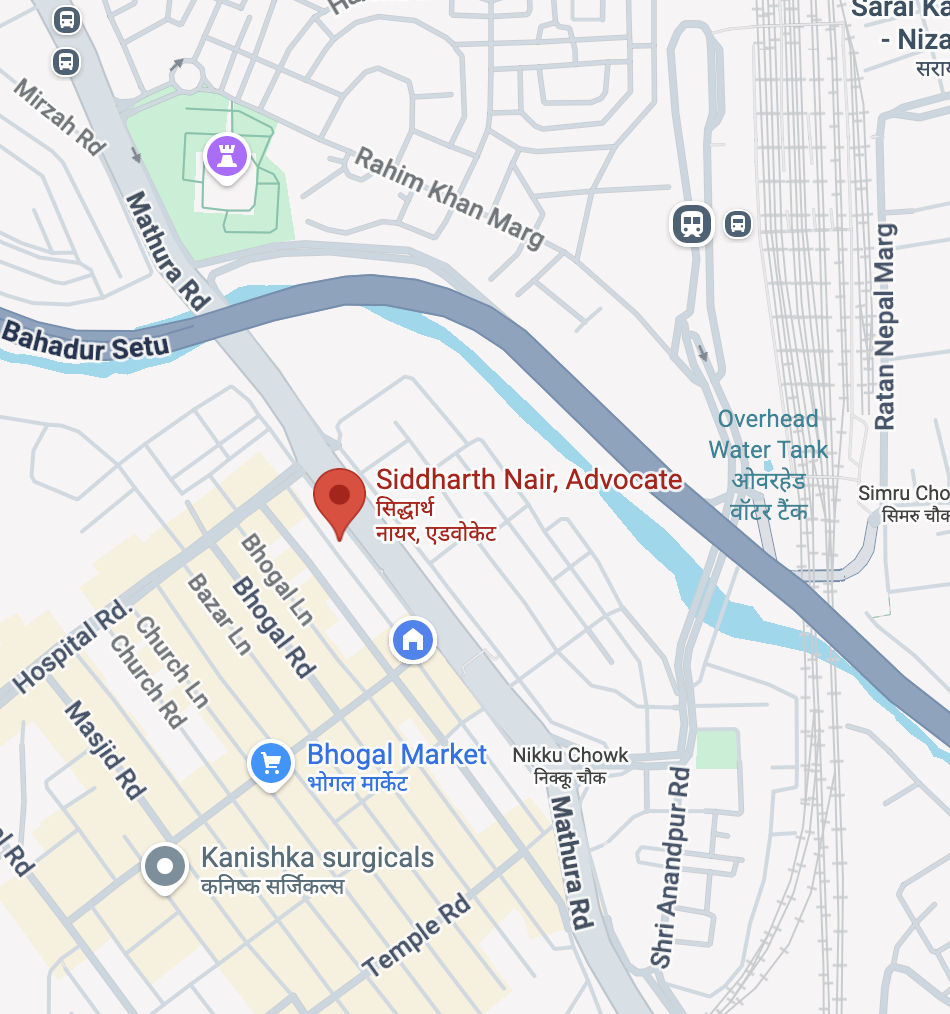

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Practice Areas:

Loan Recovery Defence | SARFAESI | DRT | Credit Card Defaults | FIR Quashing | Criminal Defence

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

A Message to Borrowers Facing Bank Notices, Recovery Calls & Court Summons

Best Lawyer Loan Non-payment New Delhi & NCR

If you are reading this page, it is likely that you or someone close to you has defaulted on a bank loan or credit card payment and is now facing legal notices, continuous recovery calls, and threats of asset seizure, police complaints, or court proceedings.

It is important to understand one fundamental legal truth at the outset:

Inability to repay a loan on time is a civil issue — not a crime.

Indian law does not permit banks, NBFCs, or recovery agents to humiliate, threaten, criminalise, or terrorise borrowers merely because they have fallen into financial distress. Unfortunately, many lenders misuse legal provisions, exploit fear, and adopt coercive tactics to force recovery.

Advocate Siddharth Nair has built his practice around protecting borrowers from exactly this abuse of power.

Who Is Advocate Siddharth Nair?

Advocate Siddharth Nair is a New Delhi–based senior litigation lawyer widely regarded as one of the best advocates in India for loan recovery defence and credit card default cases. His practice spans New Delhi, Delhi NCR, and courts across India, including the Supreme Court of India, multiple High Courts, Debt Recovery Tribunals (DRTs), and criminal courts.

He is known for:

- Taking on powerful banks and financial institutions

- Preventing illegal arrests and criminal harassment

- Securing stays on SARFAESI possession and auctions

- Quashing false FIRs under IPC Sections 420, 406, etc.

- Protecting guarantors, co-borrowers, and family members

- Restoring dignity and legal balance to borrowers’ lives

His clients consistently describe him as strategic, fearless, technically sound, and deeply empathetic—qualities that are critical when defending financially and emotionally vulnerable individuals.

Understanding Loan Defaults in Real Life: Why People Actually Default

Contrary to the narrative often pushed by banks, most loan defaulters are not wilful defaulters. Advocate Siddharth Nair routinely represents clients who defaulted due to:

- Sudden job loss or salary reduction

- Business slowdown or collapse

- COVID-19 aftermath and market volatility

- Medical emergencies or accidents

- Family crises, divorce, or bereavement

- Delayed payments from clients or government bodies

- Rising interest rates and compounding penalties

Indian courts have repeatedly recognised that financial incapacity does not amount to criminal intent.

Types of Loan & Credit Card Cases Handled

Advocate Siddharth Nair handles all categories of loan recovery matters, including:

Bank Loans

- Personal loans

- Home loans

- Education loans

- Car and vehicle loans

- Business and MSME loans

- Overdraft and cash credit facilities

Credit Cards

- Multiple card defaults

- Exorbitant interest disputes

- Recovery agent harassment

- Cheque bounce cases linked to cards

Liability Expansion Cases

- Guarantor liability disputes

- Co-borrower harassment

- Family members wrongly implicated

Legal Framework Governing Loan Recovery in India (Explained Simply)

1. SARFAESI Act, 2002

This law allows banks to seize secured assets without filing a civil suit. However, it is strictly procedural, and even a single violation can invalidate the entire recovery action.

Advocate Siddharth Nair regularly challenges:

- Invalid demand notices under Section 13(2)

- Premature possession under Section 13(4)

- Illegal valuation and reserve price fixing

- Sham or collusive auctions

- Mechanical orders by District Magistrates

2. Debt Recovery Tribunals (DRT & DRAT)

DRTs are specialised forums meant to:

- Protect borrower rights

- Examine bank compliance

- Grant interim relief

An experienced DRT lawyer is critical because technical lapses decide outcomes, not emotional arguments.

3. Criminal Law Misuse by Banks

Banks frequently misuse:

- Section 420 IPC (Cheating)

- Section 406 IPC (Criminal Breach of Trust)

Courts across India have repeatedly held that loan default ≠ cheating unless fraudulent intent existed at inception.

Advocate Siddharth Nair has secured numerous FIR quashings and stay orders on this ground.

4. Negotiable Instruments Act – Section 138

Cheque bounce cases are quasi-criminal, often filed to pressure borrowers. Strategic defence can:

- Secure compounding

- Reduce liability

- Avoid imprisonment

5. RBI Guidelines & Fair Practice Codes

Recovery agents:

- Cannot threaten arrest

- Cannot visit at odd hours

- Cannot abuse or shame borrowers

- Cannot contact employers or neighbours

Violations can lead to criminal action against banks.

Investigative & Regulatory Authorities That May Get Involved

Depending on the allegations and loan size, the following bodies may appear:

- Banks & NBFCs

- Debt Recovery Tribunals (DRT/DRAT)

- District Magistrate / CMM

- Local Police & Economic Offences Wing

- CBI (large-value public bank loans)

- Enforcement Directorate (ED)

- SFIO (corporate loan defaults)

- RBI Ombudsman

- Insolvency Professionals

Advocate Siddharth Nair coordinates defence across all parallel proceedings, ensuring consistency and protection.

Judicial Protection for Borrowers: Why Courts Are On Your Side

Indian courts—right up to the Supreme Court—have repeatedly warned banks against:

- Criminalising civil debt

- Using police as recovery agents

- Harassing families and guarantors

- Conducting sham auctions

The precedents listed earlier are not mere citations—they form the legal backbone of modern borrower defence litigation, and Advocate Siddharth Nair actively relies on them in court.

How Advocate Siddharth Nair Defends His Clients (Step-by-Step)

1. Immediate Damage Control

- Stops harassment and illegal recovery

- Issues legal notices to banks

- Secures interim protection

2. Strategic Forum Selection

- DRT vs High Court vs Criminal Court

- Avoids unnecessary litigation

3. Criminal Defence Shield

- FIR quashing

- Anticipatory bail

- Stay on arrest

4. Asset & Property Protection

- Stay on possession

- Auction cancellation

- Restoration of property

5. Negotiation & Resolution

- One-Time Settlements (OTS)

- Interest waiver arguments

- Humane repayment structuring

The Human Side: Legal, Social & Psychological Challenges Borrowers Face

Legal Stress

- Multiple cases in different forums

- Confusing notices and deadlines

- Threats of arrest

Social Stigma

- Loss of reputation

- Family pressure

- Workplace anxiety

Psychological Trauma

- Depression and anxiety

- Sleep disorders

- Fear of police and courts

Advocate Siddharth Nair approaches every case with confidentiality, dignity, and compassion, understanding that financial distress is not moral failure.

How Long Does It Take to Get Relief?

While every case is unique, realistic timelines are:

- Immediate protection: 1–3 weeks

- Criminal relief: 1–6 months

- DRT resolution: 6–24 months

- High Court relief: 3–12 months

Early legal action dramatically improves outcomes.

Why Early Legal Advice Is Critical

Most borrowers approach lawyers too late, after:

- Assets are seized

- FIRs are registered

- Auctions are scheduled

Engaging Advocate Siddharth Nair at the notice stage often prevents irreversible damage.

About Advocate Siddharth Nair (Professional Summary)

Advocate Siddharth Nair is a courtroom strategist, constitutional litigator, and borrower-rights defender whose practice stands at the intersection of financial law, criminal law, and human dignity. His reputation is built not on advertisements, but on results, judicial respect, and client trust.

Contact Advocate Siddharth Nair Now!

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

India’s Most Trusted & Result-Oriented Loan Recovery and Credit Card Default Defence Lawyer

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Practice Areas:

Loan Recovery Defence | SARFAESI | DRT | Credit Card Defaults | FIR Quashing | Criminal Defence

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

If you are facing bank pressure, recovery threats, SARFAESI notices, or criminal complaints, your legal defence begins with one correct decision—seeking timely advice from Advocate Siddharth Nair.

Loan Recovery & Credit Card Default – 30 Frequently Asked Questions (FAQs)

Answered by Advocate Siddharth Nair, Loan Recovery Defence Lawyer

1. Is loan default a criminal offence in India?

No. Loan default is a civil matter, not a criminal offence, unless there is proven fraudulent intent at the very beginning of taking the loan. Indian courts, including the Supreme Court, have repeatedly held that mere inability to repay does not amount to cheating or criminal breach of trust.

2. Can I be arrested for not paying a bank loan or credit card bill?

In normal circumstances, no arrest can be made solely for loan default. Arrests only arise if banks misuse criminal provisions, which are frequently challenged and quashed by courts. Advocate Siddharth Nair routinely obtains stay on arrest and FIR quashing in such cases.

3. Why do banks threaten police action for loan recovery?

Banks and NBFCs often use fear tactics to pressure borrowers. Police involvement is legally impermissible for civil recovery, yet FIRs under IPC Sections 420 or 406 are sometimes misused. Courts strongly disapprove of this practice.

4. What is SARFAESI Act and how does it affect borrowers?

The SARFAESI Act, 2002 allows banks to take possession of secured assets without filing a civil suit. However, the Act has strict procedural safeguards, and violations can render the entire recovery action illegal.

5. Can SARFAESI be used for personal loans or credit cards?

Generally, SARFAESI applies only to secured loans, such as home loans or loans backed by property. It does not apply to unsecured personal loans or credit cards, unless security exists.

6. What should I do after receiving a SARFAESI notice under Section 13(2)?

Do not ignore the notice. Immediate legal response is critical. Advocate Siddharth Nair examines:

- Whether the notice is valid

- Whether RBI norms are followed

- Whether the bank has jurisdiction

Early action often prevents possession and auction.

7. Can a bank take my house without a court order?

Banks may attempt possession under SARFAESI, but only after strict compliance and often with assistance of the District Magistrate. Courts frequently stay such actions when due process is violated.

8. What is a Debt Recovery Tribunal (DRT)?

DRT is a specialised tribunal that hears disputes between banks and borrowers. Borrowers have a statutory right to challenge SARFAESI actions before the DRT.

9. How important is it to have a lawyer for DRT cases?

DRT proceedings are highly technical. Small procedural lapses can decide the case. Advocate Siddharth Nair’s experience before DRTs and DRATs significantly improves the chances of interim and final relief.

10. Can banks harass me through recovery agents?

No. Recovery agents must follow RBI Fair Practice Codes. They cannot:

- Threaten arrest

- Use abusive language

- Visit at odd hours

- Contact neighbours or employers

Violations can lead to criminal and regulatory action.

11. What if recovery agents keep calling my family members?

This is illegal. Advocate Siddharth Nair issues cease-and-desist notices and initiates legal proceedings to stop harassment and protect family dignity.

12. Can guarantors be harassed for loan recovery?

Guarantors are liable only within legal limits. Guarantors cannot be criminally harassed or threatened. Many cases involve illegal pressure on elderly parents or spouses, which courts do not tolerate.

13. Can my employer be informed about my loan default?

No. Informing employers is a gross violation of privacy and RBI norms. Such conduct strengthens the borrower’s legal case.

14. What is a cheque bounce case under Section 138 NI Act?

If a repayment cheque bounces, banks may file a Section 138 NI Act case, which is quasi-criminal. Strategic defence can:

- Avoid imprisonment

- Reduce liability

- Enable settlement

15. Can cheque bounce cases be settled?

Yes. Courts actively encourage compounding and settlement. Advocate Siddharth Nair frequently negotiates favourable outcomes without prolonged litigation.

16. Can banks file both civil and criminal cases simultaneously?

Banks often try to do so, but courts have held that criminal proceedings cannot be used as recovery tools. Parallel proceedings are frequently stayed or quashed.

17. What if I have multiple loans and credit cards?

Multiple defaults require coordinated legal strategy across forums. Advocate Siddharth Nair handles consolidated defence to prevent overlapping harassment.

18. Can my property auction be stopped once scheduled?

Yes, in many cases. Courts and DRTs regularly stay auctions where valuation, notice, or procedure is flawed. Timing is critical.

19. How long does loan recovery litigation usually take?

Timelines vary, but generally:

- Interim protection: 1–3 weeks

- Criminal relief: 1–6 months

- DRT cases: 6–24 months

Early legal action shortens timelines significantly.

20. Can I negotiate a One-Time Settlement (OTS)?

Yes. Properly negotiated OTS can result in:

- Reduced principal

- Interest waiver

- Closure without stigma

Legal negotiation yields far better results than direct talks.

21. Is insolvency under IBC an option for individuals?

For personal guarantors and certain borrowers, IBC remedies may apply. Advocate Siddharth Nair evaluates whether insolvency proceedings are beneficial or risky.

22. Can police summon me for loan default?

Police cannot summon or detain borrowers for civil recovery. Any such action is legally challengeable and often results in court protection.

23. What if an FIR is already registered against me?

Immediate legal intervention is crucial. Advocate Siddharth Nair handles:

- Anticipatory bail

- FIR quashing

- Stay on coercive steps

Many such FIRs do not survive judicial scrutiny.

24. Can banks involve ED or CBI in loan default cases?

Only in exceptional cases involving large-scale fraud or money laundering. Routine loan defaults do not attract ED or CBI jurisdiction.

25. Are senior citizens treated differently in recovery cases?

Yes. Courts take a strict view against harassment of senior citizens, and relief is often expedited.

26. Can women borrowers or homemakers be arrested?

No special criminal liability arises merely due to gender or role as co-borrower. Courts are particularly protective against gender-based harassment.

27. What mistakes should borrowers avoid?

- Ignoring legal notices

- Believing recovery agents

- Giving blank cheques

- Signing documents under pressure

Early legal advice prevents irreversible harm.

28. Why should I approach a lawyer before replying to a bank notice?

An incorrect reply can weaken your legal position. Advocate Siddharth Nair ensures responses are strategically sound and legally protective.

29. How does Advocate Siddharth Nair approach borrower defence differently?

He combines:

- Financial law expertise

- Criminal defence strategy

- Constitutional remedies

- Negotiation leverage

This multi-layered approach maximises protection.

30. When should I contact Advocate Siddharth Nair?

The moment you receive a bank notice, recovery call, or police communication. Early intervention often prevents escalation, litigation, and reputational damage.

Final Note for Borrowers

Financial distress is not a moral or legal failure. Indian law provides robust protections—when used correctly.

Advocate Siddharth Nair ensures that borrowers are defended with dignity, legality, and strategic precision.

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

India’s Most Trusted & Result-Oriented Loan Recovery and Credit Card Default Defence Lawyer

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Practice Areas:

Loan Recovery Defence | SARFAESI | DRT | Credit Card Defaults | FIR Quashing | Criminal Defence

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Loan Recovery, Bank Loan Default & Credit Card Due Defence

Frequently Asked Questions – Immediate Legal Help Available

Facing bank notices, recovery calls, SARFAESI action, or police pressure?

You are not alone—and you are not a criminal.

This page answers the most urgent questions borrowers ask when they are under pressure from banks, NBFCs, or recovery agents.

All answers below are provided from real courtroom experience by

Advocate Siddharth Nair, one of India’s leading loan recovery and credit card default defence lawyers, practising in New Delhi, Delhi NCR, and across India.

Start Here: What Every Borrower Must Know

Loan default is a civil issue, not a crime.

Banks frequently rely on fear, misinformation, and harassment to force recovery. Indian courts—including the Supreme Court—have repeatedly protected borrowers from illegal criminalisation of debt.

If you have received:

- A bank or NBFC legal notice

- SARFAESI possession or auction notice

- Recovery agent threats

- Police calls or FIRs

- Cheque bounce summons

Immediate legal intervention can stop escalation.

Frequently Asked Questions (Client-Focused & Action-Oriented)

1. Is loan default a criminal offence in India?

No. Failure to repay a loan due to financial difficulty is not a criminal offence. Criminal charges require proof of fraud at the time the loan was taken—not inability to pay later.

2. Can I be arrested for not paying a bank loan or credit card bill?

No arrest is permitted for ordinary loan default. Arrest threats are often illegal pressure tactics and can be challenged immediately in court.

3. Why do banks threaten police action for recovery?

Because fear works. Many banks misuse IPC sections like 420 or 406 to pressure borrowers. Courts consistently quash such cases when no fraud exists.

4. What should I do if I receive a legal notice from a bank?

Do not ignore it and do not reply without legal advice. A poorly drafted reply can weaken your defence. Early legal response often prevents further action.

5. What is SARFAESI and why am I receiving notices under it?

SARFAESI allows banks to take possession of secured assets. However, it is governed by strict procedures. Even minor violations can invalidate the bank’s action.

6. Can SARFAESI be applied to personal loans or credit cards?

Generally, no, unless the loan is secured by property. Many SARFAESI notices are issued incorrectly and can be challenged successfully.

7. Can a bank take my house without going to court?

Only after following strict legal steps. Courts frequently stay possession and auctions where procedure or valuation is flawed.

8. How can I stop a property auction once it is scheduled?

Urgent legal action before the DRT or High Court can stay auctions. Time is critical—delays reduce available remedies.

9. What is the Debt Recovery Tribunal (DRT)?

DRT is a specialised forum where borrowers can challenge bank recovery actions. It is not borrower-unfriendly when cases are argued correctly.

10. Do I really need a lawyer for DRT matters?

Yes. DRT litigation is technical and procedural. Most borrowers lose relief due to technical mistakes, not weak facts.

11. Can recovery agents harass me or my family?

No. Recovery agents must follow RBI Fair Practice Codes. Abuse, threats, repeated calls, or contacting family members is illegal.

12. What if recovery agents are calling my workplace or neighbours?

This is a serious violation of privacy and strengthens your legal case. Courts take such conduct very seriously.

13. Can guarantors be forced to pay or threatened?

Guarantors can be proceeded against only within legal limits. Harassment of elderly parents or spouses is routinely restrained by courts.

14. What is a cheque bounce case under Section 138 NI Act?

It is a quasi-criminal case used to pressure borrowers. With proper defence, imprisonment is usually avoided and cases are settled favourably.

15. Can cheque bounce cases be settled?

Yes. Courts actively encourage settlement. Legal negotiation yields significantly better outcomes than dealing directly with banks.

16. Can banks file civil and criminal cases together?

They try to—but courts do not allow criminal law to be used as a recovery tool. Parallel proceedings are often stayed or quashed.

17. What if I have multiple loans and credit cards?

Multiple defaults require a single, coordinated legal strategy to prevent overlapping harassment and contradictory proceedings.

18. How long does it take to get relief?

- Immediate protection: 1–3 weeks

- Criminal relief / FIR quashing: 1–6 months

- DRT matters: 6–24 months

Early action reduces timelines.

19. Can I negotiate a One-Time Settlement (OTS)?

Yes. When negotiated legally, OTS can significantly reduce liability, waive interest, and close disputes permanently.

20. Can police summon me for loan default?

Police have no authority to summon or detain borrowers for civil recovery. Such actions are legally challengeable.

21. What if an FIR is already registered?

Immediate legal defence is critical. Anticipatory bail, stay on arrest, and FIR quashing are commonly granted in such cases.

22. Can ED or CBI get involved in loan defaults?

Only in rare, high-value fraud cases. Routine loan defaults do not attract ED or CBI jurisdiction.

23. Are senior citizens given special protection?

Yes. Courts are particularly strict against harassment of senior citizens and often grant expedited relief.

24. Are women borrowers or homemakers treated differently?

Courts strongly protect women from coercive recovery and misuse of criminal law, especially when they are co-borrowers or guarantors.

25. What mistakes should borrowers avoid?

- Ignoring notices

- Believing recovery agents

- Giving blank cheques

- Signing documents under pressure

26. Why should I consult a lawyer before replying to a bank?

Because one incorrect admission can weaken your entire case. Legal replies are strategic documents, not explanations.

27. How is Advocate Siddharth Nair’s approach different?

He combines banking law, criminal defence, constitutional remedies, and negotiation strategy—not just one-dimensional litigation.

28. When should I contact Advocate Siddharth Nair?

Immediately after receiving a notice, recovery call, or police communication. Delay only benefits the bank.

Why Borrowers Across India Trust Advocate Siddharth Nair

- Extensive experience against banks & NBFCs

- Proven success in SARFAESI, DRT, and criminal defence

- Strong High Court & Supreme Court practice

- Dignified, confidential, borrower-centric approach

He does not treat loan default as wrongdoing—he treats it as a legal problem requiring precise defence.

Speak to the Best Loan Recovery Defence Lawyer in New Delhi & Delhi NCR Before the Situation Escalates

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

India’s Most Trusted & Result-Oriented Loan Recovery and Credit Card Default Defence Lawyer

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Practice Areas:

Loan Recovery Defence | SARFAESI | DRT | Credit Card Defaults | FIR Quashing | Criminal Defence

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

If you are under pressure from banks, recovery agents, or police,

the right legal advice at the right time can stop everything.

🚨 48-Hour Emergency Legal Help for Loan Defaulters

What You Must Do Immediately After Receiving a Bank Notice, Recovery Threat, or Police Call

If you have just received a bank legal notice, SARFAESI possession notice, recovery agent threat, police call, or court summons, the next 48 hours are critical.

Decisions taken during this period often determine whether the situation stabilises or escalates.

This section is for you if:

- A bank or NBFC has issued a legal notice or SARFAESI notice

- Recovery agents are calling continuously or threatening police action

- You have received a police call, FIR copy, or summons

- Your property auction date has been announced

- You are being pressured to sign documents or give cheques

- Your family members or employer are being contacted

What NOT to Do in the First 48 Hours (Very Important)

Many borrowers unintentionally weaken their own case due to panic.

Do not make these mistakes:

❌ Do NOT ignore the notice

❌ Do NOT panic or assume arrest is inevitable

❌ Do NOT visit the bank or police station alone

❌ Do NOT sign any documents under pressure

❌ Do NOT give blank or post-dated cheques

❌ Do NOT admit liability verbally or in writing

❌ Do NOT believe recovery agents’ threats

Anything you say or sign can later be used against you.

What You SHOULD Do Immediately

✅ Step 1: Pause and Secure Legal Protection

Loan default is not a criminal offence. The law is on your side—but only if invoked correctly and on time.

✅ Step 2: Preserve All Documents

Keep copies of:

- Loan agreement

- Bank notices

- SARFAESI notices

- WhatsApp messages / call recordings (if any)

- Police communication

- Cheque bounce summons

These documents form the foundation of your defence.

✅ Step 3: Take Legal Advice Before Any Reply or Appearance

An improperly drafted reply or an uninformed police visit can escalate matters unnecessarily.

How Advocate Siddharth Nair Intervenes Within 48 Hours

When contacted at the emergency stage, Advocate Siddharth Nair typically acts in the following manner:

🔹 Immediate Legal Assessment

- Identifies whether the issue is civil, criminal, or mixed

- Detects misuse of IPC sections or SARFAESI provisions

- Assesses urgency (arrest risk, auction risk, coercion)

🔹 Stoppage of Harassment

- Issues legal communications to banks/NBFCs

- Initiates action against illegal recovery practices

- Prevents further contact with family or employer

🔹 Protection Against Arrest or Coercive Action

- Advises on anticipatory bail (if required)

- Prepares grounds for FIR quashing or stay

- Guides safe handling of police communication

🔹 Asset & Property Protection

- Evaluates legality of possession or auction

- Prepares urgent DRT or High Court filings

- Seeks interim stay where possible

🔹 Strategic Reply to Notices

- Drafts legally protective replies

- Avoids admissions or damaging statements

- Preserves future remedies

Why Timing Matters More Than Anything Else

Most borrowers seek legal help after damage is already done:

- Property possession taken

- FIR registered

- Auction concluded

- Arrest threatened

In contrast, early intervention often prevents all of the above.

The same case handled at the notice stage and at the arrest stage has very different outcomes.

Who Should Seek Emergency Legal Help Immediately?

- Salaried employees fearing police involvement

- Senior citizens receiving recovery threats

- Women borrowers or guarantors under pressure

- MSME owners facing SARFAESI action

- Families being harassed for someone else’s loan

- Borrowers with multiple loans or credit cards

Speak to the Best Loan Recovery Defence Lawyer in New Delhi & Delhi NCR Before the Situation Escalates

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

India’s Most Trusted & Result-Oriented Loan Recovery and Credit Card Default Defence Lawyer

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Practice Areas:

Loan Recovery Defence | SARFAESI | DRT | Credit Card Defaults | FIR Quashing | Criminal Defence

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Final Reminder

Financial distress is not a crime, but silence and delay can be costly.

The first correct legal step—taken within 48 hours—can stop everything.

⚠️ What Happens If You Delay Taking Legal Action?

Many borrowers believe that waiting will “buy time” or that banks will “eventually stop calling.”

In reality, delay almost always strengthens the bank’s position and weakens yours.

Below is a clear comparison between early legal intervention and delayed action.

Early Legal Intervention (Within 48–72 Hours)

✔ Recovery harassment is stopped or controlled

✔ Legally sound replies prevent damaging admissions

✔ SARFAESI possession or auction can be stayed

✔ Illegal FIRs can be prevented or neutralised

✔ Police pressure is handled through proper legal channels

✔ Guarantors and family members remain protected

✔ Negotiation leverage remains strong

✔ Courts view the borrower as responsible and proactive

✔ Lower legal cost and faster resolution

Delayed or No Legal Action

✖ Recovery agents escalate pressure and threats

✖ Improper replies weaken future court remedies

✖ SARFAESI possession may be completed

✖ Property auction may be scheduled or concluded

✖ FIRs or criminal complaints may be registered

✖ Police involvement becomes harder to undo

✖ Family members may face harassment

✖ Negotiation power reduces significantly

✖ Courts have fewer options once damage is done

✖ Longer timelines, higher stress, higher cost

The Reality Borrowers Often Learn Too Late

The law provides strong protection—but only when invoked on time.

Most cases that appear “out of control” could have been stabilised at the notice stage.

Once possession, auction, or arrest steps begin, the legal battle becomes more complex, more expensive, and more stressful.

A Simple Rule Borrowers Should Follow

Notice received → Legal advice taken → Situation stabilised

Waiting rarely improves outcomes. Acting early almost always does.

Take Control Before the Situation Escalates

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

India’s Most Trusted & Result-Oriented Loan Recovery and Credit Card Default Defence Lawyer

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

If you are uncertain whether your situation is urgent, it usually is.

Early legal advice costs far less than late legal rescue.

A Concluding Word from Advocate Siddharth Nair

Financial distress can happen to anyone. In my years of legal practice, I have represented salaried professionals, business owners, senior citizens, women borrowers, guarantors, and families who found themselves under extreme pressure—not because they acted dishonestly, but because circumstances changed.

It is important for you to know this clearly: defaulting on a loan or credit card payment does not make you a criminal, nor does it strip you of your legal rights or dignity. Indian law provides strong protections to borrowers—but those protections are effective only when asserted calmly, correctly, and at the right time.

Most situations that appear overwhelming today can be stabilised with timely legal intervention. My role as your lawyer is not merely to respond to banks or appear in court, but to shield you from unlawful coercion, prevent misuse of criminal law, protect your assets and family, and guide you toward a legally sound resolution—whether through litigation, settlement, or structured negotiation.

If you have received a notice, a threat, or a call that has caused fear or uncertainty, I encourage you not to delay. Early legal advice often prevents irreversible consequences. You do not have to face this alone, and you should not face it without proper legal guidance.

Contact Advocate Siddharth Nair

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

India’s Most Trusted & Result-Oriented Loan Recovery and Credit Card Default Defence Lawyer

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Core Practice Areas:

- Bank Loan Recovery Defence

- Credit Card Default Cases

- SARFAESI Act Litigation

- Debt Recovery Tribunal (DRT & DRAT)

- Cheque Bounce Defence (NI Act)

- FIR Quashing & Anticipatory Bail

- Recovery Agent Harassment Matters

- Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Final Note

If you are unsure whether your situation requires immediate legal help, it usually does.

A single, timely legal consultation can often stop escalation before it begins.

Early action protects your rights. Delay strengthens the bank’s position.

Call Now For Help: +91-9625799959

©2026 www.nairlawchamber.com

Best Lawyer for Loan Non-payment of Loan New Delhi/Delhi NCR

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

India’s Most Trusted & Result-Oriented Loan Recovery and Credit Card Default Defence Lawyer

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

A Message to Borrowers Facing Bank Notices, Recovery Calls & Court Summons

If you are reading this page, it is likely that you or someone close to you has defaulted on a bank loan or credit card payment and is now facing legal notices, continuous recovery calls, and threats of asset seizure, police complaints, or court proceedings.

It is important to understand one fundamental legal truth at the outset:

Inability to repay a loan on time is a civil issue — not a crime.

Indian law does not permit banks, NBFCs, or recovery agents to humiliate, threaten, criminalise, or terrorise borrowers merely because they have fallen into financial distress. Unfortunately, many lenders misuse legal provisions, exploit fear, and adopt coercive tactics to force recovery.

Advocate Siddharth Nair has built his practice around protecting borrowers from exactly this abuse of power.

Who Is Advocate Siddharth Nair?

Advocate Siddharth Nair is a New Delhi–based senior litigation lawyer widely regarded as one of the best advocates in India for loan recovery defence and credit card default cases. His practice spans New Delhi, Delhi NCR, and courts across India, including the Supreme Court of India, multiple High Courts, Debt Recovery Tribunals (DRTs), and criminal courts.

He is known for:

- Taking on powerful banks and financial institutions

- Preventing illegal arrests and criminal harassment

- Securing stays on SARFAESI possession and auctions

- Quashing false FIRs under IPC Sections 420, 406, etc.

- Protecting guarantors, co-borrowers, and family members

- Restoring dignity and legal balance to borrowers’ lives

His clients consistently describe him as strategic, fearless, technically sound, and deeply empathetic—qualities that are critical when defending financially and emotionally vulnerable individuals.

Understanding Loan Defaults in Real Life: Why People Actually Default

Contrary to the narrative often pushed by banks, most loan defaulters are not wilful defaulters. Advocate Siddharth Nair routinely represents clients who defaulted due to:

- Sudden job loss or salary reduction

- Business slowdown or collapse

- COVID-19 aftermath and market volatility

- Medical emergencies or accidents

- Family crises, divorce, or bereavement

- Delayed payments from clients or government bodies

- Rising interest rates and compounding penalties

Indian courts have repeatedly recognised that financial incapacity does not amount to criminal intent.

Types of Loan & Credit Card Cases Handled

Advocate Siddharth Nair handles all categories of loan recovery matters, including:

Bank Loans

- Personal loans

- Home loans

- Education loans

- Car and vehicle loans

- Business and MSME loans

- Overdraft and cash credit facilities

Credit Cards

- Multiple card defaults

- Exorbitant interest disputes

- Recovery agent harassment

- Cheque bounce cases linked to cards

Liability Expansion Cases

- Guarantor liability disputes

- Co-borrower harassment

- Family members wrongly implicated

Legal Framework Governing Loan Recovery in India (Explained Simply)

1. SARFAESI Act, 2002

This law allows banks to seize secured assets without filing a civil suit. However, it is strictly procedural, and even a single violation can invalidate the entire recovery action.

Advocate Siddharth Nair regularly challenges:

- Invalid demand notices under Section 13(2)

- Premature possession under Section 13(4)

- Illegal valuation and reserve price fixing

- Sham or collusive auctions

- Mechanical orders by District Magistrates

2. Debt Recovery Tribunals (DRT & DRAT)

DRTs are specialised forums meant to:

- Protect borrower rights

- Examine bank compliance

- Grant interim relief

An experienced DRT lawyer is critical because technical lapses decide outcomes, not emotional arguments.

3. Criminal Law Misuse by Banks

Banks frequently misuse:

- Section 420 IPC (Cheating)

- Section 406 IPC (Criminal Breach of Trust)

Courts across India have repeatedly held that loan default ≠ cheating unless fraudulent intent existed at inception.

Advocate Siddharth Nair has secured numerous FIR quashings and stay orders on this ground.

4. Negotiable Instruments Act – Section 138

Cheque bounce cases are quasi-criminal, often filed to pressure borrowers. Strategic defence can:

- Secure compounding

- Reduce liability

- Avoid imprisonment

5. RBI Guidelines & Fair Practice Codes

Recovery agents:

- Cannot threaten arrest

- Cannot visit at odd hours

- Cannot abuse or shame borrowers

- Cannot contact employers or neighbours

Violations can lead to criminal action against banks.

Investigative & Regulatory Authorities That May Get Involved

Depending on the allegations and loan size, the following bodies may appear:

- Banks & NBFCs

- Debt Recovery Tribunals (DRT/DRAT)

- District Magistrate / CMM

- Local Police & Economic Offences Wing

- CBI (large-value public bank loans)

- Enforcement Directorate (ED)

- SFIO (corporate loan defaults)

- RBI Ombudsman

- Insolvency Professionals

Advocate Siddharth Nair coordinates defence across all parallel proceedings, ensuring consistency and protection.

Judicial Protection for Borrowers: Why Courts Are On Your Side

Indian courts—right up to the Supreme Court—have repeatedly warned banks against:

- Criminalising civil debt

- Using police as recovery agents

- Harassing families and guarantors

- Conducting sham auctions

The precedents listed earlier are not mere citations—they form the legal backbone of modern borrower defence litigation, and Advocate Siddharth Nair actively relies on them in court.

How Advocate Siddharth Nair Defends His Clients (Step-by-Step)

1. Immediate Damage Control

- Stops harassment and illegal recovery

- Issues legal notices to banks

- Secures interim protection

2. Strategic Forum Selection

- DRT vs High Court vs Criminal Court

- Avoids unnecessary litigation

3. Criminal Defence Shield

- FIR quashing

- Anticipatory bail

- Stay on arrest

4. Asset & Property Protection

- Stay on possession

- Auction cancellation

- Restoration of property

5. Negotiation & Resolution

- One-Time Settlements (OTS)

- Interest waiver arguments

- Humane repayment structuring

The Human Side: Legal, Social & Psychological Challenges Borrowers Face

Legal Stress

- Multiple cases in different forums

- Confusing notices and deadlines

- Threats of arrest

Social Stigma

- Loss of reputation

- Family pressure

- Workplace anxiety

Psychological Trauma

- Depression and anxiety

- Sleep disorders

- Fear of police and courts

Advocate Siddharth Nair approaches every case with confidentiality, dignity, and compassion, understanding that financial distress is not moral failure.

How Long Does It Take to Get Relief?

While every case is unique, realistic timelines are:

- Immediate protection: 1–3 weeks

- Criminal relief: 1–6 months

- DRT resolution: 6–24 months

- High Court relief: 3–12 months

Early legal action dramatically improves outcomes.

Why Early Legal Advice Is Critical

Most borrowers approach lawyers too late, after:

- Assets are seized

- FIRs are registered

- Auctions are scheduled

Engaging Advocate Siddharth Nair at the notice stage often prevents irreversible damage.

About Advocate Siddharth Nair (Professional Summary)

Advocate Siddharth Nair is a courtroom strategist, constitutional litigator, and borrower-rights defender whose practice stands at the intersection of financial law, criminal law, and human dignity. His reputation is built not on advertisements, but on results, judicial respect, and client trust.

Contact Now!

Advocate Siddharth Nair

Loan Recovery & Credit Card Default Defence Lawyer

New Delhi | Delhi NCR | Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Practice Areas:

Loan Recovery Defence | SARFAESI | DRT | Credit Card Defaults | FIR Quashing | Criminal Defence

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

If you are facing bank pressure, recovery threats, SARFAESI notices, or criminal complaints, your legal defence begins with one correct decision—seeking timely advice from Advocate Siddharth Nair.

Loan Recovery & Credit Card Default – 30 Frequently Asked Questions (FAQs)

Answered by Advocate Siddharth Nair, Loan Recovery Defence Lawyer

1. Is loan default a criminal offence in India?

No. Loan default is a civil matter, not a criminal offence, unless there is proven fraudulent intent at the very beginning of taking the loan. Indian courts, including the Supreme Court, have repeatedly held that mere inability to repay does not amount to cheating or criminal breach of trust.

2. Can I be arrested for not paying a bank loan or credit card bill?

In normal circumstances, no arrest can be made solely for loan default. Arrests only arise if banks misuse criminal provisions, which are frequently challenged and quashed by courts. Advocate Siddharth Nair routinely obtains stay on arrest and FIR quashing in such cases.

3. Why do banks threaten police action for loan recovery?

Banks and NBFCs often use fear tactics to pressure borrowers. Police involvement is legally impermissible for civil recovery, yet FIRs under IPC Sections 420 or 406 are sometimes misused. Courts strongly disapprove of this practice.

4. What is SARFAESI Act and how does it affect borrowers?

The SARFAESI Act, 2002 allows banks to take possession of secured assets without filing a civil suit. However, the Act has strict procedural safeguards, and violations can render the entire recovery action illegal.

5. Can SARFAESI be used for personal loans or credit cards?

Generally, SARFAESI applies only to secured loans, such as home loans or loans backed by property. It does not apply to unsecured personal loans or credit cards, unless security exists.

6. What should I do after receiving a SARFAESI notice under Section 13(2)?

Do not ignore the notice. Immediate legal response is critical. Advocate Siddharth Nair examines:

- Whether the notice is valid

- Whether RBI norms are followed

- Whether the bank has jurisdiction

Early action often prevents possession and auction.

7. Can a bank take my house without a court order?

Banks may attempt possession under SARFAESI, but only after strict compliance and often with assistance of the District Magistrate. Courts frequently stay such actions when due process is violated.

8. What is a Debt Recovery Tribunal (DRT)?

DRT is a specialised tribunal that hears disputes between banks and borrowers. Borrowers have a statutory right to challenge SARFAESI actions before the DRT.

9. How important is it to have a lawyer for DRT cases?

DRT proceedings are highly technical. Small procedural lapses can decide the case. Advocate Siddharth Nair’s experience before DRTs and DRATs significantly improves the chances of interim and final relief.

10. Can banks harass me through recovery agents?

No. Recovery agents must follow RBI Fair Practice Codes. They cannot:

- Threaten arrest

- Use abusive language

- Visit at odd hours

- Contact neighbours or employers

Violations can lead to criminal and regulatory action.

11. What if recovery agents keep calling my family members?

This is illegal. Advocate Siddharth Nair issues cease-and-desist notices and initiates legal proceedings to stop harassment and protect family dignity.

12. Can guarantors be harassed for loan recovery?

Guarantors are liable only within legal limits. Guarantors cannot be criminally harassed or threatened. Many cases involve illegal pressure on elderly parents or spouses, which courts do not tolerate.

13. Can my employer be informed about my loan default?

No. Informing employers is a gross violation of privacy and RBI norms. Such conduct strengthens the borrower’s legal case.

14. What is a cheque bounce case under Section 138 NI Act?

If a repayment cheque bounces, banks may file a Section 138 NI Act case, which is quasi-criminal. Strategic defence can:

- Avoid imprisonment

- Reduce liability

- Enable settlement

15. Can cheque bounce cases be settled?

Yes. Courts actively encourage compounding and settlement. Advocate Siddharth Nair frequently negotiates favourable outcomes without prolonged litigation.

16. Can banks file both civil and criminal cases simultaneously?

Banks often try to do so, but courts have held that criminal proceedings cannot be used as recovery tools. Parallel proceedings are frequently stayed or quashed.

17. What if I have multiple loans and credit cards?

Multiple defaults require coordinated legal strategy across forums. Advocate Siddharth Nair handles consolidated defence to prevent overlapping harassment.

18. Can my property auction be stopped once scheduled?

Yes, in many cases. Courts and DRTs regularly stay auctions where valuation, notice, or procedure is flawed. Timing is critical.

19. How long does loan recovery litigation usually take?

Timelines vary, but generally:

- Interim protection: 1–3 weeks

- Criminal relief: 1–6 months

- DRT cases: 6–24 months

Early legal action shortens timelines significantly.

20. Can I negotiate a One-Time Settlement (OTS)?

Yes. Properly negotiated OTS can result in:

- Reduced principal

- Interest waiver

- Closure without stigma

Legal negotiation yields far better results than direct talks.

21. Is insolvency under IBC an option for individuals?

For personal guarantors and certain borrowers, IBC remedies may apply. Advocate Siddharth Nair evaluates whether insolvency proceedings are beneficial or risky.

22. Can police summon me for loan default?

Police cannot summon or detain borrowers for civil recovery. Any such action is legally challengeable and often results in court protection.

23. What if an FIR is already registered against me?

Immediate legal intervention is crucial. Advocate Siddharth Nair handles:

- Anticipatory bail

- FIR quashing

- Stay on coercive steps

Many such FIRs do not survive judicial scrutiny.

24. Can banks involve ED or CBI in loan default cases?

Only in exceptional cases involving large-scale fraud or money laundering. Routine loan defaults do not attract ED or CBI jurisdiction.

25. Are senior citizens treated differently in recovery cases?

Yes. Courts take a strict view against harassment of senior citizens, and relief is often expedited.

26. Can women borrowers or homemakers be arrested?

No special criminal liability arises merely due to gender or role as co-borrower. Courts are particularly protective against gender-based harassment.

27. What mistakes should borrowers avoid?

- Ignoring legal notices

- Believing recovery agents

- Giving blank cheques

- Signing documents under pressure

Early legal advice prevents irreversible harm.

28. Why should I approach a lawyer before replying to a bank notice?

An incorrect reply can weaken your legal position. Advocate Siddharth Nair ensures responses are strategically sound and legally protective.

29. How does Advocate Siddharth Nair approach borrower defence differently?

He combines:

- Financial law expertise

- Criminal defence strategy

- Constitutional remedies

- Negotiation leverage

This multi-layered approach maximises protection.

30. When should I contact Advocate Siddharth Nair?

The moment you receive a bank notice, recovery call, or police communication. Early intervention often prevents escalation, litigation, and reputational damage.

Final Note for Borrowers

Financial distress is not a moral or legal failure. Indian law provides robust protections—when used correctly.

Advocate Siddharth Nair ensures that borrowers are defended with dignity, legality, and strategic precision.

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Loan Recovery, Bank Loan Default & Credit Card Due Defence

Frequently Asked Questions – Immediate Legal Help Available

Facing bank notices, recovery calls, SARFAESI action, or police pressure?

You are not alone—and you are not a criminal.

This page answers the most urgent questions borrowers ask when they are under pressure from banks, NBFCs, or recovery agents.

All answers below are provided from real courtroom experience by

Advocate Siddharth Nair, one of India’s leading loan recovery and credit card default defence lawyers, practising in New Delhi, Delhi NCR, and across India.

Start Here: What Every Borrower Must Know

Loan default is a civil issue, not a crime.

Banks frequently rely on fear, misinformation, and harassment to force recovery. Indian courts—including the Supreme Court—have repeatedly protected borrowers from illegal criminalisation of debt.

If you have received:

- A bank or NBFC legal notice

- SARFAESI possession or auction notice

- Recovery agent threats

- Police calls or FIRs

- Cheque bounce summons

Immediate legal intervention can stop escalation.

Frequently Asked Questions (Client-Focused & Action-Oriented)

1. Is loan default a criminal offence in India?

No. Failure to repay a loan due to financial difficulty is not a criminal offence. Criminal charges require proof of fraud at the time the loan was taken—not inability to pay later.

2. Can I be arrested for not paying a bank loan or credit card bill?

No arrest is permitted for ordinary loan default. Arrest threats are often illegal pressure tactics and can be challenged immediately in court.

3. Why do banks threaten police action for recovery?

Because fear works. Many banks misuse IPC sections like 420 or 406 to pressure borrowers. Courts consistently quash such cases when no fraud exists.

4. What should I do if I receive a legal notice from a bank?

Do not ignore it and do not reply without legal advice. A poorly drafted reply can weaken your defence. Early legal response often prevents further action.

5. What is SARFAESI and why am I receiving notices under it?

SARFAESI allows banks to take possession of secured assets. However, it is governed by strict procedures. Even minor violations can invalidate the bank’s action.

6. Can SARFAESI be applied to personal loans or credit cards?

Generally, no, unless the loan is secured by property. Many SARFAESI notices are issued incorrectly and can be challenged successfully.

7. Can a bank take my house without going to court?

Only after following strict legal steps. Courts frequently stay possession and auctions where procedure or valuation is flawed.

8. How can I stop a property auction once it is scheduled?

Urgent legal action before the DRT or High Court can stay auctions. Time is critical—delays reduce available remedies.

9. What is the Debt Recovery Tribunal (DRT)?

DRT is a specialised forum where borrowers can challenge bank recovery actions. It is not borrower-unfriendly when cases are argued correctly.

10. Do I really need a lawyer for DRT matters?

Yes. DRT litigation is technical and procedural. Most borrowers lose relief due to technical mistakes, not weak facts.

11. Can recovery agents harass me or my family?

No. Recovery agents must follow RBI Fair Practice Codes. Abuse, threats, repeated calls, or contacting family members is illegal.

12. What if recovery agents are calling my workplace or neighbours?

This is a serious violation of privacy and strengthens your legal case. Courts take such conduct very seriously.

13. Can guarantors be forced to pay or threatened?

Guarantors can be proceeded against only within legal limits. Harassment of elderly parents or spouses is routinely restrained by courts.

14. What is a cheque bounce case under Section 138 NI Act?

It is a quasi-criminal case used to pressure borrowers. With proper defence, imprisonment is usually avoided and cases are settled favourably.

15. Can cheque bounce cases be settled?

Yes. Courts actively encourage settlement. Legal negotiation yields significantly better outcomes than dealing directly with banks.

16. Can banks file civil and criminal cases together?

They try to—but courts do not allow criminal law to be used as a recovery tool. Parallel proceedings are often stayed or quashed.

17. What if I have multiple loans and credit cards?

Multiple defaults require a single, coordinated legal strategy to prevent overlapping harassment and contradictory proceedings.

18. How long does it take to get relief?

- Immediate protection: 1–3 weeks

- Criminal relief / FIR quashing: 1–6 months

- DRT matters: 6–24 months

Early action reduces timelines.

19. Can I negotiate a One-Time Settlement (OTS)?

Yes. When negotiated legally, OTS can significantly reduce liability, waive interest, and close disputes permanently.

20. Can police summon me for loan default?

Police have no authority to summon or detain borrowers for civil recovery. Such actions are legally challengeable.

21. What if an FIR is already registered?

Immediate legal defence is critical. Anticipatory bail, stay on arrest, and FIR quashing are commonly granted in such cases.

22. Can ED or CBI get involved in loan defaults?

Only in rare, high-value fraud cases. Routine loan defaults do not attract ED or CBI jurisdiction.

23. Are senior citizens given special protection?

Yes. Courts are particularly strict against harassment of senior citizens and often grant expedited relief.

24. Are women borrowers or homemakers treated differently?

Courts strongly protect women from coercive recovery and misuse of criminal law, especially when they are co-borrowers or guarantors.

25. What mistakes should borrowers avoid?

- Ignoring notices

- Believing recovery agents

- Giving blank cheques

- Signing documents under pressure

26. Why should I consult a lawyer before replying to a bank?

Because one incorrect admission can weaken your entire case. Legal replies are strategic documents, not explanations.

27. How is Advocate Siddharth Nair’s approach different?

He combines banking law, criminal defence, constitutional remedies, and negotiation strategy—not just one-dimensional litigation.

28. When should I contact Advocate Siddharth Nair?

Immediately after receiving a notice, recovery call, or police communication. Delay only benefits the bank.

Why Borrowers Across India Trust Advocate Siddharth Nair

- Extensive experience against banks & NBFCs

- Proven success in SARFAESI, DRT, and criminal defence

- Strong High Court & Supreme Court practice

- Dignified, confidential, borrower-centric approach

He does not treat loan default as wrongdoing—he treats it as a legal problem requiring precise defence.

Speak to a Loan Recovery Defence Lawyer Before the Situation Escalates

Advocate Siddharth Nair

Loan Recovery & Credit Card Default Defence Lawyer

📍 New Delhi | Delhi NCR | Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Practice Areas:

SARFAESI Defence • DRT & DRAT • Credit Card Defaults • FIR Quashing • Cheque Bounce Defence

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

If you are under pressure from banks, recovery agents, or police,

the right legal advice at the right time can stop everything.

🚨 48-Hour Emergency Legal Help for Loan Defaulters

What You Must Do Immediately After Receiving a Bank Notice, Recovery Threat, or Police Call

If you have just received a bank legal notice, SARFAESI possession notice, recovery agent threat, police call, or court summons, the next 48 hours are critical.

Decisions taken during this period often determine whether the situation stabilises or escalates.

This section is for you if:

- A bank or NBFC has issued a legal notice or SARFAESI notice

- Recovery agents are calling continuously or threatening police action

- You have received a police call, FIR copy, or summons

- Your property auction date has been announced

- You are being pressured to sign documents or give cheques

- Your family members or employer are being contacted

What NOT to Do in the First 48 Hours (Very Important)

Many borrowers unintentionally weaken their own case due to panic.

Do not make these mistakes:

❌ Do NOT ignore the notice

❌ Do NOT panic or assume arrest is inevitable

❌ Do NOT visit the bank or police station alone

❌ Do NOT sign any documents under pressure

❌ Do NOT give blank or post-dated cheques

❌ Do NOT admit liability verbally or in writing

❌ Do NOT believe recovery agents’ threats

Anything you say or sign can later be used against you.

What You SHOULD Do Immediately

✅ Step 1: Pause and Secure Legal Protection

Loan default is not a criminal offence. The law is on your side—but only if invoked correctly and on time.

✅ Step 2: Preserve All Documents

Keep copies of:

- Loan agreement

- Bank notices

- SARFAESI notices

- WhatsApp messages / call recordings (if any)

- Police communication

- Cheque bounce summons

These documents form the foundation of your defence.

✅ Step 3: Take Legal Advice Before Any Reply or Appearance

An improperly drafted reply or an uninformed police visit can escalate matters unnecessarily.

How Advocate Siddharth Nair Intervenes Within 48 Hours

When contacted at the emergency stage, Advocate Siddharth Nair typically acts in the following manner:

🔹 Immediate Legal Assessment

- Identifies whether the issue is civil, criminal, or mixed

- Detects misuse of IPC sections or SARFAESI provisions

- Assesses urgency (arrest risk, auction risk, coercion)

🔹 Stoppage of Harassment

- Issues legal communications to banks/NBFCs

- Initiates action against illegal recovery practices

- Prevents further contact with family or employer

🔹 Protection Against Arrest or Coercive Action

- Advises on anticipatory bail (if required)

- Prepares grounds for FIR quashing or stay

- Guides safe handling of police communication

🔹 Asset & Property Protection

- Evaluates legality of possession or auction

- Prepares urgent DRT or High Court filings

- Seeks interim stay where possible

🔹 Strategic Reply to Notices

- Drafts legally protective replies

- Avoids admissions or damaging statements

- Preserves future remedies

Why Timing Matters More Than Anything Else

Most borrowers seek legal help after damage is already done:

- Property possession taken

- FIR registered

- Auction concluded

- Arrest threatened

In contrast, early intervention often prevents all of the above.

The same case handled at the notice stage and at the arrest stage has very different outcomes.

Who Should Seek Emergency Legal Help Immediately?

- Salaried employees fearing police involvement

- Senior citizens receiving recovery threats

- Women borrowers or guarantors under pressure

- MSME owners facing SARFAESI action

- Families being harassed for someone else’s loan

- Borrowers with multiple loans or credit cards

Speak to a Loan Recovery Defence Lawyer Before the Situation Escalates

Advocate Siddharth Nair

Loan Recovery & Credit Card Default Defence Lawyer

📍 New Delhi | Delhi NCR | Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Core Areas of Emergency Intervention:

SARFAESI Defence • DRT & DRAT • FIR Quashing • Anticipatory Bail

Cheque Bounce Defence • Recovery Harassment Protection

Consultations: Strictly by prior appointment

Final Reminder

Financial distress is not a crime, but silence and delay can be costly.

The first correct legal step—taken within 48 hours—can stop everything.

⚠️ What Happens If You Delay Taking Legal Action?

Many borrowers believe that waiting will “buy time” or that banks will “eventually stop calling.”

In reality, delay almost always strengthens the bank’s position and weakens yours.

Below is a clear comparison between early legal intervention and delayed action.

Early Legal Intervention (Within 48–72 Hours)

✔ Recovery harassment is stopped or controlled

✔ Legally sound replies prevent damaging admissions

✔ SARFAESI possession or auction can be stayed

✔ Illegal FIRs can be prevented or neutralised

✔ Police pressure is handled through proper legal channels

✔ Guarantors and family members remain protected

✔ Negotiation leverage remains strong

✔ Courts view the borrower as responsible and proactive

✔ Lower legal cost and faster resolution

Delayed or No Legal Action

✖ Recovery agents escalate pressure and threats

✖ Improper replies weaken future court remedies

✖ SARFAESI possession may be completed

✖ Property auction may be scheduled or concluded

✖ FIRs or criminal complaints may be registered

✖ Police involvement becomes harder to undo

✖ Family members may face harassment

✖ Negotiation power reduces significantly

✖ Courts have fewer options once damage is done

✖ Longer timelines, higher stress, higher cost

The Reality Borrowers Often Learn Too Late

The law provides strong protection—but only when invoked on time.

Most cases that appear “out of control” could have been stabilised at the notice stage.

Once possession, auction, or arrest steps begin, the legal battle becomes more complex, more expensive, and more stressful.

A Simple Rule Borrowers Should Follow

Notice received → Legal advice taken → Situation stabilised

Waiting rarely improves outcomes. Acting early almost always does.

Take Control Before the Situation Escalates

Advocate Siddharth Nair

Loan Recovery & Credit Card Default Defence Lawyer

New Delhi | Delhi NCR | Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

If you are uncertain whether your situation is urgent, it usually is.

Early legal advice costs far less than late legal rescue.

A Concluding Word from Advocate Siddharth Nair

Financial distress can happen to anyone. In my years of legal practice, I have represented salaried professionals, business owners, senior citizens, women borrowers, guarantors, and families who found themselves under extreme pressure—not because they acted dishonestly, but because circumstances changed.

It is important for you to know this clearly: defaulting on a loan or credit card payment does not make you a criminal, nor does it strip you of your legal rights or dignity. Indian law provides strong protections to borrowers—but those protections are effective only when asserted calmly, correctly, and at the right time.

Most situations that appear overwhelming today can be stabilised with timely legal intervention. My role as your lawyer is not merely to respond to banks or appear in court, but to shield you from unlawful coercion, prevent misuse of criminal law, protect your assets and family, and guide you toward a legally sound resolution—whether through litigation, settlement, or structured negotiation.

If you have received a notice, a threat, or a call that has caused fear or uncertainty, I encourage you not to delay. Early legal advice often prevents irreversible consequences. You do not have to face this alone, and you should not face it without proper legal guidance.

Contact Advocate Siddharth Nair

Advocate Siddharth Nair

Loan Recovery & Credit Card Default Defence Lawyer

Practice Locations:

New Delhi | Delhi NCR | Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Core Practice Areas:

- Bank Loan Recovery Defence

- Credit Card Default Cases

- SARFAESI Act Litigation

- Debt Recovery Tribunal (DRT & DRAT)

- Cheque Bounce Defence (NI Act)

- FIR Quashing & Anticipatory Bail

- Recovery Agent Harassment Matters

- Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sunday: Holiday/ Meetings strictly by appointment

Final Note

If you are unsure whether your situation requires immediate legal help, it usually does.

A single, timely legal consultation can often stop escalation before it begins.

Early action protects your rights. Delay strengthens the bank’s position.

Call Now For Help: +91-9625799959

©2026 www.nairlawchamber.com

5 thoughts on “Best Lawyer Loan Non-payment New Delhi & NCR”

Comments are closed.