Premier Excise Duty Taxation Lawyer & Criminal Defence Advocate in New Delhi

Advocate Siddharth Nair & CS Rahul Kumar Dhiman

Expert Legal Defence Against Excise Duty Fraud, Non-Compliance & Criminal Prosecution in Delhi NCR

Contact Information:

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive Excise Duty Defence in New Delhi, Delhi NCR & Pan-India

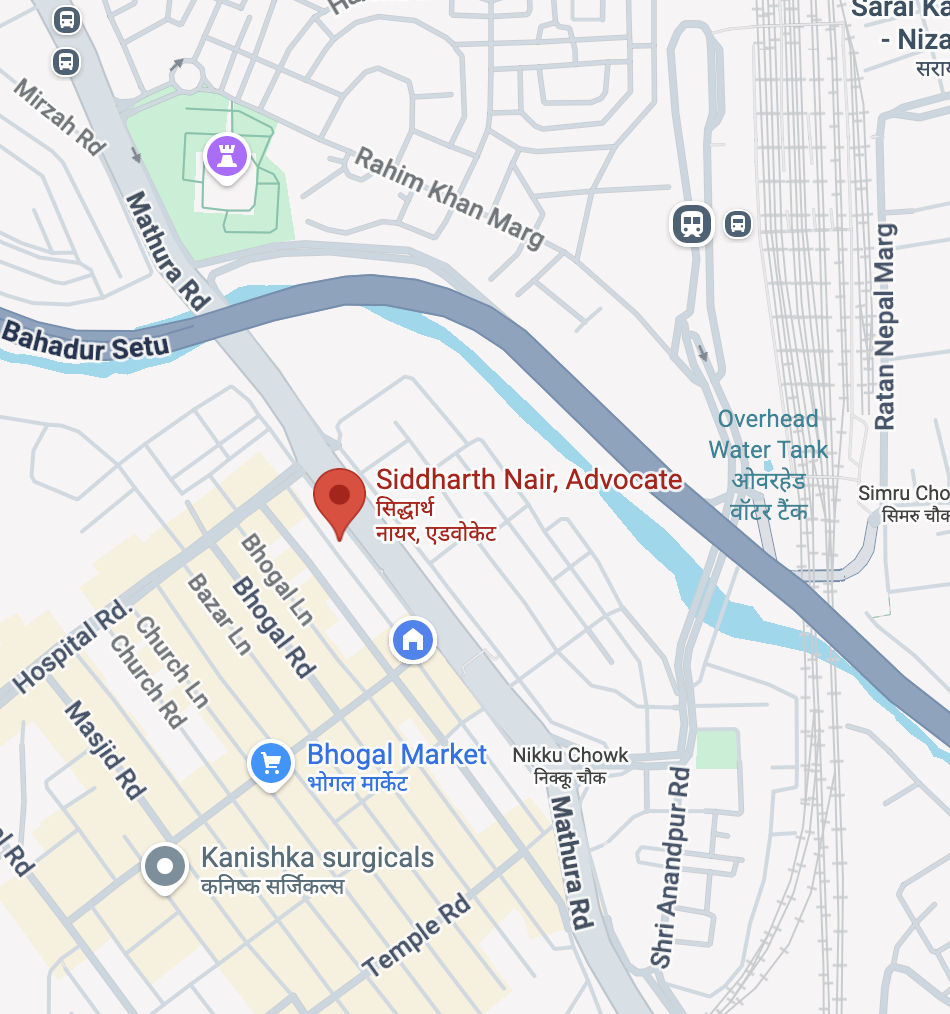

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Excise Duty

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | Debt Recovery Tribunals | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sundays, Public Holidays & Festivals: Holiday/ Meetings strictly by appointment

Introduction: Your Trusted Legal Partners for Excise Duty Litigation & Criminal Defence

BEST EXCISE DUTY LAWYERS IN NEW DELHI & NCR

Advocate Siddharth Nair stands as one of the most accomplished and sought-after excise duty taxation lawyers and criminal defence advocates in New Delhi and the Delhi NCR region. With an exemplary track record spanning numerous landmark cases, Advocate Nair has established himself as the leading legal counsel for businesses, companies, registered proprietorships, and individual entrepreneurs facing complex excise duty litigation and criminal prosecution.

In strategic partnership with Company Secretary Rahul Kumar Dhiman, recognized as the leading Company Secretary in New Delhi and Delhi NCR with specialized expertise in excise duty compliance and corporate governance, this formidable legal team offers comprehensive, integrated legal solutions that combine deep tax law expertise with corporate regulatory knowledge.

Together with their network of highly qualified associates including Chartered Accountants, Certified Auditors, and tax consultants, Advocate Siddharth Nair and CS Rahul Kumar Dhiman provide holistic legal representation that addresses every facet of excise duty disputes—from initial investigations through trial proceedings to appellate advocacy before High Courts and the Supreme Court of India.

Their client-centric approach, meticulous case preparation, and aggressive yet ethical litigation strategy have resulted in successful outcomes in hundreds of excise duty cases across New Delhi, Gurugram, Noida, Greater Noida, Faridabad, and Ghaziabad. Whether you are facing allegations of excise duty fraud, non-payment of returns, compliance violations, or criminal prosecution, this legal team possesses the expertise, experience, and dedication required to protect your rights, your business, and your freedom.

Contact Information:

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive Excise Duty Defence in New Delhi, Delhi NCR & Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Excise Duty

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | Debt Recovery Tribunals | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sundays & Festivals: Holiday/ Meetings strictly by appointment

Why Choose Advocate Siddharth Nair & CS Rahul Kumar Dhiman?

Unparalleled Expertise in Excise Duty Law

- Specialized Focus: Exclusive concentration on excise duty taxation, compliance, and criminal defence

- Comprehensive Knowledge: Deep understanding of Central Excise Act, 1944, State Excise Laws, GST Act, and related taxation statutes

- Strategic Partnership: Unique collaboration between legal advocacy and company secretarial expertise

- Multi-Jurisdictional Experience: Successfully represented clients across multiple High Courts and the Supreme Court of India

Proven Track Record of Success

- Hundreds of Cases Won: Consistent success rate in excise duty litigation and criminal trials

- Acquittals Secured: Multiple acquittals in serious criminal prosecutions involving excise duty fraud

- Bail Applications: High success rate in securing bail for clients facing excise-related criminal charges

- Duty Demands Set Aside: Significant excise duty demands successfully challenged and reversed

- Penalties Reduced/Waived: Substantial reduction or complete waiver of penalties and interest

Comprehensive Legal Services

- Investigation Stage Defence: Representation during searches, seizures, and investigations by Enforcement Directorate, CBI, DGCI, and Excise Intelligence

- Pre-Litigation Strategy: Proactive compliance review and risk mitigation

- Show Cause Notice Response: Expert handling of adjudication proceedings

- Appeal Representation: Appellate advocacy before Commissioners (Appeals), CESTAT, High Courts, and Supreme Court

- Criminal Defence: Aggressive defence in criminal trials under Section 9 of Central Excise Act and related penal provisions

- Bail Applications: Swift and strategic bail applications under all circumstances

- Quashing Petitions: Constitutional remedies under Article 226 and 227 before High Courts

- Corporate Advisory: Compliance audits, risk assessment, and preventive legal counseling

Understanding Excise Duty Law in India

Central Excise Duty Framework

The Central Excise Act, 1944 governs the levy and collection of duties of excise on goods manufactured or produced in India. Despite the implementation of GST, excise duty continues to apply to certain commodities including petroleum products, alcoholic liquor for human consumption, and other specified goods under the purview of state excise departments.

Key Provisions of Central Excise Act, 1944:

Section 3: Levy and collection of excise duty on excisable goods manufactured or produced in India

Section 4: Valuation of excisable goods for determining duty liability

Section 5: Powers to grant exemptions from duty

Section 9: Criminal prosecution for offences relating to evasion of duty

Section 9A: Cognizance and trial of offences

Section 9AA: Power to arrest

Section 11: Recovery of duties not levied or short-levied

Section 11A: Recovery of duties not paid, short-paid or erroneously refunded

Section 11AC: Imposition of penalty

Section 35: Appeals to Commissioner (Appeals)

Section 35B: Appeals to Customs, Excise & Service Tax Appellate Tribunal (CESTAT)

Section 35G: Appeals to High Court on questions of law

Section 35L: Direct appeals to Supreme Court on questions relating to rate of duty or valuation

State Excise Laws

Each state in India has enacted its own excise legislation governing the manufacture, possession, transport, purchase, and sale of intoxicating liquor and narcotic substances. Common aspects across state excise laws include:

- Licensing Requirements: Mandatory licenses for manufacture, wholesale, and retail of alcoholic beverages

- Duty Structure: State-specific excise duty rates and collection mechanisms

- Regulatory Compliance: Strict operational norms, record-keeping, and reporting requirements

- Penal Provisions: Criminal penalties for violations including illicit manufacture, possession of non-duty paid liquor, and smuggling

Major State Excise Acts:

- Delhi Excise Act, 2009

- Uttar Pradesh Excise Act, 1910

- Haryana Excise Act, 1914

- Punjab Excise Act, 1914

- Maharashtra Prohibition Act, 1949

- Rajasthan Excise Act, 1950

- Karnataka Excise Act, 1965

- Tamil Nadu Liquor (Licensing & Retail Vending) Act, 2003

Common Excise Duty Issues Faced by Businesses

1. Complex and Inconsistent State Laws

The excise regime in India is characterized by significant variations across states, creating compliance challenges for businesses operating in multiple jurisdictions. Each state has different:

- Duty rates and calculation methodologies

- Licensing procedures and requirements

- Documentation and reporting obligations

- Penalties and enforcement mechanisms

How We Help: Advocate Siddharth Nair and CS Rahul Kumar Dhiman provide multi-state compliance strategies, conduct comprehensive regulatory audits, and represent clients in disputes arising from conflicting state regulations.

2. Exclusion from GST and Tax Discrepancies

Alcoholic liquor for human consumption remains outside the GST framework, continuing to be governed by state excise laws. This creates:

- Dual taxation issues

- Credit disallowance problems

- Classification disputes

- Valuation controversies

How We Help: Our team navigates the complex interplay between excise duty and GST, advises on tax planning strategies, and represents clients in disputes involving tax credit denials and dual taxation issues.

3. Compliance and Operational Challenges

Businesses in the excise sector face rigorous compliance requirements:

- Regular submission of returns and statements

- Maintenance of detailed records and accounts

- Adherence to manufacturing and storage standards

- Compliance with labeling, packaging, and MRP requirements

- Timely payment of duties and fees

How We Help: CS Rahul Kumar Dhiman conducts compliance audits, establishes robust internal control systems, and provides ongoing regulatory guidance to ensure complete compliance and minimize legal exposure.

4. Discriminatory Taxation

Businesses often face discriminatory treatment through:

- Arbitrary assessments

- Selective enforcement

- Unequal application of exemptions and concessions

- Discriminatory licensing policies

How We Help: We challenge discriminatory practices through constitutional remedies, representing clients before High Courts under Article 14 (Right to Equality) and Article 19(1)(g) (Right to carry on business).

5. Broken Tax Chain

The exclusion of excise duty from GST creates a broken tax chain where:

- Input tax credits on raw materials cannot be claimed

- Cascading tax effects increase costs

- Compliance becomes complex across different tax regimes

How We Help: We provide strategic tax planning advice to minimize the impact of the broken tax chain and represent clients in disputes arising from credit denials.

6. Fixed Pricing & Inflation

State governments often impose fixed pricing regimes for alcoholic beverages, creating challenges during periods of:

- Rising input costs

- Inflationary pressures

- Changes in raw material prices

- Increased operational expenses

How We Help: We represent businesses in negotiations with excise authorities for price revisions and challenge arbitrary pricing policies through legal proceedings.

7. Transit Wastage Penalties

Businesses face penalties for alleged excess wastage during transportation and storage, including:

- Unexplained shortages

- Evaporation and leakage claims

- Documentation discrepancies

- Route violations

How We Help: We defend clients against excessive wastage penalties, present scientific evidence on normal wastage, and negotiate reasonable settlements with authorities.

8. Arbitrary License Fees

Excise authorities sometimes impose:

- Exorbitant license fees

- Retrospective fee increases

- Arbitrary conditions in licenses

- Unjustified security deposits

How We Help: We challenge arbitrary license fee demands through legal proceedings and represent clients in license renewal disputes and regulatory negotiations.

9. Cartelization Allegations

Businesses may face allegations of:

- Price-fixing

- Market allocation

- Anti-competitive practices

- Violation of competition laws in conjunction with excise violations

How We Help: We defend clients against cartelization allegations, coordinate with competition law experts, and represent clients before the Competition Commission of India and courts.

10. Mandatory NOCs and Clearances

Operations often require multiple No Objection Certificates from:

- Pollution Control Boards

- Fire Departments

- Municipal Authorities

- Land Use Authorities

- Excise Intelligence Agencies

How We Help: We facilitate obtaining necessary clearances, represent clients in disputes over NOC denials, and challenge unreasonable conditions imposed by authorities.

11. Strict MRP Enforcement

State excise departments strictly enforce Maximum Retail Price (MRP) regulations, leading to:

- Penalties for overcharging

- Product recalls for MRP violations

- License suspensions

- Criminal prosecutions

How We Help: We defend clients in MRP violation cases, advise on compliant pricing strategies, and represent businesses in enforcement proceedings.

12. Illegal/Non-Duty Paid Liquor (NDPL)

One of the most serious violations involves:

- Possession of non-duty paid liquor

- Illicit manufacture

- Smuggling and transportation of contraband liquor

- Supply chain violations

How We Help: Advocate Siddharth Nair provides aggressive criminal defence in NDPL cases, secures bail for accused persons, and achieves acquittals through meticulous trial advocacy.

13. Compliance with Operational Norms

Detailed operational requirements include:

- Production capacity limits

- Storage facility standards

- Transportation protocols

- Record-keeping systems

- Quality control measures

How We Help: CS Rahul Kumar Dhiman establishes comprehensive compliance systems, conducts operational audits, and ensures businesses meet all regulatory requirements.

14. Insolvency & Background Checks

Excise authorities conduct rigorous background verification including:

- Financial solvency requirements

- Criminal background checks

- Tax compliance history

- Previous license violations

How We Help: We assist clients in license applications with proper documentation, address adverse findings in background checks, and represent clients in license denial appeals.

15. Litigation and Dispute Resolution

Excise disputes involve multiple forums:

- Adjudication before Excise Commissioners

- Appeals to Commissioners (Appeals)

- Tribunal proceedings before CESTAT

- High Court litigation under Article 226 and Section 35G

- Supreme Court appeals

How We Help: Advocate Siddharth Nair has extensive experience representing clients at every stage of litigation, from initial adjudication through Supreme Court proceedings.

16. Criminal Trials Related to Excise Duty Fraud

The most serious consequences involve criminal prosecution under:

- Section 9 of Central Excise Act, 1944

- State Excise Acts’ penal provisions

- Indian Penal Code sections (420, 467, 468, 471, 120B)

- Prevention of Corruption Act (for cases involving public officials)

How We Help: Advocate Siddharth Nair provides comprehensive criminal defence including bail applications, discharge applications, trial advocacy, and appellate representation to secure acquittals and protect clients’ liberty and reputation.

Criminal Charges Related to Excise Duty Fraud & Non-Compliance

Businesses and their directors/officers may face serious criminal charges in excise duty matters:

Offences Under Central Excise Act, 1944

Section 9(1) – Specific Offences

Criminal prosecution for:

- Evasion of excise duty

- Fraudulent availment of exemptions

- Clandestine removal of goods

- Suppression of production

- Misuse of Cenvat credit

- Maintenance of false records

- Violation of rules and regulations

Punishment: Imprisonment up to 7 years + fine

Section 9(1)(a) – Abetment

- Aiding, abetting, or conniving at the commission of offences

- Conspiracy to evade excise duty

Punishment: Same as principal offence

Section 9(1A) – Enhanced Penalty for Specified Goods

For certain specified goods (like illicit liquor):

- Higher penalties

- Stricter enforcement

- Mandatory minimum punishment

Punishment: Imprisonment up to 3 years + fine

Offences Under State Excise Acts

Each state excise act contains specific criminal provisions, typically including:

Illicit Manufacture

- Manufacturing without license

- Manufacturing in excess of licensed capacity

- Unauthorized production

- Use of prohibited substances

Punishment: Imprisonment up to 3-10 years + substantial fines

Illicit Possession

- Possession of non-duty paid liquor

- Possession beyond prescribed limits

- Unexplained possession

- Storage in unauthorized premises

Punishment: Imprisonment up to 5 years + confiscation + fine

Illicit Transportation

- Transport without proper documents

- Route violations

- Quantity discrepancies

- Use of unauthorized vehicles

Punishment: Imprisonment up to 3-7 years + vehicle confiscation + fine

Smuggling

- Import/export violations

- Cross-border smuggling

- Inter-state smuggling without permits

Punishment: Imprisonment up to 10 years + heavy fines

Offences Under Indian Penal Code (IPC)

Section 420 – Cheating

Cheating excise authorities through:

- False declarations

- Forged documents

- Deceptive practices

Punishment: Imprisonment up to 7 years + fine

Section 467 – Forgery of Valuable Security

Forging excise documents, duty stamps, licenses

Punishment: Imprisonment for life or up to 10 years + fine

Section 468 – Forgery for Purpose of Cheating

Creating false excise records with intent to cheat

Punishment: Imprisonment up to 7 years + fine

Section 471 – Using Forged Document

Using forged excise documents, licenses, or duty payment receipts

Punishment: Same as forgery (up to 10 years)

Section 120B – Criminal Conspiracy

Conspiracy to commit excise duty fraud

Punishment: Punishment of the target offence

Economic Offences

Prevention of Money Laundering Act, 2002 (PMLA)

When excise duty evasion involves:

- Proceeds of crime

- Money laundering

- Layering and integration of illicit funds

Punishment: Imprisonment from 3 to 7 years + fine + attachment of property

Investigating Agency: Enforcement Directorate (ED)

Prevention of Corruption Act, 1988

When excise violations involve:

- Bribery of excise officials

- Illegal gratification

- Abuse of official position by public servants

Punishment: Imprisonment from 3 to 7 years + fine

Investigating Agency: Central Bureau of Investigation (CBI), State Anti-Corruption Bureau

Corporate and Director Liability

Companies Act, 2013

Directors and officers of companies can be held personally liable for:

- Company’s excise violations

- Fraudulent conduct

- Breach of fiduciary duties

Relevant Sections:

- Section 447: Punishment for fraud (imprisonment up to 10 years)

- Section 448: Punishment for false statements (imprisonment up to 2 years)

Vicarious Liability

Under most excise laws, the following persons can be prosecuted:

- Directors of companies

- Partners of firms

- Managers and persons in charge of business

- Company secretaries

- Chief financial officers

Defence Available: Person can escape liability by proving:

- Offence committed without their knowledge

- They exercised due diligence to prevent offence

- They were not in charge of relevant operations

Contact Information:

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive Excise Duty Defence in New Delhi, Delhi NCR & Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Excise Duty

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | Debt Recovery Tribunals | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sundays & Festivals: Holiday/ Meetings strictly by appointment

Investigative & Regulatory Agencies Involved in Excise Duty Cases

Central Government Agencies

1. Directorate General of GST Intelligence (DGGI)

Jurisdiction: Central excise duty evasion, GST fraud, cross-border smuggling

Powers:

- Search and seizure

- Summons to witnesses

- Arrest of accused persons

- Provisional attachment of property

Legal Framework: Central Excise Act, 1944; CGST Act, 2017

2. Directorate of Revenue Intelligence (DRI)

Jurisdiction: Smuggling, customs duty evasion, illicit international trade

Powers:

- Intelligence gathering

- Preventive enforcement

- Search and arrest

- Prosecution

Legal Framework: Customs Act, 1962

3. Enforcement Directorate (ED)

Jurisdiction: Money laundering arising from excise duty fraud

Powers:

- Investigation of scheduled offences

- Attachment of proceeds of crime

- Arrest of accused

- Search of premises

Legal Framework: Prevention of Money Laundering Act, 2002

4. Central Bureau of Investigation (CBI)

Jurisdiction: Corruption cases involving excise officials, major economic offences

Powers:

- Investigation of serious crimes

- Search and seizure

- Prosecution in special courts

Legal Framework: DSPE Act; Prevention of Corruption Act, 1988

5. Central Excise Department (Under CBIC)

Jurisdiction: Assessment, collection, and enforcement of central excise duties

Powers:

- Adjudication proceedings

- Issue of show cause notices

- Penalty imposition

- Initiation of prosecution

Legal Framework: Central Excise Act, 1944; Central Excise Rules, 2002

State Government Agencies

1. State Excise Departments

Jurisdiction: State excise duty collection, licensing, enforcement

Powers:

- Grant and cancellation of licenses

- Inspection of licensed premises

- Search and seizure

- Criminal prosecution under state excise acts

Legal Framework: Respective State Excise Acts

2. State Excise Intelligence Bureaus

Jurisdiction: Detection of excise violations, intelligence operations

Powers:

- Surveillance

- Information gathering

- Raids and searches

- Arrest of offenders

3. State Vigilance and Anti-Corruption Bureaus

Jurisdiction: Corruption in excise administration

Powers:

- Investigation of public servants

- Prosecution for bribery

- Trap operations

Legal Framework: Prevention of Corruption Act, 1988

4. State Commercial Tax/GST Departments

Jurisdiction: GST assessment, cross-taxation issues

Powers:

- Assessment and adjudication

- Search and inspection

- Penalty imposition

Legal Framework: State GST Acts

Quasi-Judicial Bodies

1. Customs, Excise & Service Tax Appellate Tribunal (CESTAT)

Jurisdiction: Appeals against orders of Commissioners

Powers:

- Hear appeals

- Stay of demand

- Final adjudication on facts

Legal Framework: Central Excise Act, Section 35B

2. Settlement Commission

Jurisdiction: Settlement of excise duty disputes (currently non-functional post-GST)

3. Authority for Advance Rulings

Jurisdiction: Providing advance rulings on classification, valuation, and applicability of exemptions

Other Investigating Agencies

1. Economic Offences Wing (EOW)

State police units investigating economic crimes including large-scale excise frauds

2. Special Investigation Teams (SITs)

Constituted for specific high-value or complex excise cases

3. Narcotics Control Bureau (NCB)

When excise violations involve narcotic substances

Judicial Precedents: Recent Landmark Cases

Supreme Court of India – Excise Duty Cases (2024-2025)

1. Bharat Petroleum Corporation Ltd. v. Commissioner of Central Excise, Nashik

Citation: Civil Appeal No. 5642 of 2009

Date: January 20, 2025

Facts: Oil Marketing Companies (OMCs) were facing demand of excise duty on inter-supply of petroleum products under Memorandum of Understanding designed for smooth nationwide distribution.

Issue: Whether prices under MoU for inter-supply of petroleum products constitute “transaction value” for excise duty purposes.

Held: Prices under the MoU for inter-supply of petroleum products do not constitute “transaction value” and are exempt from excise duty due to their non-commercial nature, as the arrangement aimed at facilitating seamless distribution. This case provides significant relief for oil companies engaged in inter-supply arrangements.

Relevance: This judgment protects businesses engaged in inter-company transfers from excise duty liability when such transfers are for operational efficiency rather than commercial profit.

How Advocate Siddharth Nair Can Help: When your business faces excise duty demands on inter-company transfers, internal supplies, or related-party transactions, we analyze the commercial substance of such transactions and argue that they do not constitute taxable events under excise law. This precedent is particularly valuable for manufacturing groups with multiple units and integrated operations.

2. M/s Oswal Petrochemicals Ltd. v. Commissioner of Central Excise, Mumbai – II

Citation: Civil Appeal Nos. 129-130 of 2011

Facts: Central excise authorities reclassified petrochemical products based on a test report, leading to higher duty demand without providing copy of test report to the assessee.

Issue: Whether denial of test report which forms basis of reclassification violates principles of natural justice.

Held: When a test report forms the basis for reclassification necessitating higher duty, copy of such test report must be furnished to the manufacturer-taxpayer. Revenue authorities violated principles of natural justice by failing to share key evidence. The ₹2.15 crore excise duty demand was set aside.

Relevance: This case establishes that taxpayers have a fundamental right to access all evidence relied upon by revenue authorities.

How Advocate Siddharth Nair Can Help: If your business faces excise duty demands based on laboratory test reports, scientific analysis, or technical evaluations that have not been shared with you, we invoke this precedent to challenge such demands on grounds of natural justice violation. We file applications for production of documents and seek quashing of orders passed in violation of fair procedure.

3. M/s Suraj Impex (India) Pvt. Ltd. v. Union of India & Ors.

Citation: SLP (C) Nos. 26178-79 of 2016

Facts: Central Board of Excise and Customs (CBEC) issued a clarificatory circular dated September 17, 2010, and the question arose whether such circular should be given retrospective effect.

Issue: Whether clarificatory circulars issued by revenue authorities have retrospective effect.

Held: A circular/notification issued by the revenue department, clarifying or explaining a fiscal regulation, must be given retrospective effect. Clarificatory circulars are declaratory of the law and apply from the date of the original provision they clarify.

Relevance: This judgment protects taxpayers from retrospective levy of duties when clarificatory circulars are issued in their favor.

How Advocate Siddharth Nair Can Help: When beneficial circulars or clarifications are issued after the relevant period, we rely on this precedent to claim retrospective application. Conversely, when adverse circulars are sought to be applied retrospectively, we distinguish this case and argue that only beneficial clarifications should have retrospective effect under tax jurisprudence principles.

4. Quashing of Departmental Proceedings Does Not Bar Criminal Prosecution

Citation: Judgment delivered July 24, 2025

Bench: CJI B.R. Gavai and Justice Augustine George Masih

Facts: Departmental adjudication order in excise duty matter was quashed on procedural grounds, and accused sought quashing of criminal complaint on the basis that departmental proceedings had been set aside.

Issue: Whether setting aside of departmental adjudication order on procedural grounds automatically renders criminal complaint groundless.

Held: The setting aside of a departmental adjudication order on procedural grounds does not automatically render a criminal complaint for the same offence “groundless.” Criminal prosecution can proceed independently of civil adjudication proceedings.

Relevance: This case clarifies that civil and criminal proceedings in excise matters are independent and success in one forum does not guarantee success in the other.

How Advocate Siddharth Nair Can Help: While this judgment creates challenges when departmental proceedings are favorable, we use strategic defence approaches including: (a) arguing that if there is no civil liability, mens rea for criminal offence is absent, (b) seeking discharge on the ground that no cognizable offence is made out, (c) demonstrating that procedural defects in departmental proceedings reflect systematic flaws in the entire investigation. Our comprehensive approach addresses both civil and criminal aspects simultaneously.

5. State of Maharashtra v. Prism Cement Limited & Anr.

Facts: Amendment to Section 8(5) of Central Sales Tax Act regarding state government’s power to grant tax exemptions.

Issue: Whether 2002 amendment to CST Act is retrospective.

Held: Though after the amendment of Section 8(5) of the Central Sales Tax Act, the State Government’s right to grant exemption from tax has ceased to exist, the amendment is prospective. Every statute is prima facie prospective unless stated otherwise, and accrued rights cannot be taken away by subsequent amendments.

Relevance: This case protects businesses that have availed tax benefits and exemptions under laws existing at the time, even if such laws are subsequently amended.

How Advocate Siddharth Nair Can Help: When your business has availed excise duty exemptions, concessions, or benefits under schemes that are subsequently withdrawn or amended, we argue for protection of accrued rights and vested benefits based on this and similar precedents. We establish that your rights crystallized under the law existing at the relevant time and cannot be retrospectively taken away.

Contact Information:

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive Excise Duty Defence in New Delhi, Delhi NCR & Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Excise Duty

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | Debt Recovery Tribunals | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sundays & Festivals: Holiday/ Meetings strictly by appointment

Delhi High Court – Excise Duty Cases (2024-2025)

1. Commissioner of Central Tax v. ASP Metal Industries

Citation: Appeal under Section 35G of Central Excise Act, 1944

Date: February 2025

Facts: ASP Metal Industries, engaged in manufacturing copper ingots, was alleged to have clandestinely removed significant quantities without accounting or paying duty. DGCEI conducted search, recovered ₹6.20 lakh cash, detected shortage of 3,500 kg copper scrap, and seized documents allegedly indicating unaccounted transactions.

Issue: Whether allegations of clandestine removal can be sustained on basis of assumptions and suspicions without credible evidence.

Held: While criminal charges must be proved beyond reasonable doubt, excise adjudication, being civil in nature, requires proof based on preponderance of probabilities. However, mere presumptions and assumptions cannot replace proof, and even strong suspicion is no substitute for evidence. CESTAT rightly concluded that case of clandestine removal was built on inadequate and unsubstantiated evidence. High Court refused to interfere.

Relevance: This landmark judgment establishes high evidentiary standards for proving clandestine removal and reinforces that revenue authorities must present concrete evidence, not mere suspicions.

How Advocate Siddharth Nair Can Help: In cases involving allegations of clandestine removal, we meticulously analyze the evidence presented by revenue authorities, identify gaps in documentation, challenge assumptions, and demonstrate that suspicions cannot substitute for proof. We cross-examine departmental witnesses, expose contradictions, and establish that the burden of proof lies on the revenue to prove guilt beyond reasonable doubt in criminal cases and on preponderance of probabilities in civil proceedings.

2. Delhi Excise Policy Case – Money Laundering Proceedings

Context: Delhi High Court proceedings related to 2021-2022 Delhi Excise Policy

Facts: Several high-profile prosecutions involving allegations of irregularities in formulation and implementation of Delhi Excise Policy 2021-22, including allegations of favoring private entities, license fee waivers, and bribery.

Issues Involved:

- Validity of arrests by Enforcement Directorate

- Bail considerations in economic offences

- Sanction for prosecution

- Whether Chief Minister can continue in office while in custody

- Procedural compliance in money laundering investigations

Status: Multiple proceedings ongoing before Delhi High Court and Supreme Court involving constitutional questions, bail applications, and challenges to prosecution.

Relevance: These cases highlight the serious consequences of alleged excise policy violations and the intersection of excise law with anti-corruption and money laundering statutes.

How Advocate Siddharth Nair Can Help: When your business or its officials face allegations of excise policy violations coupled with corruption or money laundering charges, we provide comprehensive defence strategy addressing multiple legal dimensions. We challenge the legal basis of arrests, file bail applications emphasizing business continuity, argue for discharge on technical and substantive grounds, and coordinate defence across multiple investigative agencies and forums.

3. Konark Exim Pvt. Ltd. & JMD Limited Cases

Citation: 2025 decisions

Year: 2025

Issue: Whether appeals involving taxability, classification, or valuation disputes under Central Excise Act should be filed directly before Supreme Court under Section 35L or before High Court under Section 35G.

Held: Taxability, classification, or valuation disputes must be filed directly before the Supreme Court under Section 35L, not under Section 35G before High Court. This establishes clear jurisdictional demarcation.

Relevance: This procedural ruling is critical for determining correct appellate forum and avoiding dismissal of appeals on jurisdictional grounds.

How Advocate Siddharth Nair Can Help: We provide expert guidance on appropriate appellate forum selection, ensure appeals are filed in correct courts, draft comprehensive appeals addressing jurisdictional requirements, and prevent procedural dismissals that could irreparably harm your case.

4. Metal One Corporation India (P) Ltd. v. Union of India

Citation: (2024) 24 Centax 13 (Del.)

Issue: Valuation of deemed services from foreign affiliate when no invoice raised.

Held: Deemed value of services from a foreign affiliate should be ‘nil’ if no invoice was raised, particularly considering CBIC circular guidance.

Relevance: This case addresses complex valuation issues in international transactions involving excise duty.

How Advocate Siddharth Nair Can Help: When your business has international related-party transactions, transfer pricing issues, or cross-border service arrangements that attract excise duty implications, we provide expert guidance on valuation principles, defend against arbitrary valuations by revenue authorities, and establish that technical compliance with circulars and guidelines should protect taxpayers from adverse demands.

Bombay High Court – Excise Duty Cases (2024-2025)

1. Mahindra & Mahindra v. Union of India

Citation: 2022 (10) TMI 212

Date: Review petition dismissed January 9, 2024

Facts: Question of whether interest and penalty can be levied on payment of Additional Duty of Customs (CVD) and Special Additional Duty (SAD) under Customs Tariff Act, 1975, by borrowing provisions from Customs Act, 1962.

Issue: Whether interest and penalty provisions of Customs Act can be applied to duties levied under Customs Tariff Act in absence of specific provisions.

Held: As there is no substantive provision in Section 3 of the CTA that provides for payment of penalty or interest on duty other than BCD, penalty/interest payable on CVD/SAD is not recoverable from the assessee. In absence of specific provision for levy of interest or penalty under Section 3(12) of CTA, the same cannot be charged.

Subsequent Development: The lacuna pointed out by Bombay High Court has been rectified by Finance (No. 2) Act, 2024 by amending Section 3(12) of CTA with effect from August 16, 2024. The amendment is prospective, not retrospective.

Relevance: This case establishes the principle that taxes, interest, and penalties cannot be levied without express statutory authority, and amendments are prospective unless expressly stated otherwise.

How Advocate Siddharth Nair Can Help: For excise duty demands involving interest and penalties levied for periods before specific legislative provisions came into force, we rely on this precedent to challenge such demands as being without legal authority. We file refund claims for interest and penalties wrongfully collected and argue that any amendments enlarging revenue’s power to levy interest/penalty apply only prospectively.

2. Jaiprakash Bawiskar v. State of Maharashtra & Anr.

Context: PIL regarding wine manufacturers’ illegal collection of excise duty

Date: December 2024

Issue: State’s obligation to realize excise duty illegally collected by wine manufacturers.

Held: Bombay High Court disposed of PIL directing state authorities to take appropriate measures for recovery of excise duty and interest illegally collected by wine manufacturers.

Relevance: This case addresses the state’s enforcement obligations and manufacturer compliance in excise duty collection and remittance.

How Advocate Siddharth Nair Can Help: When disputes arise regarding proper collection and remittance of excise duty, particularly in state excise matters involving allegations of illegal collection or short payment, we represent manufacturers in addressing compliance issues, negotiating with excise authorities, and defending against allegations of fraudulent collection while protecting business operations.

3. Interest on IGST – Post-Mahindra Developments

Multiple Cases: Various tribunals and High Courts interpreting Mahindra judgment

Subsequent Tribunals:

- Chennai CESTAT in Acer India Pvt. Ltd. v. CC [2023 (9) TMI 1553]: Followed Mahindra, held interest cannot be levied on CVD/SAD absent specific provisions

- Kolkata CESTAT in Texmaco Rail Engineering Limited v. CC [2024 (1) TMI 902]: Took contrary view, held interest leviable under Section 28AA

Issue: Whether interest under Section 28AA of Customs Act can be levied on confirmed CVD demand under Section 3(1) of CTA.

Relevance: This divergence of opinion demonstrates the complexity of excise and customs duty law and the importance of skilled legal representation to navigate conflicting precedents.

How Advocate Siddharth Nair Can Help: We monitor all tribunal and High Court decisions on evolving excise duty issues, identify favorable precedents, distinguish unfavorable ones, and present comprehensive legal arguments supported by the strongest available jurisprudence. Our approach involves detailed legal research, comparative analysis of decisions, and persuasive advocacy to secure the most favorable interpretation of law for our clients.

High Court of Kerala – Excise Cases (2024-2025)

1. State of Kerala v. Ansar V.K.

Citation: SLP(Crl) No. 1025/2025

Filed in: Supreme Court (Appeal from Kerala High Court)

Issue: Criminal proceedings under Kerala Excise Act.

Status: Special Leave Petition filed by State of Kerala challenging Kerala High Court judgment.

Relevance: This case involves state excise enforcement and criminal prosecution procedures specific to Kerala jurisdiction.

How Advocate Siddharth Nair Can Help: In cases involving Kerala Abkari Act, we collaborate with local counsel having expertise in Kerala excise law, defend clients against criminal prosecutions for excise violations, challenge arbitrary enforcement actions, and represent clients through trial and appellate proceedings while coordinating Kerala-specific legal strategies.

2. Various Excise Duty Classification Cases

Context: Multiple Kerala High Court cases involving classification of goods for excise duty purposes

Common Issues:

- Classification of alcoholic beverages

- Rate of duty applicable

- Exemption notifications

- Valuation disputes

How Advocate Siddharth Nair Can Help: Classification disputes require deep understanding of HSN codes, tariff schedules, and product characteristics. We engage technical experts, present scientific evidence, rely on favorable precedents, and establish that classification should be interpreted liberally in favor of taxpayer when ambiguity exists.

High Court of Uttar Pradesh – Excise Cases (2024-2025)

1. Bihar Foundry and Casting Ltd. (Jharkhand HC)

Citation: 2024

Related State: Uttar Pradesh (similar issues)

Issue: Taxability, classification, or valuation disputes under Central Excise Act—whether appeals should be filed before High Court or Supreme Court.

Held: Such disputes must be filed directly before Supreme Court under Section 35L, not before High Court.

Relevance: Establishes appellate forum jurisdiction, crucial for Uttar Pradesh excise matters.

How Advocate Siddharth Nair Can Help: We ensure proper forum selection for appeals, file appropriate applications for condonation of delay if required, and present jurisdictional arguments to prevent dismissal on technical grounds.

2. U.P. Excise Act Cases – License Cancellations

Context: Multiple cases involving cancellation of wholesale and retail liquor licenses

Common Grounds:

- Violation of license conditions

- Shortage of stock

- Sale of spurious liquor

- Non-payment of license fees

- Violation of local restrictions

Typical Relief Sought:

- Stay of cancellation orders

- Restoration of licenses

- Compensation for business losses

How Advocate Siddharth Nair Can Help: When facing license cancellation under U.P. Excise Act, we file immediate stay applications before High Court under Article 226, argue that cancellation is disproportionate to alleged violation, establish compliance with all material conditions, demonstrate that procedural lapses are minor and technical, and secure interim relief to protect business continuity while main petition is decided.

3. U.P. Excise Policy Disputes

Context: Annual excise policy implementations and challenges

Common Issues:

- Arbitrary reserve price fixing

- Discriminatory zoning

- Unreasonable license fee demands

- Retrospective policy changes

- Violation of legitimate expectations

How Advocate Siddharth Nair Can Help: We challenge arbitrary excise policy provisions through constitutional writ petitions, establish violation of Article 14 (equality) and Article 19(1)(g) (right to trade), seek policy modifications through representations and litigation, and protect established business rights against unreasonable policy changes.

High Court of Rajasthan – Excise Cases (2024-2025)

1. Rajasthan Excise Act Enforcement Cases

Context: Criminal prosecutions under Rajasthan Excise Act, 1950

Common Offences:

- Illicit manufacture of liquor

- Illegal transportation

- Possession of non-duty paid liquor

- License violations

- Quality standard violations

Typical Punishments: Imprisonment ranging from 3 months to 10 years depending on gravity

How Advocate Siddharth Nair Can Help: We provide aggressive criminal defence in Rajasthan excise prosecutions, secure bail even in serious offences, file discharge applications based on lack of evidence, cross-examine prosecution witnesses effectively, establish procedural violations in investigation, and achieve acquittals through meticulous trial strategy.

2. Rajasthan Excise Policy – Auction and Tender Disputes

Context: Disputes related to auction of retail liquor vends and wholesale licenses

Common Issues:

- Arbitrary disqualification of bidders

- Cancellation of successful bids

- Forfeiture of earnest money

- Changes in tender conditions mid-process

- Discriminatory treatment of bidders

How Advocate Siddharth Nair Can Help: We represent clients in tender and auction disputes, challenge arbitrary disqualifications, seek restoration of rights, prevent forfeiture of security deposits, and establish that tender process must be fair, transparent, and in accordance with principles of natural justice.

High Court of Madhya Pradesh – Excise Cases (2024-2025)

1. M.P. Excise Act Prosecutions

Context: Criminal cases under Madhya Pradesh Excise Act, 1915

Frequent Violations:

- Illegal transport of liquor across district boundaries

- Violation of quantity restrictions

- Possession of country liquor without license

- Operating without valid permits

How Advocate Siddharth Nair Can Help: In M.P. excise criminal cases, we challenge the legality of search and seizure, question the chain of custody of seized materials, establish that accused had no mens rea (guilty mind), demonstrate compliance with all applicable rules, and secure acquittals by creating reasonable doubt in prosecution’s case.

2. Excise Duty Recovery Cases

Context: Recovery of outstanding excise duty from licensees

Common Scenarios:

- Disputes over calculation of duty

- Set-off and adjustment claims

- Force majeure situations affecting operations

- Disputes over wastage allowances

How Advocate Siddharth Nair Can Help: We negotiate with M.P. excise authorities for reasonable settlement of dues, challenge excessive recovery demands through writ petitions, establish entitlement to adjustments and set-offs, and prevent coercive recovery measures that could cripple business operations.

High Court of Punjab & Haryana – Excise Cases (2024-2025)

1. Haryana Excise Policy Implementation

Reference: Haryana Excise Policy 2024-25

Key Features:

- E-bidding system for zone allotment

- Reserve price determination

- Distance restrictions from schools, religious places, highways

- Quarterly license periods

- Re-allotment procedures

Common Disputes:

- Challenge to reserve prices

- Location restrictions

- License renewal denials

- Penalty for re-allotment at assessee’s default

How Advocate Siddharth Nair Can Help: We represent clients in Punjab & Haryana excise policy disputes, challenge arbitrary reserve price fixations, seek relaxation of location restrictions in appropriate cases, prevent license cancellations, and negotiate favorable terms for license renewals.

2. Punjab Excise Act Enforcement

Context: Criminal prosecutions under Punjab Excise Act, 1914

Notable Provisions:

- Strict liability for possession of illicit liquor

- Heavy penalties for bootlegging

- Vehicle confiscation powers

- Presumptions against accused in certain cases

How Advocate Siddharth Nair Can Help: Punjab excise cases often involve harsh presumptions against accused. We challenge these presumptions by presenting credible defence evidence, establishing innocent explanations for possession or transport, proving that accused had no knowledge of illegal nature of goods, and successfully securing bail even in serious prosecutions by demonstrating that accused is not a flight risk and will cooperate with investigation.

High Court of Madras – Excise Cases (2024-2025)

1. Tamil Nadu Liquor Vending Cases

Context: Disputes under Tamil Nadu Liquor (Licensing & Retail Vending) Act, 2003

Common Issues:

- TASMAC (State liquor corporation) licensing disputes

- Private wholesale licensing

- Bar license conditions and violations

- MRP enforcement

How Advocate Siddharth Nair Can Help: Tamil Nadu has unique excise regime with state monopoly in retail. We handle wholesale licensing issues, represent bar and restaurant owners in license disputes, challenge arbitrary enforcement actions, and defend against criminal prosecutions arising from alleged license violations.

2. Customs and Excise Duty Classification

Context: Multiple classification disputes before Madras High Court

Common Products in Dispute:

- Alcoholic beverages classification

- Industrial alcohol vs. potable alcohol

- Denatured spirit classifications

- Duty rate applicability

How Advocate Siddharth Nair Can Help: Classification determines duty liability. We conduct detailed technical analysis of products, engage chemical and technical experts, present scientific evidence before courts, rely on international standards and practices, and establish most beneficial classification for our clients while remaining within bounds of law.

High Court of West Bengal – Excise Cases (2024-2025)

1. West Bengal Excise Act Enforcement

Context: Criminal prosecutions and revenue recovery under West Bengal Excise Act, 1909

Common Violations:

- Illicit distillation

- Smuggling from neighboring states and Bangladesh

- Operating illegal liquor dens

- Violation of foreign liquor license conditions

How Advocate Siddharth Nair Can Help: West Bengal excise matters often involve cross-border smuggling allegations. We challenge jurisdiction, question identification and admissibility of seized goods, establish lack of criminal intent, secure bail through convincing grounds, and achieve favorable outcomes in trials.

2. Excise Duty on Industrial Alcohol

Context: Disputes regarding excise duty on alcohol used for industrial purposes

Issues:

- Eligibility for concessional duty rates

- Diversion of industrial alcohol to potable use

- Verification and monitoring requirements

- Penalty for misuse

How Advocate Siddharth Nair Can Help: We assist industries using alcohol as raw material, ensure compliance with industrial alcohol regulations, defend against allegations of diversion, and challenge disproportionate penalties for procedural violations.

High Court of Andhra Pradesh & Telangana – Excise Cases (2024-2025)

1. State of Telangana Cases

Context: Excise enforcement under Telangana Excise Act

Notable Case: Prasanna Kasini v. State of Telangana

Citation: Crl.A. No. 76/2026 (Supreme Court)

Type: Criminal appeal involving excise violation

How Advocate Siddharth Nair Can Help: Andhra Pradesh and Telangana have strict excise enforcement. We provide comprehensive criminal defence in serious prosecutions, secure bail in non-bailable offences, file quashing petitions under Section 482 CrPC, and represent clients through all stages of criminal proceedings.

2. Potnuru Appala Naidu v. State of Andhra Pradesh

Citation: Crl.A. No. 1421/2025 (Supreme Court)

Type: Criminal appeal in excise matter

Issue: Criminal prosecution under state excise laws

How Advocate Siddharth Nair Can Help: When cases reach appellate stages, our comprehensive trial preparation ensures strong grounds for appeal. We identify errors in trial court judgments, present additional evidence where permissible, and argue for acquittal or sentence reduction based on facts and law.

3. Excise Duty on Domestic Breweries

Context: Multiple disputes involving domestic breweries in Andhra Pradesh and Telangana

Common Issues:

- Production capacity assessments

- Wastage and evaporation allowances

- Transfer pricing for interstate supplies

- Differential duty rates

How Advocate Siddharth Nair Can Help: Brewery operations involve complex technical and regulatory issues. We provide end-to-end legal support including compliance audits, regulatory approvals, dispute resolution, and defence against enforcement actions.

High Court of Bihar & Jharkhand – Excise Cases (2024-2025)

1. Bihar Foundry and Casting Ltd. v. Commissioner

Citation: 2024 (Jharkhand HC)

Issue: Appellate jurisdiction in excise matters—whether High Court or Supreme Court

Held: Disputes involving rate of duty, classification, or valuation must go directly to Supreme Court under Section 35L of Central Excise Act.

Relevance: Establishes jurisdictional principles for Bihar and Jharkhand excise appeals.

How Advocate Siddharth Nair Can Help: We guide clients on proper appellate forum, prepare comprehensive appeals addressing jurisdictional and substantive issues, and represent clients effectively before High Courts and Supreme Court.

2. Bihar Prohibition and Excise Act Cases

Context: Bihar has total prohibition on alcohol since 2016

Common Cases:

- Prosecutions for possession of alcohol

- Smuggling from neighboring states

- Manufacture and sale of illicit liquor

- Very strict enforcement and harsh penalties

Special Considerations: Bihar’s total prohibition creates unique legal issues regarding:

- Inter-state transport through Bihar

- Industrial alcohol exemptions

- Medicinal use permissions

- Penalties on outsiders unaware of prohibition

How Advocate Siddharth Nair Can Help: Bihar prohibition cases require special expertise. We establish lack of criminal intent for persons transiting through Bihar, argue for proportionate punishment considering circumstances, secure bail in serious prosecutions, and achieve acquittals by demonstrating lack of knowledge of prohibition law or establishing that possession was for permitted purposes.

High Court of Chhattisgarh – Excise Cases (2024-2025)

1. Ranvijay Bharti v. State of Chhattisgarh

Citation: Crl.A. No. 3397/2025 (Supreme Court)

Type: Criminal appeal in excise matter

Issue: Challenge to conviction in excise prosecution

How Advocate Siddharth Nair Can Help: Appeals from Chhattisgarh excise convictions require thorough analysis of trial court records, identification of legal and factual errors, preparation of comprehensive appeal memorandum, and persuasive appellate advocacy before High Court and Supreme Court.

2. Ritesh Shrivas v. State of Chhattisgarh

Citation: SLP(Crl) No. [pending] (Supreme Court)

Date: January 2026

Type: Special Leave Petition in criminal excise matter

Issue: Challenge to High Court order in excise criminal case

How Advocate Siddharth Nair Can Help: When High Courts dismiss criminal appeals, we file Special Leave Petitions before Supreme Court, present compelling grounds for grant of leave, argue exceptional circumstances warranting Supreme Court intervention, and secure relief even in cases where lower courts have ruled against the accused.

3. Chhattisgarh Excise Duty Recovery

Context: Recovery proceedings against licensees

Common Issues:

- Outstanding license fees

- Penalty recovery

- Interest calculations

- Attachment of business assets

How Advocate Siddharth Nair Can Help: We prevent coercive recovery measures through stay applications, negotiate payment plans with authorities, challenge excessive demands, and protect business assets from attachment while disputes are resolved.

High Court of Goa (Bombay High Court Bench) – Excise Cases

1. Goa Excise Duty Act Cases

Context: Unique excise regime in Goa with different duty structure

Special Features:

- Lower excise duties compared to other states

- Tourism-oriented policies

- Special provisions for heritage liquors (feni, etc.)

- Beach shack licensing

Common Disputes:

- License conditions for tourism establishments

- Interstate smuggling allegations

- Classification of indigenous liquors

- Violation of sale restrictions in prohibited areas

How Advocate Siddharth Nair Can Help: Goa’s unique excise environment creates specialized legal issues. We provide expertise in tourism-related excise matters, defend against smuggling allegations, represent clients in license disputes, and protect businesses operating in Goa’s distinctive excise regime.

Comprehensive Legal Services Offered

1. Pre-Litigation Advisory & Compliance

Excise Duty Compliance Audits

- Comprehensive review of excise duty compliance

- Identification of potential vulnerabilities and risks

- Corrective action recommendations

- Implementation of robust compliance systems

Regulatory Compliance Framework

- Design and implementation of internal controls

- Standard Operating Procedures (SOPs) for excise compliance

- Training of staff on excise laws and procedures

- Periodic compliance monitoring

Due Diligence for Acquisitions

- Excise duty liability assessment in M&A transactions

- Identification of contingent liabilities

- Risk assessment and mitigation strategies

- Indemnity clause drafting

Advisory on Licensing

- Assistance in license applications

- Preparation of required documentation

- Liaison with excise authorities

- Appeal against license rejections

Advance Rulings

- Application for advance rulings on classification, valuation, exemptions

- Representation before Authority for Advance Rulings

- Advisory on applicability of exemption notifications

Policy Advocacy

- Representations to government on policy issues

- Participation in stakeholder consultations

- Industry association coordination

2. Investigation Stage Defence

Representation During Search & Seizure

- Physical presence during excise department raids

- Ensuring procedural compliance during searches

- Protection of client rights during seizure operations

- Recording of statements with legal safeguards

- Challenge to illegal searches and seizures

Response to Summons

- Legal representation in response to summons by Enforcement Directorate, CBI, DGGI, Excise Intelligence

- Preparation of clients for questioning

- Ensuring statements are recorded accurately

- Legal advice on scope of questioning

- Protection against self-incrimination

Representation During Arrest

- Immediate legal assistance upon arrest

- Challenge to illegal or arbitrary arrests

- Ensuring compliance with arrest procedures under CrPC

- Informing family members and arranging for bail

- Medical examination if required

Evidence Collection & Documentation

- Preservation of favorable evidence

- Documentation of procedural violations by investigating agencies

- Technical expert consultation

- Forensic analysis arrangements

- Witness identification and preparation

Negotiation with Investigating Agencies

- Strategic communication with investigators

- Voluntary disclosure where beneficial

- Cooperation with investigation while protecting rights

- Settlement discussions where appropriate

3. Adjudication Proceedings

Show Cause Notice Response

- Detailed analysis of allegations

- Comprehensive written submissions

- Evidence compilation and presentation

- Legal research and precedent citation

- Technical expert reports

Personal Hearing Representation

- Oral advocacy before Adjudicating Authorities

- Presentation of documentary evidence

- Cross-examination of departmental witnesses

- Arguments on law and facts

- Submission of additional evidence

Adjudication Order Challenge

- Analysis of adjudication orders

- Identification of legal and factual errors

- Preparation of appeal grounds

- Swift filing of appeals with stay applications

Stay of Demand

- Applications for stay of duty demands

- Arguments for waiver of pre-deposit

- Demonstration of financial hardship

- Prima facie case establishment

Settlement Applications

- Assessment of settlement benefits

- Preparation of settlement applications

- Negotiation of settlement terms

- Full and true disclosure preparation

4. Appellate Advocacy

Commissioner (Appeals) Level

- Appeal drafting and filing

- Stay applications

- Oral hearings

- Additional evidence submission

- Cross-appeals where necessary

CESTAT (Customs, Excise & Service Tax Appellate Tribunal)

- Appeal memorandum preparation

- Legal research and precedent compilation

- Technical brief preparation

- Oral arguments before Tribunal

- Stay of demand applications

- Cross-examination of witnesses

- Written submissions

High Court Appeals (Section 35G)

- Appeals on substantial questions of law

- Writ petitions under Article 226 and 227

- Constitutional challenges

- Interim stay applications

- Comprehensive legal arguments

- Precedent analysis and citation

Supreme Court Appeals (Section 35L)

- Direct appeals on rate of duty, classification, valuation issues

- Special Leave Petitions

- Civil appeals from High Court judgments

- Constitutional matters

- Oral arguments before Supreme Court Benches

5. Criminal Defence Services

First Information Report (FIR) Quashing

- Petitions under Section 482 CrPC

- Quashing of frivolous criminal complaints

- Constitutional remedy under Article 226

- Demonstration of malafide prosecution

Anticipatory Bail Applications

- Section 438 CrPC applications

- Preventive protection from arrest

- Conditions negotiation

- Appellate relief if rejected

Regular Bail Applications

- Swift bail applications after arrest

- Section 437 and 439 CrPC applications

- High Court and Supreme Court bail petitions

- Bail in economic offences

- Violation of bail condition defence

Discharge Applications

- Applications under Section 227 and 245 CrPC

- Demonstration of no prima facie case

- Technical discharge grounds

- Citing of favorable precedents

Trial Representation

- Complete trial management

- Defence strategy formulation

- Cross-examination of prosecution witnesses

- Defence evidence presentation

- Expert witness arrangement

- Technical defence preparation

- Final arguments

- Written submissions

Appeal Against Conviction

- Criminal appeals before High Courts and Supreme Court

- Sentence reduction applications

- Review petitions

- Curative petitions in exceptional cases

Compounding of Offences

- Applications for compounding where permissible

- Negotiation with prosecution

- Court applications for compounding

- Compliance with compounding terms

6. Constitutional & Writ Remedies

Writ of Mandamus

- Compelling authorities to perform statutory duties

- Issuance of licenses

- Grant of exemptions

- Processing of refund claims

Writ of Prohibition

- Preventing authorities from acting beyond jurisdiction

- Stopping illegal proceedings

- Protection against ultra vires actions

Writ of Certiorari

- Quashing of illegal orders

- Setting aside arbitrary decisions

- Correction of jurisdictional errors

Writ of Habeas Corpus

- Release from illegal detention

- Challenge to illegal arrests

- Protection of personal liberty

Constitutional Challenges

- Article 14 (Equality) challenges

- Article 19(1)(g) (Right to trade) violations

- Article 21 (Life and Liberty) violations

- Challenge to arbitrary laws and policies

- Doctrine of legitimate expectation

- Proportionality challenges

7. Recovery Prevention & Debt Management

Challenge to Recovery Notices

- Legal challenge to recovery proceedings

- Stay of recovery pending appeal

- Challenge to mode and manner of recovery

Bank Attachment Prevention

- Applications to prevent bank account attachment

- Release of attached funds

- Alternative security arrangements

Property Attachment Challenge

- Challenge to provisional attachment orders

- Release of attached property

- Bonding arrangements

Installment Facility Negotiation

- Negotiation for payment in installments

- Extended payment timeline

- Interest waiver applications

Refund Claims

- Excise duty refund applications

- Interest on delayed refunds

- Litigation for denied refund claims

8. Specialized Services

Classification & Valuation Disputes

- Technical classification analysis

- Valuation methodology challenges

- HSN code determination

- Expert technical opinions

- Comparative analysis with similar products

Exemption Notification Analysis

- Eligibility assessment for exemptions

- Interpretation of exemption conditions

- Application for exemption certificates

- Challenge to denial of exemptions

Cenvat Credit Disputes

- Eligibility for input tax credit

- Challenge to credit reversals

- Documentation compliance

- Credit accumulation issues

Export & Import Matters

- Duty drawback claims

- Export incentives

- EPCG scheme compliance

- Import duty disputes with excise implications

Transfer Pricing in Excise

- Related party transaction issues

- Valuation for inter-unit transfers

- Arm’s length price determination

- Transfer pricing documentation

Industry-Specific Expertise

- Petroleum products

- Alcoholic beverages

- Tobacco products

- Automobiles

- Pharmaceuticals

- Chemicals

- Consumer electronics

9. Corporate Advisory Services by CS Rahul Kumar Dhiman

Company Secretarial Compliance

- Board resolution drafting for excise matters

- Corporate governance in excise compliance

- Director liability minimization

- Company law compliance

Documentation & Record Keeping

- Statutory record maintenance

- Excise register management

- Electronic record systems

- Document retention policies

Due Diligence & Risk Assessment

- Excise compliance due diligence

- Risk rating and assessment

- Contingent liability quantification

- Remedial action plans

Regulatory Filings

- Annual compliance filings

- ROC filings related to excise matters

- Disclosure compliance

- Corporate restructuring with excise implications

Audit Coordination

- Coordination with Chartered Accountants

- Excise audit support

- Financial statement implications

- Tax audit certifications

Strategic Advantages of Our Integrated Legal Approach

Synergy Between Legal & Corporate Expertise

The partnership between Advocate Siddharth Nair and CS Rahul Kumar Dhiman creates unique advantages:

Comprehensive Analysis: Legal issues are analyzed not just from litigation perspective but also from corporate governance and compliance standpoint, ensuring holistic solutions.

Preventive Approach: Company Secretary expertise enables identification of potential issues before they escalate into litigation, saving substantial costs and business disruption.

Coordinated Defence: In cases involving both civil adjudication and criminal prosecution, our team provides coordinated defence strategy addressing all aspects simultaneously.

Documentation Excellence: CS expertise ensures that all documentation, records, and filings are maintained to highest standards, creating strong defence against allegations of non-compliance.

Multi-Disciplinary Team: Our network includes Chartered Accountants for tax calculations, certified auditors for financial analysis, technical experts for product analysis, and forensic experts for evidence examination.

Business Continuity Focus: We understand that litigation can disrupt business operations. Our strategies prioritize business continuity while defending legal rights.

Unique Value Propositions

1. Immediate Response Capability

- 24/7 availability for emergency situations

- Swift response to raids, searches, arrests

- Immediate bail application filing

- Crisis management expertise

2. End-to-End Service

- From investigation stage through Supreme Court

- No need to change counsel at different stages

- Consistent strategy throughout proceedings

- Institutional knowledge of case preserved

3. Transparent Communication

- Regular case updates

- Clear explanation of legal positions

- Realistic assessment of case prospects

- No false promises or guarantees

4. Cost-Effective Solutions

- Transparent fee structure

- Value-based pricing

- Flexible payment options

- Cost-benefit analysis for litigation decisions

5. National Presence

- Representation across India

- Network of associate counsel in all states

- Coordination with local experts

- Uniform quality of service

6. Success-Oriented Approach

- Focus on achieving best possible outcome

- Multiple strategy options

- Contingency planning

- Persistent advocacy

Contact Information:

Advocate Siddharth Nair

Call: +91-9625799959

New Delhi | Delhi NCR | Pan-India Practice

Leading Tax Litigation Advocate & Company Secretary Partnership for Comprehensive Excise Duty Defence in New Delhi, Delhi NCR & Pan-India

Office: 434, Lower Ground Floor, Jangpura, Mathura Road, New Delhi, NCT of Delhi, India-110014

Phone: +91-9625799959

Email: mailme@nairlawchamber.com

Website: www.nairlawchamber.com

Practice Areas:

- Excise Duty

- Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Union Territory Goods and Services Tax (UTGST) & Integrated Goods and Services Tax (IGST)

- Best Family Law & Criminal Defence Lawyer in Delhi NCR for MTP/Abortion Cases

- Loan Recovery Defence | SARFAESI | Debt Recovery Tribunals | RERA | Credit Card Defaults | FIR Quashing | Criminal Defence

- Premier Criminal Defence Lawyer Specializing in False Cruelty & Dowry Harassment Cases

Consultations: Monday to Saturday: Call Now For an Appointment (9am to 9pm)

Sundays & Festivals: Holiday/ Meetings strictly by appointment

Understanding Penalties & Consequences in Excise Matters

Civil Penalties

Under Central Excise Act, 1944:

Section 11AC – Penalty for Duty Evasion

- Equal to duty evaded or Rs. 5,000, whichever is higher

- Can be imposed along with interest under Section 11AB

- Commissioner may reduce or waive penalty in certain circumstances

Rule 25 & 26 of Central Excise Rules

- Penalties for procedural violations

- Late filing of returns

- Documentation irregularities

- Typically Rs. 200 per day of delay subject to maximum limits

Penalty for Wrong Availment of Cenvat Credit

- Equal to credit wrongly availed

- Plus interest at prescribed rate

- Additional penalty under Section 11AC possible

Interest Liability

Section 11AB – Interest on Delayed Payment

- Applicable when duty not paid or short-paid

- Rate: As notified by government (currently 18% per annum)

- Calculated from date of actual removal of goods

- No waiver provision; mandatory levy

Section 11AA – Interest on Delayed Refund

- When refund not sanctioned within 3 months

- Rate: As notified by government

- Payable from date of expiry of 3 months till refund payment

Criminal Consequences

Imprisonment Terms:

Minor Violations: 6 months to 1 year

- First-time procedural violations

- Documentation irregularities without fraud element

- Small quantum of duty involved

Moderate Violations: 1-3 years

- Repeated violations

- Significant duty evasion

- Fraudulent conduct

Serious Violations: 3-7 years

- Large-scale duty evasion

- Organized fraud

- Clandestine removal

- Forged documents

Aggravated Violations: 7-10 years or life imprisonment

- Involvement of public officials (corruption)

- Organized crime connections

- Large-scale smuggling operations

- National security implications

Collateral Consequences

Business Impact:

- License suspension or cancellation

- Blacklisting from government contracts

- Credit rating downgrades

- Bank loan recall

- Reputational damage

- Loss of business opportunities

Personal Impact on Directors/Officers:

- Travel restrictions

- Passport impoundment

- Difficulty in future business ventures

- Social stigma

- Family distress

Financial Impact:

- Legal costs

- Business disruption losses

- Settlement amounts

- Interest accumulation

- Asset attachment

- Frozen bank accounts

How Advocate Siddharth Nair Can Help: Specific Scenarios

Scenario 1: Sudden Raid by Excise Intelligence

Situation: Excise intelligence officers arrive unannounced at your manufacturing facility with search warrant.

Immediate Actions by Advocate Siddharth Nair:

- Rush to premises within shortest possible time

- Verify authority and jurisdiction of searching officers

- Ensure compliance with search procedures under CrPC

- Ensure independent witnesses are present

- Record proceedings through video if permitted

- Ensure no coercion or threats during statement recording

- Advise client on scope of questioning

- Prevent self-incriminating statements

- Ensure panchnama is accurate and complete

- Obtain copies of all seizure documents

- Arrange for immediate legal representation if arrest imminent

Follow-up Actions:

- File challenge to illegal search if procedures violated

- Prepare response strategy to anticipated allegations

- Secure evidence in client’s favor

- Coordinate with technical experts for product analysis

- Prepare for anticipated show cause notice

Scenario 2: Arrest in Excise Fraud Case

Situation: Client or company director arrested for alleged excise duty fraud.

Immediate Actions by Advocate Siddharth Nair:

- Rush to police station/investigating agency office

- Ensure arrest memo is issued

- Ensure medical examination conducted

- Inform family members

- File bail application immediately (anticipatory or regular)

- Arrange for surety if bail granted

- Challenge arrest if illegal or procedurally improper