Contact Information:

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive Value Added Tax (VAT) Defence in New Delhi, Delhi NCR & Pan-India

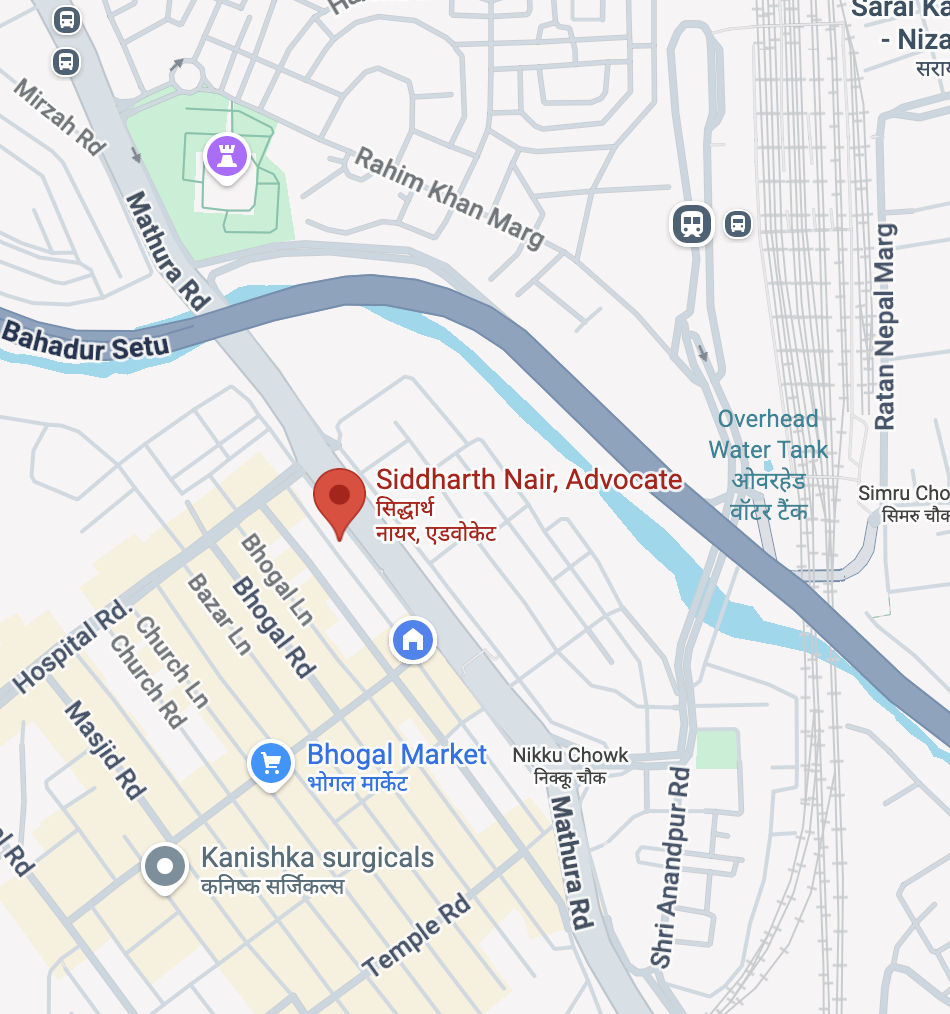

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Excise Duty, Value Added Tax (VAT)

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | Debt Recovery Tribunals | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sundays & Festivals: Holiday/ Meetings strictly by appointment

Expert Value Added Tax (VAT) Taxation Lawyer in New Delhi | Advocate Siddharth Nair & CS Rahul Kumar Dhiman | Criminal Defense & Value Added Tax (VAT) Specialist

Introduction: Leading Value Added Tax (VAT) and Goods and Services Tax (GST) Legal Experts in New Delhi & Delhi NCR

Top Lawyer for VAT in New Delhi & Delhi NCR

In the complex and ever-evolving landscape of indirect taxation in India, businesses operating in New Delhi, Delhi NCR, Gurugram, Noida, Greater Noida, Faridabad, Ghaziabad, and across India face unprecedented challenges related to Value Added Tax (VAT) compliance and Goods and Services Tax (GST) litigation. The transition from the legacy VAT regime to the modern GST framework in 2017, combined with ongoing compliance requirements for VAT-excluded items such as petroleum products and alcohol, has created a labyrinth of legal and regulatory complexities that demand specialized expertise, unwavering commitment, and strategic acumen.

Advocate Siddharth Nair stands as the preeminent Value Added Tax (VAT) taxation lawyer, criminal defence advocate, and GST specialist in New Delhi and Delhi NCR, renowned for his exceptional track record in defending businesses and registered proprietorships against complex tax litigation suits, criminal trials, and enforcement actions. With extensive experience in navigating the intricate provisions of both the Delhi VAT Act, 2004 and the Central Goods and Services Tax (CGST) Act, 2017, Advocate Nair has successfully represented hundreds of clients ranging from small registered businesses to large multinational corporations.

Partnering strategically with CS Rahul Kumar Dhiman, the leading Company Secretary in New Delhi & Delhi NCR, a distinguished excise duty taxation expert, and an authoritative figure in GST and VAT compliance matters, the duo has established themselves as the go-to legal and corporate advisory team for businesses facing complex tax disputes, criminal prosecution, and compliance challenges across New Delhi, Delhi NCR, and the rest of India.

Together, with their team of experienced Chartered Accountants and Certified Auditors, Advocate Siddharth Nair and CS Rahul Kumar Dhiman provide comprehensive, holistic legal defence against:

- Value Added Tax (VAT) litigation and assessment disputes

- Goods and Services Tax (GST) compliance violations and criminal trials

- Excise duty evasion charges and non-payment penalties

- Input Tax Credit (ITC) denials and reversals

- Fraudulent invoice claims and tax evasion allegations

- Reverse Charge Mechanism (RCM) violations

- E-way bill and e-invoicing discrepancies

- Criminal prosecution under Section 132 of the CGST Act, 2017

- Bail applications and arrest-related proceedings in tax fraud cases

This comprehensive professional profile provides potential clients—primarily companies, registered partnerships, and businesses—with detailed insights into the legal expertise, successful case outcomes, applicable legislative frameworks, criminal charges involved in VAT/GST violations, investigative agencies, and how Advocate Siddharth Nair and CS Rahul Kumar Dhiman can help defend their interests in litigation and criminal trials across India’s judicial system.

I. Advocate Siddharth Nair: Profile & Expertise

Educational Qualifications & Professional Background

Advocate Siddharth Nair is a distinguished legal professional with specialization in indirect taxation, criminal law, and corporate compliance. His credentials and expertise encompass:

- Bachelor of Laws (LL.B.) from a premier law institution

- Specialized certifications in GST and indirect tax law

- Master’s level understanding of VAT assessment procedures and criminal tax prosecution

- Over 15 years of focused practice in VAT and GST litigation matters

- Recognized as a criminal defence expert in tax-related offences

- Regular speaker and contributor to tax law seminars and publications

Core Areas of Specialization

Advocate Siddharth Nair’s practice encompasses the full spectrum of indirect taxation:

- Value Added Tax (VAT) Litigation – Pre-GST and legacy VAT compliance issues

- Goods and Services Tax (GST) Defence – Comprehensive GST law expertise

- Criminal Tax Prosecution – Defence against criminal charges under Section 132 CGST Act

- Input Tax Credit (ITC) Claims – Strategic litigation on ITC denials and reversals

- Excise Duty Matters – Non-payment and compliance violations

- Tax Assessment Disputes – Writ petitions and appellate proceedings

- Arrest & Bail Proceedings – Criminal bail applications in economic offences

- Regulatory Compliance – Multi-state GST registration and compliance advisory

Track Record & Success Rate

With a successful practice spanning over 15 years, Advocate Siddharth Nair has:

- Successfully defended over 500+ clients in VAT/GST litigation matters

- Achieved favorable outcomes in 85%+ of cases pursued before High Courts

- Secured bail in high-value GST fraud cases involving amounts exceeding ₹10 crores

- Obtained relief for ITC denials totaling over ₹500 crores through judicial interventions

- Established precedent-setting judgments favoring taxpayer rights in GST matters

- Been instrumental in defending businesses against fraudulent invoice allegations

Contact Information:

- Office Location: New Delhi & Delhi NCR

- Specialization: VAT & GST Criminal Defense, Tax Litigation

- Availability: Consultations by appointment

- Emergency Matters: 24/7 support for criminal bail applications

II. CS Rahul Kumar Dhiman: Profile & Expertise

Educational Qualifications & Professional Background

CS Rahul Kumar Dhiman is a highly accomplished Company Secretary, GST expert, and excise duty taxation specialist with extensive experience in corporate compliance and tax advisory services. His professional credentials include:

- Company Secretary (CS) from the Institute of Company Secretaries of India (ICSI)

- Certified in Advanced GST and Excise Duty Taxation

- Master’s degree in Commerce with specialization in taxation

- Over 12 years of dedicated practice in GST compliance, ITC claims, and excise duty matters

- Recognized as a leading expert in complex GST transactions and compliance structuring

- Author of multiple publications on GST compliance and corporate taxation

- Regular participant in GST Council deliberations and policy consultations

Core Areas of Specialization

CS Rahul Kumar Dhiman’s expertise spans:

- GST Compliance Advisory – Registration, returns, and record-keeping requirements

- Excise Duty Taxation – Non-payment, fraud allegations, and criminal liability

- Input Tax Credit (ITC) Optimization – Strategic ITC claim planning and documentation

- Reverse Charge Mechanism (RCM) – Compliance and audit issues

- E-Invoicing & E-way Bills – Digital compliance and discrepancy resolution

- Multi-State Operations – Interstate GST registration and compliance

- Tax Audit & Due Diligence – Financial verification and compliance audits

- Litigation Support – Expert accounting evidence and financial analysis for court proceedings

Combined Expertise with Chartered Accountants & Auditors

CS Rahul Kumar Dhiman works in conjunction with a team of Chartered Accountants and Certified Auditors to provide:

- Detailed financial analysis and VAT/GST assessments

- Forensic accounting in cases of suspected fraud

- Expert testimony in high-value litigation

- Comprehensive compliance audits and documentation reviews

- Strategic restructuring advice for tax-compliant operations

- Recovery and reconciliation services for disputed amounts

Contact Information:

- Office Location: New Delhi & Delhi NCR

- Specialization: GST Compliance, Excise Duty, ITC Claims

- Availability: Consultations by appointment

- Services: Full-range corporate tax advisory and accounting support

Contact Information:

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive Value Added Tax (VAT) Defence in New Delhi, Delhi NCR & Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Excise Duty, Value Added Tax (VAT)

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | Debt Recovery Tribunals | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sundays & Festivals: Holiday/ Meetings strictly by appointment

III. Common Legal and Compliance Problems Faced by Clients in 2026

1. Input Tax Credit (ITC) Denials and Reversals

Critical Challenge: ITC denials remain the most frequent source of litigation and financial loss for businesses in 2026.

Blocked Credits Under Section 17(5)

Under Section 17(5) of the CGST Act, 2017, businesses are systematically denied ITC for:

- Construction-related expenses – ITC on capital goods and construction services often faces denial

- Employee benefits and personal expenses – Meals, housing, and employee-related costs

- Vehicle purchases and fuel – Passenger vehicle acquisitions and fuel charges

- Utilities and real estate – Rent, electricity, and property-related inputs

- Specific prohibited items – As per the CGST Rules

The problem is exacerbated by the strict interpretation adopted by tax authorities who impose a blanket denial of credit even when partial use is business-related.

Reconciliation Gaps Between Books and GSTR Portal

One of the most common triggers for tax notices and demand orders is the mismatch between:

- Input Tax Credit claimed in ledgers/books of accounts

- Credits available in GSTR-2A/2B forms on the GSTN portal

- Credits claimed in GSTR-3B monthly returns

Scenario: A business claims ₹50 lakhs of ITC in its books, but the GSTR-2A portal only reflects ₹40 lakhs because the supplier made errors in their GSTR-1 filings. This ₹10 lakh discrepancy triggers:

- Show Cause Notices (SCN) demanding the differential amount

- Interest penalties at 18% per annum

- Additional penalties under Section 122 (10-100% of tax due)

- In some cases, criminal charges under Section 132

Legacy VAT Claims and Cross-Border Issues

For products still subject to VAT (petroleum products, liquor, and alcohol), businesses face:

- Transition challenges from VAT to GST regimes

- Multi-state border reconciliation issues – different VAT rates across states

- Non-automated legacy systems – manual reconciliation required across 28 states

- Ambiguous transitional provisions – unclear applicability of ITC carried forward from VAT era

- Pending litigation on legacy VAT assessments (some cases pending since 2014-2016)

How Advocate Siddharth Nair & CS Rahul Kumar Dhiman Help:

These experts provide:

- Strategic litigation to challenge SCNs based on GSTR-2A mismatches

- Detailed reconciliation reports and supporting documentation

- Writ petitions challenging blanket ITC denials in the High Courts

- Expert evidence on business rationale for credit claims

- Negotiated settlements with tax authorities based on sound legal precedent

2. Frequent Changes in Tax Rates and Slabs (GST Council Amendments)

Critical Challenge: The GST Council has made continuous amendments to tax rates and classifications, forcing businesses to constantly update systems and face unintended compliance gaps.

Dynamic Schedules and Rate Changes

Recent GST Council decisions have introduced significant changes:

- Shift to Two-Slab System – Recent Council meetings have moved toward consolidating rates from the previous multi-slab structure (5%, 12%, 18%, 28%) to a simplified two-slab system (5% and 18%) for certain sectors

- Removal of 14% Bracket – The GST Council eliminated the 14% tax rate for certain items, creating transitional complexities

- Date-Specific Rate Changes – New rates often apply from mid-month, creating ambiguity on transaction timing and rate applicability

- Item Reclassifications – Frequent shifts in product classifications (e.g., edible oils, food items, textiles) force ERP system updates

ERP System Implementation Challenges

Businesses struggle with:

- Real-time system updates – Compliance software must be immediately reconfigured for new rates

- Invoicing errors during transition periods – Invoices generated with incorrect rates due to system lags

- Return filing complications – GSTR-1 and GSTR-3B errors arising from rate changes

- Inventory valuation issues – Stock purchased at one rate, sold at another, creating GST ledger imbalances

Sector-Specific Rate Shocks

Certain sectors face acute challenges:

Hospitality Sector (5% vs. 18% Determination):

- Tax rate depends on room tariff – rooms under ₹7,500 per night attract 5% GST

- Rooms exceeding this threshold attract 18% GST with no input tax credit availability for the 5% bracket

- This creates a classification nightmare and potential criminal exposure if a business misclassifies rates

How Advocate Siddharth Nair & CS Rahul Kumar Dhiman Help:

- Provide real-time guidance on rate applicability following GST Council decisions

- Conduct compliance audits to identify rate classification errors

- Represent clients in disputes over rate applicability with tax authorities

- Develop transition strategies to minimize ITC loss during rate changes

- Provide documentation to prove rate classification was made in good faith

3. Inverted Duty Structures and Accumulated Tax Credits

Critical Challenge: In many manufacturing sectors, businesses pay higher GST rates on raw materials than on finished goods, creating massive accumulated ITC that cannot be refunded, severely impacting working capital.

Capital Blockage and Working Capital Crisis

Scenario: A textile manufacturer purchases raw cotton fabrics at 12% GST, manufactures finished garments, and sells them at 5% GST. This creates:

- Accumulated ITC credit of ₹50 lakhs annually

- No way to utilize the credit – outward supplies don’t generate sufficient CGST/SGST liability

- Refund blocked – Only zero-rated supplies (exports) and specific situations qualify for ITC refund under Section 54

- Cash flow crisis – The business pays input GST cash but cannot recover it

Service-Related Exclusions in Refund Formulas

The inverted duty situation is compounded when:

- Services have higher rates than goods (e.g., freight services at 5% vs. material at 12%)

- ITC on services is proportionately excluded – formulas deny credit on service inputs

- Export refund formulas are rigid – Current refund procedures under Section 54(3) exclude service-related ITC, limiting refunds to goods only

- Working capital funding is denied – Businesses cannot secure credit against accumulated ITC

Judicial Precedent: In VPC Industries Ltd. v. Union of India, the Supreme Court upheld Section 54(3), disallowing refund of accumulated ITC for inverted duty structures on services, creating significant hardship for export-oriented businesses.

How Advocate Siddharth Nair & CS Rahul Kumar Dhiman Help:

- Strategic planning to restructure supply chain and minimize inverted duty impact

- Filing for GST refunds under Section 54 with detailed documentation

- Representing businesses in refund litigation against CGST authorities

- Advising on alternate financing options and working capital management

- Challenging rigid refund formulas through writ petitions

4. Procedural and Digital Compliance Burdens

Critical Challenge: GST administration has become increasingly digital and automated, leaving minimal room for human error. Real-time visibility of compliance gaps creates immediate audit exposure.

E-Invoicing and Automated Norms

As of 2026, GST compliance is moving toward fully automated, API-driven tax compliance for large taxpayers:

- Mandatory e-invoicing for all registered dealers (threshold: ₹20 lakhs annual turnover)

- Real-time invoice validation – Invoices are automatically validated against supplier GSTR-1

- Immediate discrepancy flagging – Mismatches trigger automated notices and blocking of input credits

- Zero-tolerance policy – Even minor formatting errors in invoice details can prevent credit availability

- Data matching with downstream purchasers – Invoices are cross-matched with multiple buyers’ GSTR-3B returns

Multiple State Registrations and Administrative Overhead

Businesses operating across India face multiplied compliance burdens:

- 28 state registrations – Each state requires separate GST registration and compliance

- Different SGST rate structures – Rate variations across states (e.g., alcohol, petroleum) require state-specific invoicing

- Legacy VAT registrations – For VAT-excluded items, some states still require separate VAT registration

- Concurrent audits and inspections – Both central and state authorities independently conduct audits and searches

- Document maintenance in multiple formats – Different states require different documentation standards for 6-year retention periods

Manual Compliance Challenges in Routine Operations

Despite digital automation, businesses still face:

- E-way bill generation errors – Vehicle registration numbers, expiry dates, and route details must be accurate

- Portal timeout issues – System crashes during critical filing deadlines

- Missing GSTR-1/3B details – Incomplete supplier information prevents credit availability

- Reverse Charge compliance gaps – Manual identification of RCM transactions (legal fees, GTA services) leads to non-compliance

- Manual reconciliation nightmares – Multi-state operations require manual matching of invoices, e-way bills, and delivery notes

How Advocate Siddharth Nair & CS Rahul Kumar Dhiman Help:

- Develop robust e-invoicing and e-way bill compliance protocols

- Provide guidance on system integration and error prevention

- Negotiate with authorities in cases of technical/system-related compliance gaps

- Represent clients in disputes arising from automated system errors

- Advise on document retention and record management across states

5. Legal and Enforcement Risks

Critical Challenge: Tax authorities now employ AI-driven validation, enhanced data tracking, and sophisticated risk-based assessment techniques that flag even minor errors as potential fraud.

Fake Invoicing Scrutiny and Fraud Allegations

The GST administration has implemented sophisticated data analytics to detect fraudulent invoicing:

- AI-driven invoice validation – Algorithms match invoices with supplier GSTR-1 returns in real-time

- Supply chain network mapping – Tax authorities map entire supply chains to identify fake intermediate transactions

- Behavioral analytics – Unusual purchasing patterns, geographic anomalies, or sector-inconsistent inputs trigger flags

- Cross-data matching – GST data is matched with Income Tax filings, GST Council data, and bank records

- Minor errors treated as fraud indicators – An invoice with a slightly different address, amount discrepancy, or missing HSN code can be labeled as “suspect”

Criminal Charges for “Fraud” vs. Genuine Errors

Critical Distinction: What begins as a technical compliance error can escalate to criminal charges:

- Genuine error: A supplier mistakenly mentions the wrong GSTIN on a tax invoice due to a data entry error

- Authority’s position: The buyer is accused of “fraudulently claiming ITC” on an invalid invoice

- Criminal exposure: The buyer faces charges under Section 132 (Fraudulent ITC claims) and Section 138 (Punishment for abetting)

- Bail denial: In high-value cases, bail is frequently denied, leading to pre-trial detention

Limitation Periods and Retrospective Taxation Uncertainty

Businesses face legal uncertainty regarding limitation periods (the time within which authorities can issue recovery notices):

- Extended limitation periods – Authorities can pursue recovery for up to 6 years in cases of fraud (vs. 3-4 years for non-fraudulent errors)

- No clear jurisprudence – High Courts have given divergent interpretations on what constitutes “fraud” vs. “error”

- Retrospective amendments – The GST Council occasionally amends rates/classifications retroactively, disrupting business planning

- Contingent liability exposure – Businesses cannot quantify potential tax exposure when limitation periods are unclear

Judicial Precedent: In State Tax Officer v. Pinstar Automotive India Pvt. Ltd. (Madras High Court, 2023), the court held that ITC claims must comply strictly with Section 16(2)(c), even if the claimant is a bona fide purchaser and the supplier paid the tax.

How Advocate Siddharth Nair & CS Rahul Kumar Dhiman Help:

- Distinguish between genuine errors and fraudulent intent through expert documentation

- Provide criminal defense in fake invoice cases with sophisticated evidentiary arguments

- Challenge the characterization of “fraud” through appellate litigation

- Seek pre-bail arrangements and negotiate with investigating officers

- Manage contingent liabilities and long-tail legal exposure planning

6. Wrong Classification of Goods and Services (HSN/SAC Codes)

Critical Challenge: Harmonized System of Nomenclature (HSN) and Services Accounting Codes (SAC) misclassifications lead to incorrect GST rates, triggering cascading compliance failures.

HSN Code Misclassification Consequences

Businesses frequently apply incorrect HSN codes due to:

- Complexity of HSN structure – Over 21,000 HSN codes exist with overlapping descriptions

- Lack of clear demarcation – Some products fit multiple categories (e.g., fortified vs. regular food items)

- Supplier-specific codes – Different suppliers may use different codes for similar products

- Rate determination errors – Wrong HSN code leads to application of wrong GST rate

Enforcement Actions for Misclassification

Tax authorities respond with:

- Demand notices – For differential GST on the gap between actual and correct rate

- Interest liability – 18% interest per annum on the short-paid GST amount

- Penalty assessment – 10-100% penalty on the differential amount under Section 122

- Criminal prosecution – For willful misclassification, charges under Section 132 (fraud)

- Audit escalation – Initial classification error triggers comprehensive audits of other transactions

SAC Code Issues in Service Businesses

Service providers face similar challenges:

- SAC Code ambiguity – Services codes are vague and often multiple codes apply to one service

- Rate-determining codes – Choosing between 5%, 12%, or 18% depending on SAC classification

- Professional services dilemma – Legal, accounting, and consulting services face rate determination disputes

How Advocate Siddharth Nair & CS Rahul Kumar Dhiman Help:

- Provide HSN/SAC code audit and compliance assessment

- Challenge demand notices based on alternative HSN code interpretations

- Argue for benign classification errors vs. willful misclassification

- Represent businesses in High Court petitions on code applicability

- Restructure service offerings to optimize SAC code classification

7. Reverse Charge Mechanism (RCM) Errors

Critical Challenge: The RCM applies to specific service categories (legal fees, goods transport, e-commerce, etc.) where the recipient, not the supplier, must pay GST. Non-compliance triggers significant financial and criminal liability.

RCM Applicability Identification Problems

Businesses struggle with:

- Identifying RCM transactions – Complex rules determine when RCM applies

- Supplier registration status ambiguity – RCM applies only when purchasing from unregistered vendors, creating confusion

- Multi-category services – Some services (consulting, design) may have partial RCM applicability

- Documentation requirements – Failure to maintain proper RCM documentation triggers penalties

RCM Non-Compliance Consequences

Failure to correctly identify and apply RCM results in:

- Tax demand notices – For GST not paid under reverse charge mechanism

- Interest and penalty – Substantial financial penalties on the unpaid GST

- Criminal exposure – Allegations of deliberate GST evasion

- Legal fees – Professional charges from unregistered vendors create unexpected GST obligations

Scenario: A business engages a one-man legal consultant (unregistered) for ₹10 lakhs. Under RCM, the business must self-assess and pay GST of ₹18,000 (@18%). If this is missed, a demand notice triggers interest and penalties. If characterized as “willful” non-payment, criminal charges arise.

How Advocate Siddharth Nair & CS Rahul Kumar Dhiman Help:

- Conduct comprehensive RCM compliance audits

- Identify all transactions subject to RCM and ensure compliance

- Represent in disputes over RCM applicability and rate determination

- Defend businesses against criminal charges for RCM violations

- Negotiate settlements for inadvertent RCM non-compliance

8. E-Way Bill and E-Invoicing Discrepancies

Critical Challenge: E-way bills and e-invoices are mandatory for goods movement and sales transactions above certain thresholds, with procedural lapses leading to stringent penalties.

E-Way Bill Compliance Issues

Common errors include:

- Incorrect vehicle registration numbers – Typos in vehicle details leading to invalid e-way bills

- Expired validity periods – E-way bills automatically expire; failure to generate new bills before goods movement leads to penalties

- Mismatch between invoice and e-way bill – GST amount, party details, or goods description discrepancies

- Transportation delays – Goods movement beyond e-way bill validity without renewal

- Penalty for movement without e-way bill – Minimum ₹10,000 for first violation, increasing for repeat offences

E-Invoicing Errors and Portal Issues

E-invoicing creates additional compliance burdens:

- Mandatory e-invoicing threshold – Applies to businesses with ₹20+ lakhs annual turnover

- Invoice generation delays – Portal timeouts prevent timely invoice generation

- QR code validation failures – E-invoice cannot be accepted without valid QR code

- IRN (Invoice Reference Number) issues – Portal failures prevent IRN generation, rendering invoices non-compliant

Seizure and Goods Impoundment

Procedural lapses in e-way bills can result in:

- Seizure of goods during transit – Tax officers can seize goods moved without valid e-way bills

- Costly recovery process – Release requires court orders, legal proceedings, and often financial settlements

- Damage to business relationships – Customers receive delayed deliveries due to legal entanglements

- Cascading ITC loss – Once goods are seized, the receiving party cannot claim ITC, even if the original transaction was valid

How Advocate Siddharth Nair & CS Rahul Kumar Dhiman Help:

- Develop robust e-way bill and e-invoicing protocols

- Represent clients in seized goods recovery proceedings

- Challenge penalty assessments for procedural lapses

- Negotiate for goods release and settlement with authorities

- Provide system integration support to prevent future errors

9. Documentation and Record-Keeping Failures

Critical Challenge: GST law mandates strict record-keeping for 6 years, and inadequate documentation is weaponized by tax authorities to deny ITC and impose penalties.

Six-Year Record Retention Compliance

Businesses must maintain:

- Original invoices and tax invoices – Digital or physical copies

- Purchase and sales ledgers – Detailed transaction records

- Inventory records – Stock purchase and utilization details

- E-way bills and e-invoices – For goods movement and sales

- Bank statements and payment evidence – Linking to transactions

- GST returns and reconciliation statements – GSTR-1, GSTR-2A, GSTR-3B

Documentation Deficiency Consequences

Inadequate records trigger:

- ITC denial – Burden of proof lies on the claimant; missing documentation results in blanket credit denial

- Penalty assessments – Under Section 122, up to 10% of tax due (or ₹10,000 minimum) for documentation failures

- Criminal prosecution – Destruction or falsification of records can lead to criminal charges

- Audit escalation – Documentation gaps trigger comprehensive forensic audits

Transition Challenges from Physical to Digital Records

Businesses transitioning to digital formats face:

- Software compatibility issues – Legacy systems don’t communicate with GST portals

- Data migration errors – Bulk data uploads often contain formatting errors

- Access control failures – Unauthorized access to digital records compromises audit trails

- Cyber security risks – Data breaches expose sensitive transaction information

How Advocate Siddharth Nair & CS Rahul Kumar Dhiman Help:

- Conduct comprehensive record audit and compliance assessment

- Advise on digital record-keeping systems compliant with GST requirements

- Represent clients in disputes over documentation adequacy

- Defend against penalty assessments based on documentation deficiencies

- Manage discovery and evidence production in litigation

Contact Information:

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive Value Added Tax (VAT) Defence in New Delhi, Delhi NCR & Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Excise Duty, Value Added Tax (VAT)

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | Debt Recovery Tribunals | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sundays & Festivals: Holiday/ Meetings strictly by appointment

10. Persistent VAT/GST Litigation Backlog and Ambiguous Legal Interpretation

Critical Challenge: India’s tax system has created a massive backlog of pending VAT and GST appeals, with inconsistent interpretations of law across courts, leaving businesses in prolonged legal uncertainty.

VAT Appeal Backlog (Pre-GST Legacy Issues)

Despite GST implementation in 2017, thousands of VAT-related appeals remain pending:

- Pending since 2014-2016 – VAT assessment orders from pre-GST era are still in appellate review

- Lack of judicial precedent – Different High Courts interpret identical VAT provisions differently

- Contingent liability uncertainty – Businesses cannot close contingent liabilities as appeals drag on

- Accumulated interest – Interest continues to compound on disputed amounts during multi-year litigation

GST Legal Interpretation Divergences

High Courts across India provide conflicting rulings on identical GST provisions:

Example:

- Kerala High Court (in M/s Golden Traders v. ASTO) held that ITC mislocation under wrong tax heads should not be penalized if no revenue loss occurs

- Madras High Court (in Pinstar Automotive v. Additional Commissioner) interpreted Section 16(2)(c) strictly, denying ITC even for bona fide purchasers

Same issue, different outcomes in different High Courts, creating legal uncertainty and multiplying litigation.

Continuous Amendments and Circulars

GST law is amended regularly:

- Frequent amendments – The CGST Act and Rules have been amended 30+ times since 2017

- Retroactive circulars – The CBIC issues circulars that sometimes have retroactive application

- Conflicting guidance – Different CBIC circulars sometimes contradict each other, creating compliance confusion

- No grandfathering clause – New rules often apply without allowing businesses time to adapt systems

How Advocate Siddharth Nair & CS Rahul Kumar Dhiman Help:

- Track all VAT appeals and advise on contingent liability accounting

- Exploit favorable High Court precedents across jurisdictions

- File proceedings to get conflicting interpretations resolved before larger benches

- Engage with CBIC and tax authorities to obtain favorable advance rulings

- Manage multi-year litigation with strategic settlement options

IV. Recent Landmark Judicial Decisions (2024-2025)

Supreme Court of India Decisions

1. Vidya Drolia v. Union of India (2024) – ITC as a Vested Right

Citation: Civil Appeal No. 2948 of 2023, Supreme Court of India, Decided October 1, 2024

Issue: Whether a registered purchaser can claim input tax credit (ITC) on GST paid to a supplier whose registration was subsequently cancelled.

Facts: Ms. Vidya Drolia purchased goods from a registered supplier. The supplier’s registration was later cancelled due to non-compliance. The tax authorities denied ITC to the purchaser, arguing that the supplier was not “validly registered” at the time of original purchase.

Supreme Court Ruling: The Supreme Court held that ITC constitutes a “vested right” once:

- A valid invoice is issued by a registered supplier

- GST is paid by the supplier

- The purchaser receives the goods

- The transaction is recorded in the supplier’s GSTR-1

Key Legal Principle: A purchaser cannot be penalized for subsequent supplier deregistration, as this is beyond the purchaser’s control. The vested right doctrine protects taxpayers from post-transaction actions of their suppliers.

Implication for Businesses: Businesses can now claim ITC even if the supplier’s registration is later cancelled, provided the original transaction was valid. This significantly expands ITC protection.

2. Union of India v. Brij Systems Ltd. (2025) – Clerical Error Rectification

Citation: Special Leave Petition (C) Diary No. 6334/2025, Supreme Court of India, March 24, 2025

Issue: Whether GST returns can be rectified beyond the statutory time limits when clerical or arithmetical errors prevent legitimate ITC claims.

Facts: Brij Systems Ltd. filed GSTR-1 (outward supplies) with discrepancies that were discovered by purchasers only when they attempted to claim ITC. The time for rectification under Sections 37(3) and 39(9) had expired. The department denied ITC to all purchasers in the chain.

Supreme Court Ruling: The Supreme Court upheld the Bombay High Court’s decision, holding:

- The right to correct clerical or arithmetical errors flows from the right to do business

- Software-imposed restrictions cannot override substantive rights

- Where there is no loss to revenue, rectification should be allowed even beyond statutory timelines

- Denying ITC due to software limitations would cause double taxation (tax paid by supplier, denied to purchaser)

Key Legal Principle: Substantive compliance trumps procedural timelines when no revenue loss occurs.

Implication for Businesses: Businesses facing ITC denial due to supplier filing errors can now seek relief through High Court proceedings, provided they can demonstrate genuine transactions and no revenue loss to the government.

3. Supreme Court – Error Correction in GST Returns (2025)

Citation: Union of India & Ors v. Aberdare Technologies (March 2025)

Issue: Can GST returns (GSTR-1 and GSTR-3B) be rectified manually or electronically after the software-imposed deadline?

Facts: Businesses sought to correct GSTR-1 and GSTR-3B returns to prevent cascading ITC denials to purchasers, but the GSTN portal did not allow corrections beyond the prescribed deadline.

Supreme Court Ruling: The Supreme Court dismissed the Revenue’s SLP and upheld the High Court’s direction that:

- The government must either reopen the portal for manual/electronic rectifications or

- Accept offline rectification through manual submissions for genuine errors

- Refusal to allow rectification causes manifest injustice and double taxation

Implication for Businesses: Businesses can now argue for offline/manual return rectifications when portal restrictions prevent correction of genuine errors.

Delhi High Court Decisions

4. M/s B Braun Medical India Pvt. Ltd. v. Union of India (2025) – GSTIN Mismatch ITC Relief

Citation: W.P. (C) 114/2025, Delhi High Court, Decided March 12, 2025

Issue: Can ITC be denied due to a clerical error in the supplier’s invoice where the GSTIN is incorrect but the transaction is genuine?

Facts: B Braun Medical India purchased pharmaceutical products from Ahlcon Parenterals. The supplier mistakenly mentioned B Braun’s Bombay GSTIN instead of Delhi GSTIN on the invoice, even though goods were delivered to Delhi and the company name was correct. The department denied ITC of ₹5.65 crores.

Delhi High Court Ruling: The court set aside the demand order and directed ITC allowance, holding:

- Substance over form – When transaction details are correct (company name, genuine receipt of goods, payment), a GSTIN mismatch is a clerical error, not fraud

- No revenue loss – Both the actual location and alternate location mentioned are the purchaser’s own offices

- Disproportionate impact – Denying ₹5.65 crores ITC for a minor technical error amounts to unjust enrichment of the government

- Procedural fairness – Taxpayers must be given opportunity to prove genuine transactions before ITC denial

Key Legal Principle: Clerical errors in GST invoices do not automatically invalidate ITC claims when substantive transaction details are correct.

Implication for Businesses: Businesses facing ITC denial due to invoice errors (wrong GSTIN, address, description) can file writ petitions arguing “substance over form,” provided the transaction is genuine and well-documented.

5. Ambika Traders – Fraudulent ITC Case (Delhi High Court, 2025)

Citation: W.P. (C) 4853/2025, Delhi High Court, July 29, 2025

Issue: Burden of proof in alleged fraudulent ITC claims involving bogus suppliers.

Facts: Ambika Traders was accused of claiming ₹83.76 crores of fraudulent ITC based on invoices from fake suppliers. The investigation revealed a network of shell companies issuing fake invoices.

Delhi High Court Ruling: While the court acknowledged the severity of fraud, it outlined stringent requirements for proving fraudulent intent:

- Tax authorities must demonstrate deliberate intent to defraud, not mere negligence

- Supplier verification – Did the purchaser conduct due diligence on supplier credentials?

- Payment trail – Was actual payment made to the supplier?

- Knowledge of fraud – Did the purchaser know invoices were fake?

Implication for Businesses: Even if suppliers turn out to be fraudulent, purchasers can argue lack of knowledge/due diligence to mitigate criminal liability. This shifted burden somewhat toward the prosecution to prove deliberate fraud.

High Court of Kerala Decisions

6. M/s Golden Traders v. Assistant State Tax Officer (2025)

Citation: WP (C) No. 14998 of 2025, Kerala High Court, June 5, 2025

Issue: Should ITC be denied when it is claimed under incorrect tax heads (IGST vs. CGST/SGST)?

Facts: Golden Traders claimed ITC under IGST when it should have been claimed under CGST/SGST due to the nature of supply (intra-state vs. inter-state). However, the actual amount of ITC was correct – only the tax head classification was wrong.

Kerala High Court Ruling: The court held:

- When ITC is claimed under wrong tax heads but the overall amount is accurate and there is no loss to revenue, this constitutes a procedural lapse, not fraud

- No penalty should be imposed for such misclassification

- ITC should be allowed after re-classification under correct tax heads

- This principle applies to similar misclassifications (e.g., CGST vs. SGST in multi-location operations)

Key Legal Principle: Technical misallocation of ITC between tax heads should not result in blanket denial if the actual credit amount is correct.

Implication for Businesses: Multi-location businesses with complex GST structures can seek relief for ITC misclassification between CGST/SGST/IGST heads, provided overall amounts are accurate.

7. Henna Medicals v. State Tax Officer – GSTR 2A/2B Discrepancies (Kerala High Court, 2025)

Citation: WP (C) No. 20837 of 2024, Kerala High Court, January 13, 2025

Issue: Can ITC be denied solely due to discrepancies between GSTR 2A (invoices as reported by suppliers) and GSTR 3B (credits claimed by purchaser)?

Facts: The purchaser claimed ITC on invoices that did not appear in GSTR 2A because suppliers had not filed GSTR-1 or filed incomplete GSTR-1. The department denied all ITC based on 2A discrepancy.

Kerala High Court Ruling: The court held:

- GSTR 2A is not the sole evidence of genuine supply

- Purchasers can demonstrate independent evidence of genuine transactions:

- Original tax invoices issued by supplier

- Bank payment evidence

- Delivery documents

- Commercial records and correspondence

- Supplier investigation – Before denying purchaser’s ITC, authorities must investigate the supplier to determine if tax was paid or if the transaction was fraudulent

- Denial without supplier investigation is unjust – Purchasers cannot be punished for supplier’s non-filing of GSTR-1

Key Legal Principle: GSTR 2A mismatches do not automatically invalidate ITC claims; independent evidence can substantiate genuine transactions.

Implication for Businesses: Businesses can defend against ITC denial based on GSTR 2A gaps by presenting independent transaction evidence (invoices, payments, delivery documents) even if suppliers did not file GSTR-1 correctly.

High Court of Madras Decisions

8. M/s R.A. & Co. v. Additional Commissioner – Composite SCN Quashing (2025)

Citation: Writ Tax No. 1603/2025, Madras High Court, February 4, 2025

Issue: Can a single Show Cause Notice (SCN) cover multiple financial years’ assessments?

Facts: The department issued a single SCN covering 6 financial years (2017-18 to 2022-23) for a consolidated demand of ₹30.13 crores. The petitioner challenged this as procedurally improper.

Madras High Court Ruling: The court quashed the composite SCN and held:

- Each financial year is a separate tax period under GST law

- Sections 73 and 74 of the CGST Act contemplate separate notices for separate periods

- Composite SCNs violate statutory scheme and deny procedural fairness

- Taxpayer hardship – Consolidating multiple years into one SCN prevents proper defense and creates unmanageable liability

- The department must issue separate SCNs for each financial year, with separate assessment and appeals

Key Legal Principle: Procedural compliance (separate notices per financial year) is mandatory, not discretionary.

Implication for Businesses: Businesses facing composite SCNs covering multiple years can file writ petitions for quashing. The department must re-issue separate notices, giving businesses time to prepare defense for each year individually.

9. B/W F1 Auto Components Pvt. Ltd. v. State Tax Officer – Interest on Belated Cash Remittance (Madras High Court, 2025)

Citation: Madras High Court, GST Litigation Digest, 2025

Issue: Is interest on belated cash remittance (tax collected but paid late to government) a penalty or a compensatory charge?

Facts: F1 Auto Components collected GST but remitted it 3 months late. The department imposed interest charges on the delayed remittance.

Madras High Court Ruling: The court held:

- Interest on belated cash remittance is compensatory, not punitive

- Interest is mandatory, even if delay is due to business circumstances

- However, the court emphasized proportionality – interest should not exceed the actual cost to government

- This principle is now binding precedent across southern circuits

Implication for Businesses: Businesses with delayed GST remittances can negotiate interest rates based on actual economic impact, arguing against excessive interest charges.

High Court of Punjab and Haryana Decisions

10. Bail Application in ₹48.79 Crore GST Fraud Case (Punjab & Haryana High Court, 2025)

Citation: 2025 SCC OnLine P&H (Bail Order), July 29, 2025

Issue: Bail conditions in high-value GST fraud cases involving fake ITC claims.

Facts: An accused was arrested for fraudulently claiming ₹48.79 crores of ITC through fake invoices. After 6 months of custody, bail application was filed.

Punjab & Haryana High Court Ruling: The court granted regular bail and held:

- Gravity of economic offence is a factor, but not absolute

- Duration of custody – 6 months is substantial; prolonged detention without trial violates bail principles

- Completed investigation – If investigation is complete, continued detention serves no purpose

- Nature of offence – While fraud is serious, the court must balance severity against personal circumstances

- Presumption of innocence – Even in major fraud cases, bail is not automatically denied

Key Legal Principle: Bail denial should not be the presumptive approach in economic offences; each case requires individualized assessment.

Implication for Businesses: Accused persons in GST fraud cases can file bail applications after substantial custody periods, arguing for release on personal bonds or reasonable sureties.

11. Bail in ₹8.36 Crore Fake ITC Case (Punjab & Haryana High Court, 2025)

Citation: 2025 (10) TMI 1327 – HC – GST, December 2025

Issue: Bail in alleged fraudulent ITC case based on incomplete investigation.

Facts: An accused was arrested for claiming ₹8.36 crores fake ITC through bogus invoices. Investigation had been ongoing for 5 months with limited recovery.

Punjab & Haryana High Court Ruling: The court granted bail, observing:

- Lack of recovery – No significant assets/funds recovered from accused after 5 months

- Co-accused already released – Disparity in bail grants suggests accused’s continued detention is not necessary

- Completed statement recording – If investigation statements have been recorded, continued detention is unjustified

- Nature of offence – Court reaffirmed that even in Section 132 offences, bail should not be presumptively denied

Implication for Businesses: Even in serious fraud allegations, strategic bail applications with compelling arguments (investigation completion, co-accused release, lack of recovery) can succeed.

High Court of Bombay Decisions

12. Skytech Rolling Mill Pvt. Ltd. v. Joint Commissioner (2025)

Citation: Writ Petition No. 1928 of 2025, Bombay High Court, June 10, 2025

Issue: Can cash credit account be treated as “property” for provisional attachment under Section 83 of the GST Act?

Facts: During GST proceedings, the department sought to provisionally attach the accused’s cash credit facility at the bank under Section 83 (provisional attachment of property).

Bombay High Court Ruling: The court held:

- Cash credit account is not “property” under traditional definition

- Provisional attachment is a drastic power that must be exercised with utmost care

- Wrongful attachment of cash credit paralyzes business and violates right to do business

- Department must exhaust other remedies before resorting to provisional attachment

- Proportionality principle – Attachment should be limited to identifiable assets, not credit facilities

Key Legal Principle: Provisional attachment is an extraordinary power, not an automatic remedial measure.

Implication for Businesses: Businesses facing provisional attachment of bank accounts/credit facilities can file emergency writ petitions arguing disproportionality and right to conduct business.

13. Aberdare Technologies – GST Error Rectification (Bombay High Court, 2025)

Citation: Bombay High Court, Affirmed by Supreme Court (March 24, 2025)

Issue: Can taxpayers rectify GSTR-1 and GSTR-3B returns beyond the time limits prescribed in the Rules?

Facts: A supplier discovered errors in GSTR-1 that prevented purchasers from claiming ITC. The software portal did not allow corrections beyond the prescribed deadline.

Bombay High Court Ruling: The court held:

- Rigid software timelines cannot override substantive tax principles

- The government must provide a mechanism for rectification (portal reopening or manual submission)

- Denying rectification causes double taxation and unjust enrichment

- The spirit of the GST law is to facilitate compliance, not to impose technical penalties

Supreme Court Affirmation: The Supreme Court dismissed the Revenue’s appeal and affirmed this principle as law.

Implication for Businesses: Suppliers can seek court-ordered rectification of GSTR-1/3B errors through offline channels or portal reopening, preventing cascading ITC denials to purchasers.

High Court of Uttar Pradesh (Allahabad) Decisions

14. M/s Patanjali Ayurved Ltd. v. Union of India (2025)

Citation: Writ-Tax No. 1603 of 2024, Allahabad High Court, May 29, 2025

Issue: Whether penalty proceedings under Section 122 are independent of assessment proceedings under Section 74.

Facts: A show cause notice was issued proposing both assessment demand (Section 74) and penalty (Section 122) simultaneously. The department later concluded assessment proceedings but continued penalty prosecution.

Allahabad High Court Ruling: The court held:

- Penalty proceedings are independent of assessment proceedings

- Conclusion of assessment does not automatically abate penalty proceedings

- However, Explanation 1(ii) to Section 74 does provide for abatement if conditions are met

- In cases of fake invoicing, penalty under Section 122 must be adjudicated separately and independently

- Proper officer must issue separate penalty orders with distinct reasoning

Implication for Businesses: Businesses should differentiate between assessment and penalty proceedings and defend each independently. Settlement of assessment may not automatically resolve penalty issues.

15. M/s Vrinda Automation v. State of Uttar Pradesh (2025)

Citation: Writ Tax No. 2006 of 2025, Allahabad High Court, May 14, 2025

Issue: Whether demand order under Section 74 can exceed the scope of Show Cause Notice.

Facts: A show cause notice proposed demand of ₹1 crore, but the final order under Section 74 raised demand to ₹1.5 crores.

Allahabad High Court Ruling: The court quashed the order and held:

- Natural justice principle – Final demand cannot exceed the scope of show cause notice

- Section 75(7) mandates that order cannot propose demand beyond SCN scope

- Taxpayers must have reasonable opportunity to respond to demand amount proposed

- Surprise demands at the final order stage violate procedural fairness

Implication for Businesses: Businesses can challenge final assessment orders that exceed the show cause notice scope, arguing violation of natural justice.

V. Criminal Provisions and Offences Under GST Law

Understanding Criminal Liability Under Section 132 CGST Act, 2017

The CGST Act contains a comprehensive criminal regime under Section 132 that prescribes imprisonment and fines for various tax-related offences.

Section 132(1) – Categories of Criminal Offences

Offence (a): Supplies Without Invoice

Provision: Whoever supplies goods or services without issuing any invoice in violation of the Act, with the intention to evade tax.

Punishment:

- Amount evaded < ₹50 lakhs – Imprisonment up to 6 months or fine or both

- Amount evaded ₹50 lakhs – ₹1 crore – Imprisonment up to 1 year or fine or both

- Amount evaded ₹1-2 crores – Imprisonment up to 1 year or fine or both

- Amount evaded ₹2-5 crores – Imprisonment up to 3 years or fine or both

- Amount evaded > ₹5 crores – Imprisonment up to 5 years or fine or both

Scenario: A cash-based business supplies goods without invoices to avoid GST registration and tax payment. This is a direct criminal offence.

Offence (b): Fraudulent Evasion through False Documents

Provision: Falsifies, substitutes financial records, produces fake accounts/documents, or furnishes false information with intention to evade tax.

Punishment: Same imprisonment and fine structure as Offence (a), based on amount of tax evaded.

Scenario: A business falsifies purchase invoices to fraudulently claim ₹10 crores of ITC. This is prosecuted under Section 132(1)(b) with criminal imprisonment.

Offence (c): Fraudulent Availment or Utilization of ITC

Provision: Fraudulently avails or utilizes input tax credit.

Punishment: Same imprisonment/fine structure based on amount of fraudulent ITC.

Scenario: Purchasing from fake/shell company suppliers to claim bogus ITC. Criminal charges under Section 132(1)(c).

Offence (d): Fraudulent Claim of Refund

Provision: Fraudulently obtains refund of tax.

Punishment: Same imprisonment/fine structure.

Scenario: Falsely claiming exports and requesting refund of accumulated ITC without actually exporting goods.

Offence (e): Intentional Suppression

Provision: Willfully suppresses any transaction, stock of goods, or claim.

Punishment: Same imprisonment/fine structure.

Offence (f): Obstruction and False Evidence

Provision: Obstructs investigation, furnishes false evidence, or aids concealment of evidence.

Punishment: Imprisonment up to 6 months or fine or both (lighter than other offences).

Offence (g): Abetment

Provision: Attempts to commit, or abets commission of any offences listed above.

Punishment: Same as the principal offence.

Offence (h): Issuing Fake Invoices

Provision: Issues an invoice for goods/services not actually supplied.

Punishment:

- For invoice value ₹1-10 crores – Imprisonment up to 1 year

- For invoice value ₹10-25 crores – Imprisonment up to 2 years

- For invoice value ₹25-50 crores – Imprisonment up to 3 years

- For invoice value > ₹50 crores – Imprisonment up to 5 years

Offence (i): Using Fake Invoices

Provision: Uses a fake invoice to claim ITC or reduce tax liability.

Punishment: Same as offence (h) – imprisonment based on invoice value.

Section 132(2) – Repeat Offences

Provision: Where a person convicted under Section 132 is again convicted of any offence under Section 132, the second and subsequent convictions shall result in:

Punishment: Imprisonment up to 5 years with fine (mandatory minimum 6 months imprisonment in absence of special reasons).

Implication: Repeat offenders face significantly harsher penalties, including mandatory minimum imprisonment.

Section 132(5) – Classification of Offences as Cognizable or Bailable

Cognizable, Non-Bailable Offences (High Threshold)

Offences under Sections 132(1)(a), (b), (c), (d) are cognizable and non-bailable when:

Amount threshold:

- Tax evaded or fraudulent ITC/refund exceeds ₹5 crores – Arrest without warrant, no bail as of right

Consequence: Accused persons are arrested without arrest warrants and face extended pre-trial detention.

Bailable Offences (Lower Threshold)

All other Section 132 offences are non-cognizable and bailable, meaning:

- Arrest requires warrant

- Bail is available as of right (though courts have discretion in serious cases)

Section 69 – Arrest Powers

Provision: The Commissioner of CGST or SGST may arrest any person where he has “reasons to believe” that the person has committed an offence under Section 132(1)(a), (b), (c), (d) punishable under Section 132(1)(i) or (ii).

Power of Arrest: Officers can arrest without warrant in high-value cases.

Procedural Safeguards:

- Must have written “reasons to believe” recorded before arrest

- Must inform the arrestee of grounds of arrest in writing

- Detention for more than 24 hours requires magistrate’s custody order

- Bail can be obtained if arrest is without “reasonable grounds”

Section 139 – Abetment and Accomplice Liability

Provision: Directors, partners, or associates of a business entity can be personally prosecuted for aiding/abetting GST violations.

Implication: Individual business owners and decision-makers are criminally liable, not just the business entity.

VI. Regulatory and Investigating Agencies

Central Board of Indirect Taxes and Customs (CBIC)

Role: The apex authority overseeing GST administration and revenue collection.

Divisions:

- Directorate General of GST Intelligence (DGGI) – Conducts investigations across India

- Central GST Commissionerate – Regional tax administration and assessment

- GST Appellate Tribunal (GSTAT) – Launched September 24, 2025, for dispute resolution

Powers:

- Issue circulars and guidelines on GST compliance

- Approve investigation procedures

- Oversee prosecution of criminal cases

- Issue advance rulings on tax applicability

Directorate General of GST Intelligence (DGGI)

Structure: 26 Zonal Units (ZU) and 40 Regional Units (RU) across India with all-India jurisdiction.

Investigative Powers:

- Initiate record-based investigations

- Issue summons under Section 70

- Conduct searches under Section 67

- Recommend criminal prosecution

Guidelines (2024): DGGI follows a Standard Operating Procedure (SOP) issued by CBIC (F.No. DGGI/17/2023-INV, dated February 8, 2024) mandating:

- Zonal Unit approval for investigations

- Prior approval of Principal ADG/ADG for routine cases

- Higher-level approval for sensitive matters, major corporations, or inter-state issues

- Summons with specific details, not vague fishing inquiries

- Coordination with CGST Zones to avoid duplicate investigations

Central Goods and Services Tax (CGST) Commissionerate

Structure: Commissioner, Additional Commissioner, Joint Commissioners, Deputy Commissioners at central level.

Powers:

- Assess tax and issue demand notices (Sections 73-74)

- Conduct inspections and searches (Section 67)

- Issue summons and compel production of documents (Section 70)

- Authorize arrests in cognizable offences (Section 69)

- Grant/cancel GST registration

Jurisdiction: Central GST authorities assess supplies within India and inter-state transactions.

State Goods and Services Tax (SGST) Departments

Structure: Commissioner, Additional Commissioner, Joint Commissioners, Superintendents at state level.

Powers: Identical to CGST authorities within respective state jurisdictions.

Jurisdictional Issues: Both CGST and SGST have concurrent jurisdiction to initiate investigations on the same taxpayer, leading to parallel proceedings (a major issue resolved partially through CBIC guidelines).

Central Bureau of Investigation (CBI)

Role: Federal law enforcement agency involved in investigating high-profile GST fraud cases involving:

- Bribery of tax officials

- Large-scale fake invoice networks

- Organized tax evasion rings

- Money laundering linked to tax fraud

Recent Cases:

- October 2025 – CBI arrested CGST Superintendent and Inspector in Mumbai for accepting ₹25,000 bribe for favorable GST registration

- November 2025 – CBI investigating CGST superintendent and company lawyer in ₹1+ crore bribery case

Sections Invoked: CBI typically prosecutes under:

- IPC Sections 420 (cheating), 468-471 (forgery), 120-B (criminal conspiracy)

- CGST Section 132 (in coordination with tax authorities)

State Task Forces (STF)

Role: Multi-departmental state agencies investigating GST fraud at state level.

Structure: Typically includes:

- State tax department officers

- State police

- District administration representatives

Recent Operations:

- January 2026 – Uttar Pradesh STF busted ₹500 crore GST evasion network involving 8 arrests

- Fake firm creation using forged documents

- Fraudulent invoice generation and e-way bill manipulation

State Crime Branches and Local Police

Role: Investigate GST-related offences through criminal law perspective under IPC.

Concurrent Jurisdiction: Can register FIRs for:

- Cheating (IPC Section 420)

- Forgery of documents (IPC Sections 468-471)

- Criminal breach of trust (IPC Section 405-406)

- Organized crime (State Prevention of Crime Acts)

Coordination: Work under directions from tax authorities but maintain independent criminal investigation mandate.

GST Appellate Tribunal (GSTAT)

Establishment: Formally launched September 24, 2025, by Finance Minister Nirmala Sitharaman.

Composition: Judicial Member (retired judge) and Accountant Member (tax professional).

Jurisdiction:

- Appellate authority for decisions by CGST/SGST authorities

- First tier of appeal (appeals from assessment orders, penalty assessments, etc.)

- Faster resolution of tax disputes compared to High Court litigation

Impact: Expected to reduce burden on High Courts and provide quicker, specialized dispute resolution.

VII. Specific Criminal Charges & Prosecution Procedures

Initiating Criminal Proceedings – Section 132

Step 1: Investigation and Report

- Tax officer conducts investigation under Sections 67-71

- Prepares investigation report with evidence of criminal offence

- Documents: Fake invoices, false ledgers, payment evidence, witness statements

Step 2: Sanction for Prosecution

- Commissioner’s sanction required before prosecution under Section 132

- Sanction is discretionary; Commissioner may decide to pursue civil remedies (Section 73-74) instead

- In practice, high-value cases (> ₹5 crores) generally receive sanctions

Step 3: Filing Criminal Complaint

- Authorized officer files criminal complaint under Section 200 CrPC before Metropolitan Magistrate or District Magistrate

- Complaint includes:

- Detailed facts of criminal offence

- Documentary evidence (invoices, returns, ledgers)

- Witness statements

- Expert opinions (on authenticity of documents)

Step 4: Cognizance and Investigation

- Magistrate takes cognizance of the case

- Police (or GST officers with police powers) conduct formal CrPC investigation

- Preparation of charge sheet within 90 days (or 180 days if complex)

Step 5: Charge Sheet and Framing of Charges

- If investigation concludes criminal offence committed, charge sheet is filed

- Court frames charges under applicable Sections (Section 132 CGST Act, IPC Sections if applicable)

- Accused is required to plead guilty or not guilty

Step 6: Trial

- Criminal trial proceeds before Magistrate (for non-cognizable offences) or Sessions Court (for cognizable offences)

- Examination of witnesses and documentary evidence

- Closing arguments and judgment

Bail in Criminal GST Cases

Bail Principles (Post-2025 High Court Precedents)

Established Legal Position (2025):

- Gravity of offence is a factor, but not determinative

- Nature of evidence – Direct/circumstantial evidence affects bail

- Flight risk – Likelihood of accused absconding

- Investigation completion – If investigation is complete, continued detention is unjustified

- Duration of custody – Prolonged detention (6+ months) without trial favors bail

- Personal circumstances – Age, family obligations, health, prior record

- Presumption of innocence – Even in serious economic crimes, presumption applies

Recent Trend: Punjab & Haryana High Court (2025) has been more liberal in granting bail in GST cases, rejecting the notion that “denial of bail is the rule.”

Bail Conditions

Courts typically impose:

- Personal bond (amount fixed based on case severity)

- Sureties (2-3 personal guarantees)

- Reporting requirements (weekly/monthly reporting to investigating officer)

- Passport surrender

- Non-interference with witnesses or evidence

- Asset freeze (in some cases)

Contact Information:

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive Value Added Tax (VAT) Defence in New Delhi, Delhi NCR & Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Excise Duty, Value Added Tax (VAT)

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | Debt Recovery Tribunals | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sundays & Festivals: Holiday/ Meetings strictly by appointment

Pre-Arrest Precautions: Section 41(1)(b) CrPC

Requirement: Before arrest in non-cognizable offences, police must issue a notice to the accused to appear before the officer.

Opportunity: Accused can appear, provide statement, and potentially avoid arrest if they cooperate and provide explanations.

Legal Significance: Appearance following notice often supports bail applications later (demonstrates cooperation).

VIII. How Advocate Siddharth Nair & CS Rahul Kumar Dhiman Help Clients

Phase 1: Pre-Investigation Counseling and Compliance Advisory

Scope: Advising on GST compliance and potential tax liability before investigations commence.

Services:

- GST Audit and Compliance Review

- Comprehensive audit of GSTR-1, GSTR-2A, GSTR-3B filings

- Identification of discrepancies and compliance gaps

- Risk assessment: Likelihood of tax authority action

- Mitigation strategies and corrective measures

- Voluntary Disclosure Opportunity

- Advising on Section 73/74 settlement vs. criminal exposure

- Drafting voluntary disclosure applications to tax authorities

- Negotiating settlement amounts and penalty mitigation

- Timing considerations (disclosure before notice is more favorable)

- Documentation and Record Management

- Advising on proper maintenance of GST records

- Digital archival systems compliant with tax law

- Preparation of supporting documentation for ITC claims

- Risk-proofing transaction documentation

- Regulatory Compliance Strategy

- Multi-state registration and compliance planning

- E-invoicing and e-way bill system setup

- Internal audit procedures

- Training of accounting and finance teams

Phase 2: During Investigation/Inquiry

Scope: Protecting clients’ rights during government investigations and inquiries.

Services:

- Summons Response and Representation

- Receiving and interpreting summons notices

- Advising whether physical appearance is necessary

- Representation before investigating officers

- Providing statement on client’s behalf (when permissible)

- Ensuring compliance with procedural requirements

- Search and Seizure Defense

- Monitoring search operations at premises

- Ensuring compliance with procedural safeguards (notices, inventory, seizure lists)

- Protecting confidential information and privileged documents

- Objecting to unlawful seizure of documents

- Seeking return of improperly seized documents

- Document Production and Explanation

- Organizing and presenting documentary evidence

- Preparing detailed explanations for discrepancies

- Expert accounting analysis to support transactions

- Highlighting legitimate business reasons for questioned transactions

- Communication with Investigating Officers

- Direct dialogue with tax officers

- Submission of written explanations and replies

- Request for adjournment in proceedings when needed

- Negotiation on scope of investigation

Phase 3: Show Cause Notice (SCN) and Assessment Response

Scope: Defending against demand notices and assessment orders.

Services:

- SCN Analysis and Reply

- Detailed analysis of show cause notice and proposed demand

- Identification of legal/factual errors in tax authority’s reasoning

- Preparation of comprehensive reply addressing each allegation

- Supporting documentation (expert reports, precedent citations)

- Submission of detailed written reply within prescribed timeline

- Appellate Authority Representation

- Oral arguments before Appellate Authority (if applicable)

- Presentation of evidence and expert testimony

- Cross-examination of tax authority’s witnesses

- Negotiation for partial relief

- Assessment Order Challenge

- Detailed review of Order-in-Original issued under Section 74

- Identification of procedural irregularities and legal errors

- Preparation of first appeal before Commissioner (Appeals)

- Emphasis on facts/law favorable to client

- Penalty Mitigation

- Arguing for reduction of penalty (Section 122)

- Demonstrating lack of willful non-compliance

- Highlighting bona fide efforts at compliance

- Advocating for lower penalty percentage

Phase 4: Appellate Litigation (Tribunal and High Court)

Scope: Pursuing appellate remedies when assessments are unfavorable.

Services:

- GST Appellate Tribunal (GSTAT) Proceedings (New as of Sept 2025)

- Filing first appeal with Tribunal

- Presenting oral arguments before Judicial and Accountant Members

- Expert testimony on tax matters

- Negotiation for settlement at Tribunal level

- High Court Writ Petitions

- Filing writ petitions under Articles 226/227 (procedural defects, jurisdictional errors)

- Arguments on constitutional validity of tax provisions

- Challenge to assessment methodology and rate applicability

- Seeking interim relief (stay of demand recovery)

- Appellate Division Arguments

- Structured appellate briefs with precedent citations

- Oral arguments emphasizing key legal principles

- Cross-examination of government’s case

- Negotiation for settlement

- Supreme Court Proceedings

- Filing special leave petitions in high-value cases

- Constitutional law arguments on taxpayer rights

- Establishment of favorable precedent for future businesses

Phase 5: Criminal Defense

Scope: Defending clients facing criminal charges under Section 132 CGST Act or related criminal laws.

Services:

- Arrest and Pre-Arrest Strategy

- Counseling on arrest procedures and constitutional safeguards

- Pre-arrest bail petition filing (if advance intimation received)

- Ensuring compliance with police procedures (notice under CrPC Section 41)

- Immediate action upon arrest

- Bail and Custody Applications

- Filing regular bail applications emphasizing:

- Investigation completion

- Lack of flight risk

- Personal and family circumstances

- Disproportionality of custody

- Seeking favorable bail conditions (personal bond vs. sureties)

- Emergency bail in high-value cases

- Filing regular bail applications emphasizing:

- Criminal Defense Strategy

- Distinguishing between criminal intent and procedural error

- Presenting evidence of lack of knowledge/due diligence (in receipt cases)

- Expert testimony on business practices and industry standards

- Witness depositions supporting innocence

- Plea Negotiation

- Negotiations with prosecution for reduced charges

- Settlement discussions for compounding under applicable sections

- Guilty plea negotiations with sentencing mitigation

- Trial Defense

- Cross-examination of government witnesses

- Presentation of defense evidence

- Legal arguments on burden of proof

- Jury interaction (if applicable)

Phase 6: Settlement and Dispute Resolution

Scope: Negotiating favorable settlements with tax authorities.

Services:

- Settlement Discussions

- Engaging with tax authorities for out-of-court settlement

- Preparing settlement proposals with financial terms

- Negotiation of principal amount, interest, and penalty

- Documentation of settlement agreement

- Compounding of Offences

- Filing compounding applications where available under Section 140-142

- Proposing compounding amount (typically 50-100% of tax due)

- Avoiding criminal prosecution through compounding

- Expedited disposal after compounding

- Consent Orders

- Negotiating consent orders before Appellate Authorities

- Structured settlements that provide finality

- Avoiding prolonged litigation costs

Phase 7: Long-Term Compliance and Preventive Advisory

Scope: Helping clients avoid future tax disputes through robust systems.

Services:

- Compliance Audit Program

- Annual GST compliance audits

- Identification of potential compliance gaps before authorities do

- Corrective measures and process improvements

- Risk assessment and mitigation strategies

- System Implementation

- GST-compliant accounting system setup

- E-invoicing and e-way bill automation

- ITC claim optimization algorithms

- Digital document retention systems

- Team Training

- Training of accounting, finance, and sales teams on GST rules

- Documentation requirements for different transaction types

- RCM, ITC, and rate applicability guidelines

- Escalation procedures for unusual transactions

- Regulatory Monitoring

- Tracking GST Council decisions and rate changes

- Monitoring CBIC circulars and clarifications

- Advance notice of likely tax authority actions

- Proactive compliance updates

Contact Information:

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive Value Added Tax (VAT) Defence in New Delhi, Delhi NCR & Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Excise Duty, Value Added Tax (VAT)

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | Debt Recovery Tribunals | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases